Sonic Healthcare (ASX:SHL): Australia’s biggest pathology stock is available at a bargain price

![]() Nick Sundich, February 22, 2024

Nick Sundich, February 22, 2024

It is not often that you can buy a blue-chip stock at a bargain price, but Sonic Healthcare (ASX:SHL) is such an opportunity. Yes, we all know its 1HY24 results didn’t look that good – at least not to the investors that sold it off – but hear us out here.

Although COVID-19 was a boom for pathology stocks, it was also a curse because revenues dropped just as fast as they took off. But investors appear to underestimate that it has a strong core business has always been doing well. And there are long-term tail winds in the company’s favour.

Introduction to Sonic Healthcare (ASX:SHL)

Sonic Healthcare is a medical diagnostics company, headquartered in Sydney but with operations around the world. It operates medical centres, pathology and radiology services. Radiology is medical imaging while pathology is analysing samples of bodily fluids or specimens for the purposes of diagnosing medical conditions.

The company employs 42,000 people globally and has strong market positions. Even in the USA, it is the third-largest private pathology provider. It was founded in 1934 and listed on the ASX in 1987. It has grown both organically and through M&A. Looking at its healthcare peers on the exchange, only CSL (ASX:CSL) has a larger market capitalisation.

A COVID boom and then a bust?

Sonic was one of the largest providers of COVID-19 tests during the pandemic and the benefit showed in its results.

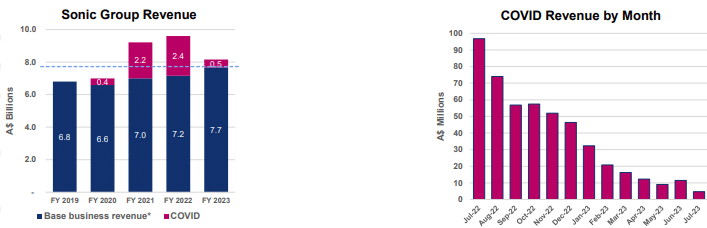

In FY19, Sonic made $6.2bn in revenue and a $550m profit. But then everything started pick up from March 2020. In FY20, $6.9bn in revenue and a $558m profit. In FY21, $8.8bn in revenue and a $1.3bn profit. Things peaked in FY22 with $9.3bn in revenue and a $1.5bn profit before the company recorded $8.2bn in revenue and a $685m profit (the latter figure down 53%).

However, Sonic’s non-COVID revenue increased 11% from $6.9bn to $7.7bn while COVID revenues slumped from $2.4bn to $485m. So this business was always far from a one-trick pony. Its core business was always growing and it has well and truly been weaned off COVID revenues. In FY23, it made $7.7bn in non-COVID revenuesand just $485m in non-COVID revenues.

Source: Company

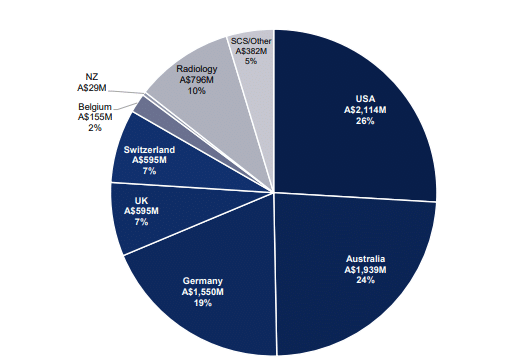

Consider that SHL’s core business is very diverse, with revenues coming from several different geographies and divisions. This is not to say the COVID boom was a bad thing – instead of distributing the extra cash to shareholders, it used the funds to pay down debt and enhance its scale in existing markets.

