Why has the proposed Healius ACL merger failed and what lies next for both companies?

The Healius ACL merger appears all but dead now that the ACCC blocked the plans. Even so, it was on shaky grounds long before the competition regulator showed its scepticism and it is not implausible that ACL may try again in 2024. Let’s look at why the tie up failed to happen and whether or not it may happen in the year.

Details of the proposed Healius ACL merger

The merger was first proposed back in late March 2023. Let us recall that Healius and ACL were the second and third largest pathology players in the market (and listed stocks) behind Sonic Healthcare (ASX:SHL).

All these companies were undergoing transition periods from temporarily inflated revenues due to COVID-19 testing. The difference between Healius and its peers is that its non-COVID businesses were not as strong. In the six months to December 2022, Healius made a net loss of $28.7m compared with a $233.2m net profit in the prior corresponding period. It had not helped that the previous management regime wasted a $500m war chest on buybacks and M&A.

ACL, despite having a market capitalisation of only half of Healius, put forward a bid in March that would see a new combined company that would be even bigger than Sonic with over 171 laboratories and 3,400 approved collection centres. ACL also promised cost cuts of $78-113m within four years of completion due to synergies as well as to show the door to most of HLS’ management and the board. That was all good news for shareholders. The bad news was that it was to be paid in ACL shares and there was essentially no premium at all – in fact a 4.2% discount to HLS’ closing price on the prior trading day.

The saga that came to nothing

Within days of the proposal becoming public, Healius’ largest shareholders declined to support the deal. Specifically, Perpetual and John Wylie’s Tanarra Capital which held over 20% of HLS shares. Given off-market bids require the consent of 90% of shareholders, this effectively killed the deal.

‘The ACL proposal is unattractive in terms of its structure, certainty, and terms and in our view could likely result in an inappropriate transfer of value from Healius shareholders to ACL,’ Perpetual declared.

This was even before HLS’ management said anything. When HLS finally spoke out publicly, it claimed to have tried to resolve issues it had with the deal to no avail, so it would raise the matters with the Takeovers Panel. The Panel declined to make its own judgement in the matter, in effect telling HLS that it was HLS’ job to tell investors why it was a bad deal and leave the decision to them.

Not all shareholders were opposed – one was Ethical Partners which owned 8.7% and argued the combined entity could eventually generate a premium share price. It argued that a control premium was unnecessary given that opportunity as well as that HLS investors would have 68% of the new entity.

In mid-July, the ACCC made an interim ruling, raising 30 pages worth of issues, commencing with competition concerns. ACL refused to give up, telling investors it would work with the ACCC to try and soothe the latter’s concerns. How exactly was not made clear, although some ideas could have included offloading certain centres.

The struggles for HLS continued. For the full FY23, the company made a $368m net loss, including substantial impairments. During November, Healius had to raise $187m in fresh capital to help reduce its debt levels. Only day afterwards, its AGM was held and chairwoman Jenny Macdonald resigned after sensing that she would lose a vote for re-election.

On December 15, the ACCC gave its final ruling, saying no to the deal on the basis that it would lessen competition, given the pair would operate over 50% of approved centres and in some regions would have a monopoly.

HLS told its investors it welcomed the announcement and that,’ The Healius Board and management remains focused on running Healius’ businesses in the best interests of shareholders’. Look, there’s no doubt this saga was a distraction, but to say that this was the only reason the company is under the pump is farcical. ACL has formally withdrawn the offer but has still claimed that both companies have potential to be worth ‘significantly more together than as standalone entities’.

