What are the 3 most Underrated stocks in Australia right now?

![]() Nick Sundich, May 5, 2023

Nick Sundich, May 5, 2023

What are the most Underrated stocks in Australia right now? We think it is consumer facing stocks that are resilient to inflation, but where shareholders have not realised it yet.

Do you need solid trading & investment ideas on the ASX? Stocks Down Under Concierge can help!

Concierge is a service that gives you timely BUY and SELL alerts on ASX-listed stocks – with price targets, buy ranges, stop loss levels and Sell alerts too. We only send out alerts on very high conviction stocks following substantial due diligence and our stop loss recommendations limit downside risks to individual stocks and maximise total returns.

Concierge is outperforming the market by a significant margin!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Some consumer stocks can withstand economic headwind

Consumer facing companies are classified as either a staple or discretionary. Consumer staples refer to goods that are considered to be necessities, such as food, household supplies and certain personal care items. These products have a high demand regardless of economic conditions, making them a stable investment in times of recession or economic downturn. Your classic example of stocks in this category are supermarkets such as Coles (ASX:COL) and Woolworths (ASX:WOW).

On the other hand, consumer discretionaries are goods that are considered to be non-essential, such as luxury items and entertainment products. Companies within this category tend to have more volatility and risk associated with their performance as they are highly influenced by changes in consumer behaviour and economic trends. At least, in theory. Some companies perceived as consumer discretionaries have loyal customer bases that will stick around irrespective of economic circumstances. This doesn’t mean investors won’t realise this and scorn the company as a consequence. Therein lies the chance to make gains, because the company will not be underrated forever.