Sonic Healthcare revenue split for FY23 (Source: Company)

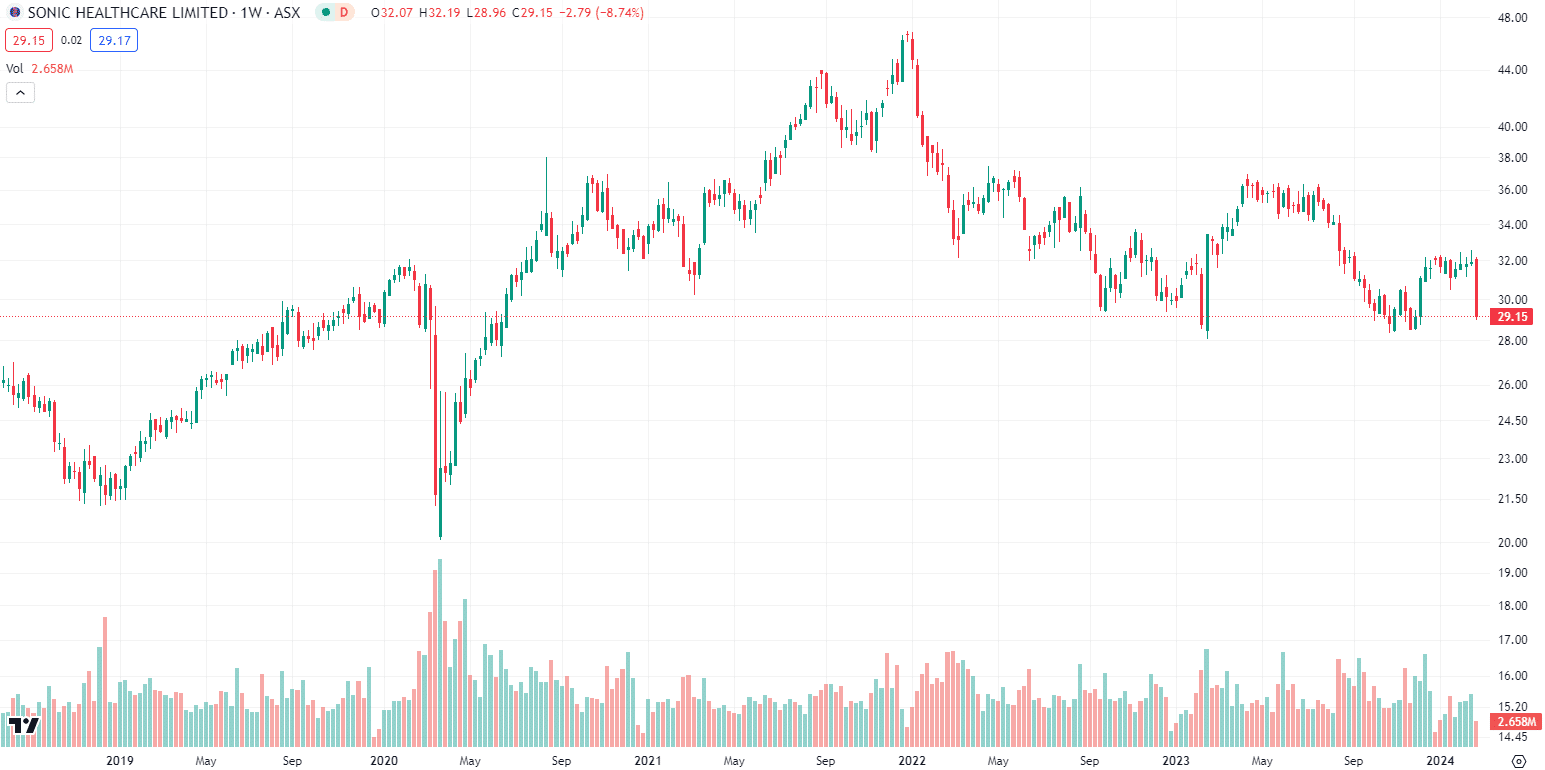

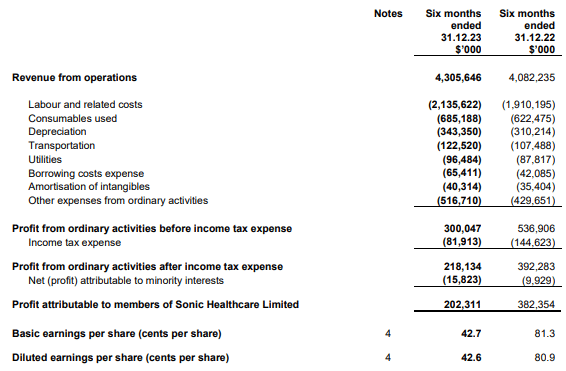

Fast forward to 1HY24, and its base business revenue was $4.3bn, up 15% fro m12 months prior, and it made just $39m in COVID revenues. Total revenue was 5% higher than before. Unfortunately, its net profit was only $202m, barely over half 1HY23, and this scared investors.

Sonic Healthcare (ASX:SHL) share price chart, log scale (Source: TradingView)

What’s the story?

We think the company did itself no favours by simply blaming the lack of COVID-19 revenues. If you look at its accounts report, certain expenses have gone up – especially labour costs which spiked over 10%.

The company had a single bullet point stating ‘cost reduction programs well advanced’ without giving further details. It was more keen to point out the revenue growth in its core business – claiming to have made acquisitions and secured contracts worth A$500m in the last 6 months.

Growth to come in the short and medium terms

6 months ago, Sonic guided to $1.7-$1.8bn in EBITDA, which would be up to 5% growth. Despite these results, it stuck to this guidance, albeit admitting it would be towards the lower range of guidance.

The company has told investors its interest expense would be $125m and it would have an effective tax rate of 25-27%. It assumed current exchange rates and interest rates prevailed but did not take into account potential acquisitions.

Investors were told there were several initiatives that would help earnings growth in the next year, including:

- Momentum in its core-business

- Post-COVID normalisation of its workforce

- Synergies from acquisitions

- Fee indexation in various markets

- Lab infrastructure rationalisation underway in Germany

- Digital pathology and AI to enhance efficiencies

And in the long-term too