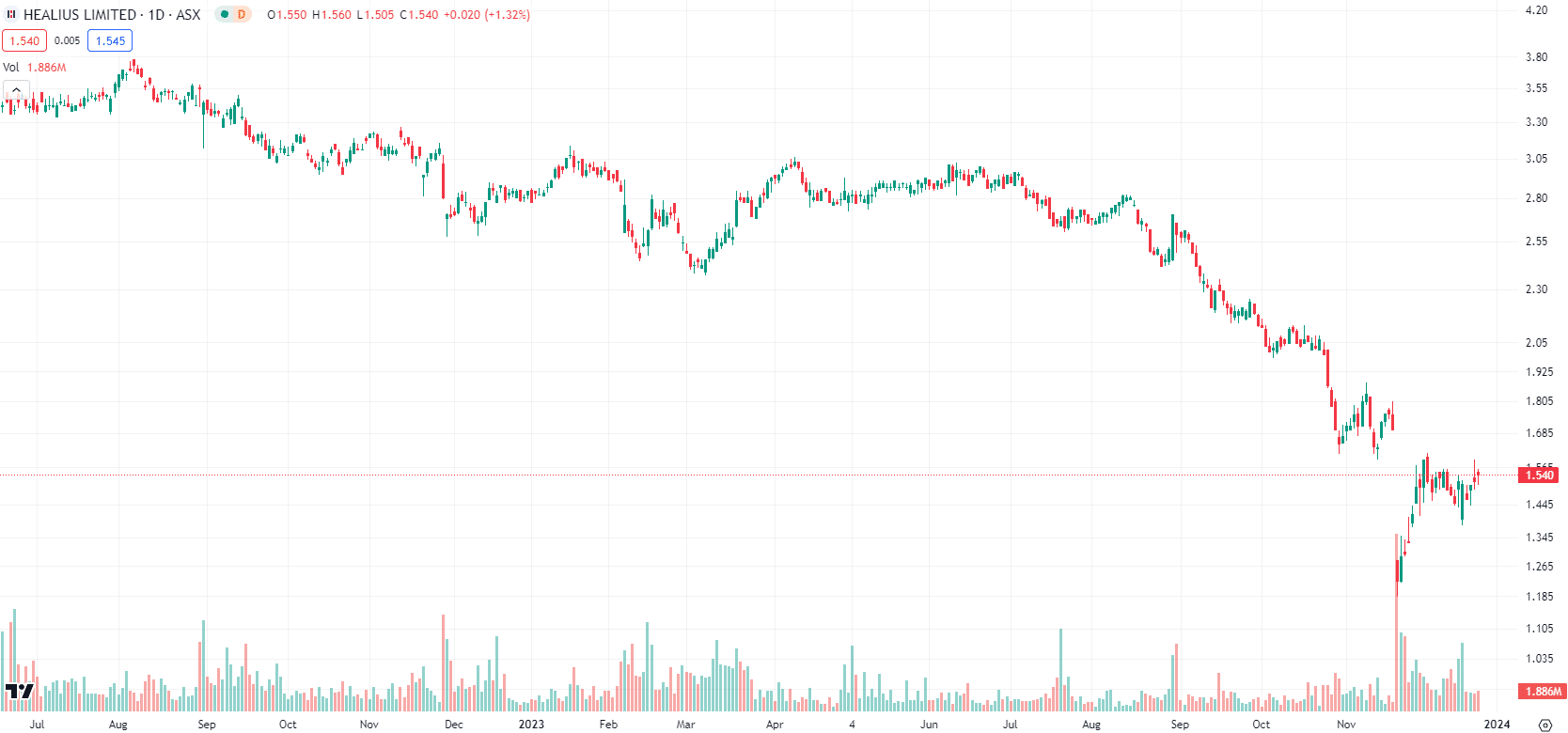

HLS shares are down over 40% in 2023, while ACL shares are down over 6%.

Healius (ASX:HLS) share price chart, log scale (Source: TradingView)

So where to now from here?

As is always the case in corporate takeovers land, it is anyone’s guess. There’s no doubt the deal proposed back in March isn’t going ahead. It is not implausible, however, that ACL may come back with a new offer that raises the competition regulator’s concerns. ACL may alternatively look for assets elsewhere, as may HLS.

Nonetheless, even as outsiders, we would find it frustrating that all these efforts have come to nothing so far, even if it is far from the only company to have suffered the fate of seeing months of negotiations all come to nought.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…