Yes they can

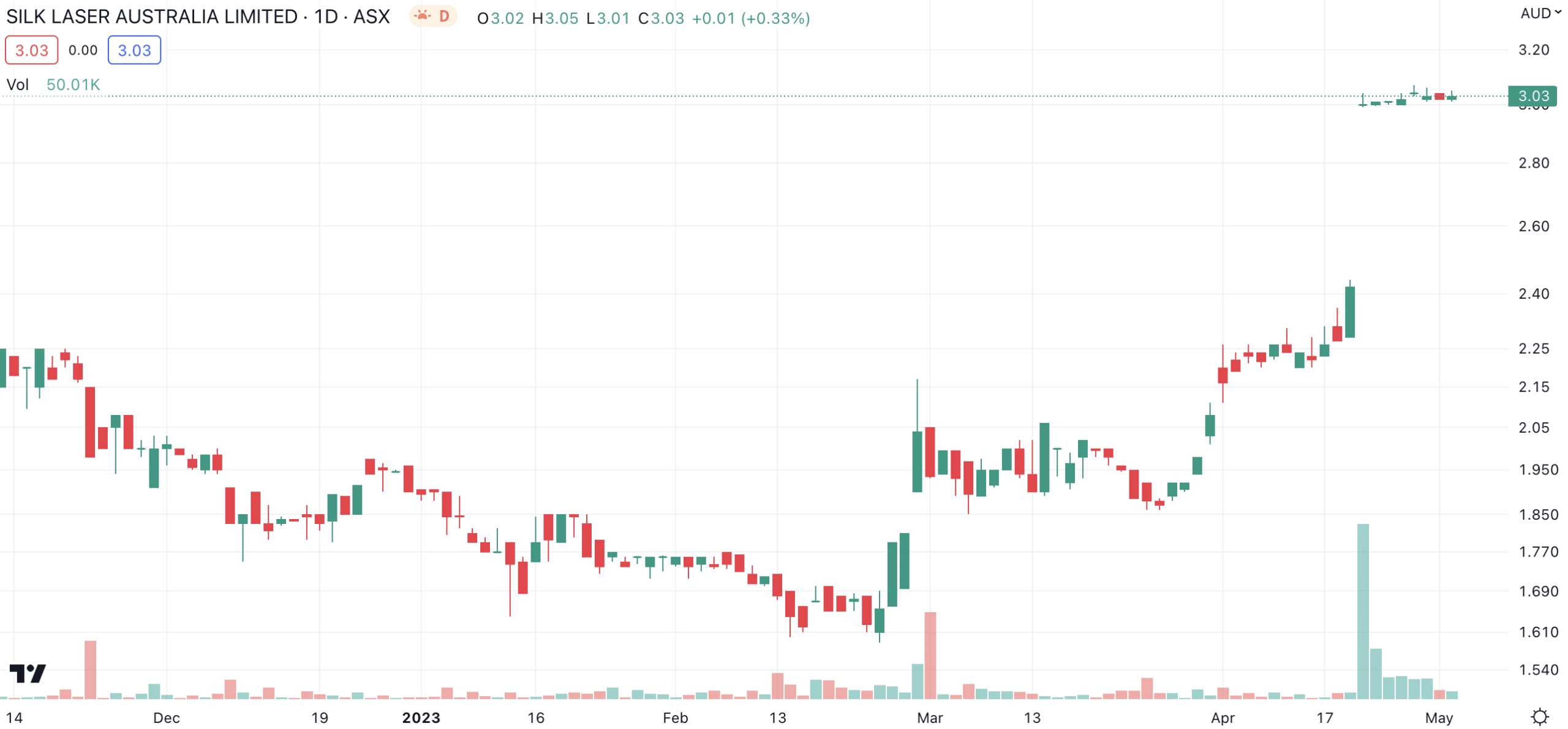

Take for instance Silk Laser (ASX:SLA) which we wrote about back on March 8. It is an owner and operator of cosmetic injections and skincare clinics and products, with ~140 outlets across Australia and New Zealand. In just 2 months, its share price has gained 67% due to a takeover offer. The company continued to record solid revenues and profits, but investors didn’t give it the credit – until the takeover emerged.

Investors underrated the stock because they feared consumers would cut back their spending, but they weren’t. This company’s customers were big spenders, spending over $500 a treatment on average, and in many cases required the treatment for health reasons and not just for general aesthetics.

Silk Laser Australia (ASX:SLA) share price chart, log scale (Source: TradingView)

Our top 3 Underrated stocks in Australia

1. Breville (ASX:BRG)

This company is first on our list of underrated ASX shares. The 80-year old company makes and distributes household devices, such as coffee machines and air fryers. It sells over $1.4bn in goods each year in over 100 countries globally and its goods cater to middle to higher income earners.

It is underrated because of fears that it will be crippled by the impact of inflation on consumer demand, along with cost increases and supply chain issues. But the company’s results have shown otherwise. In FY22, it made $1.4bn in revenue (up 19.4%), $156.4m EBIT (up 14.6%) and a $105.7m NPAT (up 16.2%). Fir FY23, consensus estimates call for $1.48bn in revenue (up 4.2%) and $208.7m EBITDA (up 11.7%).

Looking to FY24, estimates call for $1.6bn in revenue (up 8%) and $229.5m in EBITDA (up 10%). Not too bad during times of economic headwind and high interest rates.

2. Viva Leisure (ASX:VVA)

Next in our list of underrated shares is Viva Leisure (ASX: VVA), a gym and health club operator with over 300 locations Australia-wide. This company was forced to close during the pandemic, leading to a heavy sell off that pushed its bottom line into negative territory. It has been underrated since because investors have believed that gyms are easily dispensable in a period of high inflation. But theory is not matching reality – at least if this company’s membership numbers are anything to go by. Granted, comparison with prior periods is difficult due to the company’s expansion.

In FY22 it generated $90.8m in revenue, $5.5m in EBITDA and closed the period with over 320,000 members.

Consensus estimates for FY23 call for $139.9m in revenue (up 54%) and $60.2m in EBITDA (up 994%). The reason for the substantial EBITDA increase is fixed costs that had to be met even though gyms were closed and under-utilised during the pandemic. Currently, a lot of the additional revenues coming in are dropping straight to the bottom line.

Looking to FY24, consensus estimates call for $158.8m in revenue (up 14%) and $69.1m in EBITDA (up 15%).

3. Pacific Smiles (ASX:PSQ)

Our third most underrated ASX stocks is Pacific Smiles (ASX:PSQ), a dental franchisor.Again, it is underrated because investors fear people will cut back their spending on dental services. Granted, you may be able to postpone a monthly checkup. But procedures such as root canal and wisdom teeth can’t be put off for too long.

Consensus estimates for FY23 call for $168.1m in revenue (up 20.5%), $23.4m EBITDA (up 107%) and a $4.8m NPAT. Looking to FY24, the market expects $194.5m in revenue (up 16%), $33.5m in EBITDA (up 43%) and a $11.1m NPAT (up 131%).

PSQ is trading at 9.4x EV/EBITDA and 20.8x P/E for FY24. It is trading at just 0.15x PEG and 0.2x EV/EBITDA-to-EBITDA-growth for that year – we would consider either of the latter two multiples at or near 1x to be fairly valued. So behold…a big undervaluation, in our view.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…