Yes, Sonic is an AI play. In 2021, it bought into Harrison.ai, to develop AI solutions for pathology, including a chest X-ray AI tool and CT brain AI application. It has another joint venture with a company called Franklin.ai that will see the pair complete an anatomical pathology AI product that would eventually be deployed within Sonic and sold globally. The company is good at delivering capital returns being a fan of share-buybacks (buying $425m in FY23) and paying a dividend of $1.04 per share (yielding over 3%).

One risk the company was facing was the prospect of a merger between Healius (ASX:HLS) and Australian Clinical Labs (ASX:ACL), a deal that would’ve created a competitor bigger than them. Thankfully for Sonic, the ACCC has poured cold water on this deal.

The ageing population at home and abroad will inevitably be to the company’s benefit. As the nation gets older, there’ll be a need for more medical tests – diagnostic imaging and pathology. And as such a large provider, Sonic is in prime position to benefit.

ESG investors fear not, there’s an angle for you too. Yes, healthcare stocks generally are good ESG elements because of ow they improve human life. But Sonic goes above and beyond with several initiatives underway. Among them: Adding sustainability clauses to new supplier contracts and achieving ESG certifications from MSCI and ISS ESG.

Our valuation

We think Sonic is worth $38.63 per share, using a blended DCF/relative methodology. Its peers (a list including Ramsay Healthcare, Healius, Cochlear, Integral Diagnostics, Capitol Health and Australian Clinical Labs) trade at 27.9x forward P/E. Sonic is currently trading at just 20.8x, but a P/E of 24.8x would be $37.13 per share, up over 24% from the current share price. Our DCF valuation is $40.09 per share, using consensus estimates and a 9.56% WACC.

There are rarely opportunities to buy very good companies at bargain prices, but we think Sonic Healthcare is one of them.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…