Why buying Australian Cash ETFs makes sense for investors

![]() Marc Kennis, December 7, 2022

Marc Kennis, December 7, 2022

What are Exchange Traded Funds (ETFs)?

ETFs are funds that track the performance of specific indexes or assets and seek to provide the returns of those indexes or assets for their investors. ETFs are traded on exchanges, thereby making them easy to invest in by retail investors.

ETFs can hold multiple assets and investing in an ETF saves the investor the trouble of making multiple transactions to achieve the same exposure to those assets. Therefore, ETFs provide diversification at a low cost.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

What are Cash ETFs?

A Cash ETF is an ETF that invests in a basket of cash deposits offered by reputable banks. Cash ETFs normally pay interest rates monthly and offer competitive interest rates compared to typical banks’ savings accounts.

Main benefits of Cash ETFs

Cash ETFs are normally quick to pass on changes in interest rates and retail investors can invest in them simply using their stock trading accounts, making them useful in times when they hold excessive amounts of cash, like during recessions when investors normally try to limit their exposure to stocks.

What are the most famous Australian Cash ETFs?

It invests in deposit accounts held with selected banks in Australia.

- Market capitalisation: $2.44bn

- Dividend Yield: 1.118%

It invests in Australian dollar denominated bank bills, such as cash deposits and negotiable certificates of deposits with maturities of up to 91 days.

- Market Capitalisation: $433m

- Dividend Yield: 0.98%

It invests in Australian dollar denominated floating rate notes with maturities of up to 5 years and bank bills, such as cash deposits and negotiable certificates of deposits with maturities of up to 91 days.

- Market Capitalisation: $275m

- Dividend Yield: 1.036%

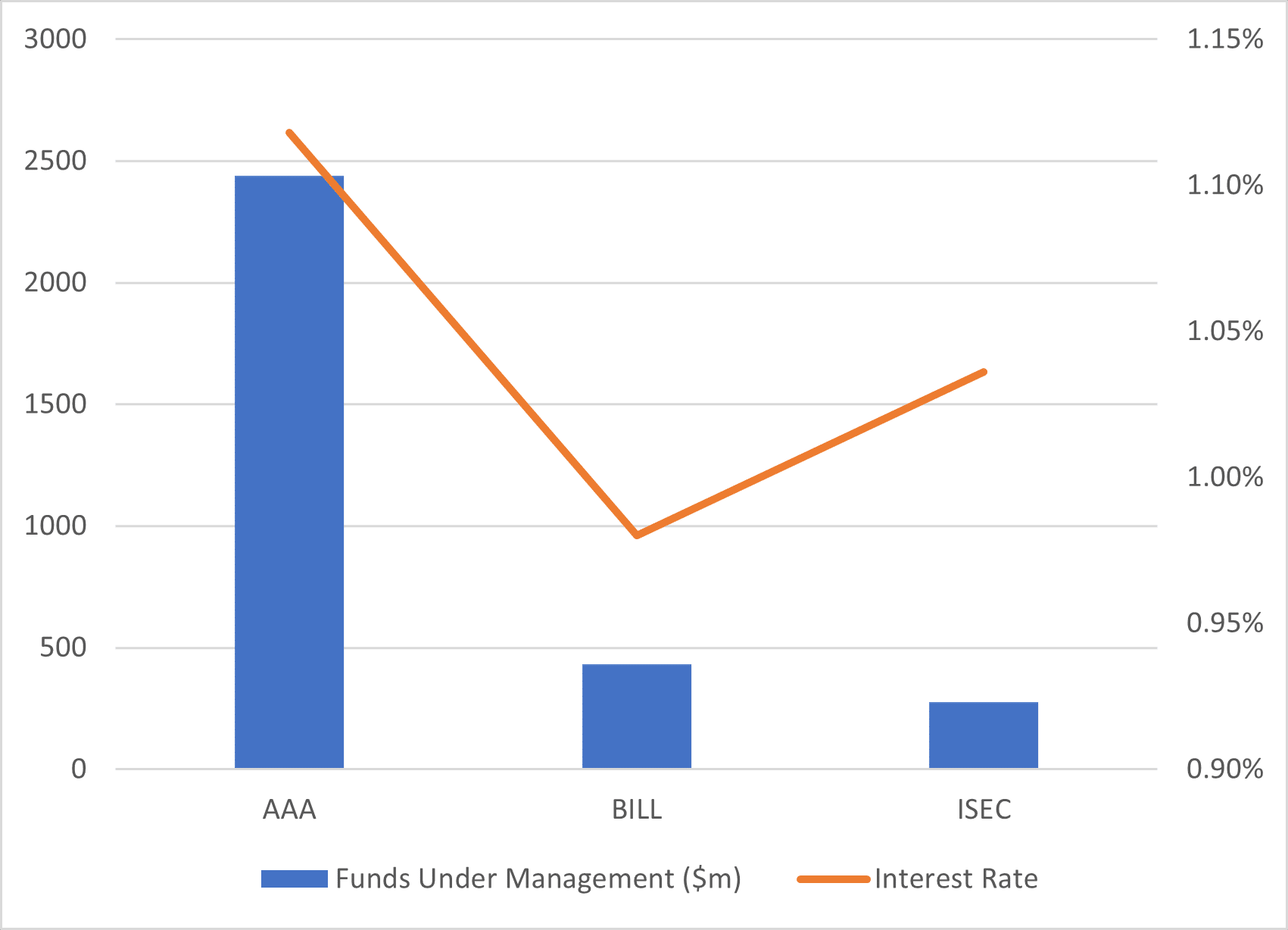

A simple comparison between the three ETF’s discussed

Australian Cash ETFs

Based on this information, Australian High-Interest Cash ETF (ASX: AAA) seems to have a higher liquidity and interest rate than the other two.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Proteomics’ PromarkerD test for DKD has been launched in Australia, and two more tests will launch later in 2025

2025 has been, and will continue to be, a big year for Proteomics, which has just launched PromarkerD onto the…

Should I buy Apple shares from Australia? Can the US$3.3tn behemoth grow any further?

Investors asking themselves, ‘Should I buy Apple shares from Australia,’ are not just considering buying shares any company, but the…

Will Ozempic hurt healthcare stocks? Here are 5 reasons we don’t think so

Will Ozempic hurt healthcare stocks? Investors who’ve been selling healthcare stocks left right and centre – except Novo Nordisk of…