Why is bitcoin rising again? Are we on the cusp of a new crypto boom in 2024?

Why is bitcoin rising again? Yes, it is rising – up over 120% across CY23, but why? Were the crypto bros right all along and it is the way of the future? Or this another speculative bubble that’ll burst soon. Let’s take a closer look.

Where is bitcoin right now?

It is just over US$40,000. Bitcoin, like all other cryptocurrencies, has been very volatile. It underwent a near 2 year from the Corona Crash to late 2021, at which point rising interest rates made risk assets of all kinds sink. Cryptocurrencies were tarnished by scandals such as the collapse of exchanges like Binance & FTX and the coming to light of how they were run by their greedy executives.

But, it more than doubled in 2023. Why is this? And is there more to come?

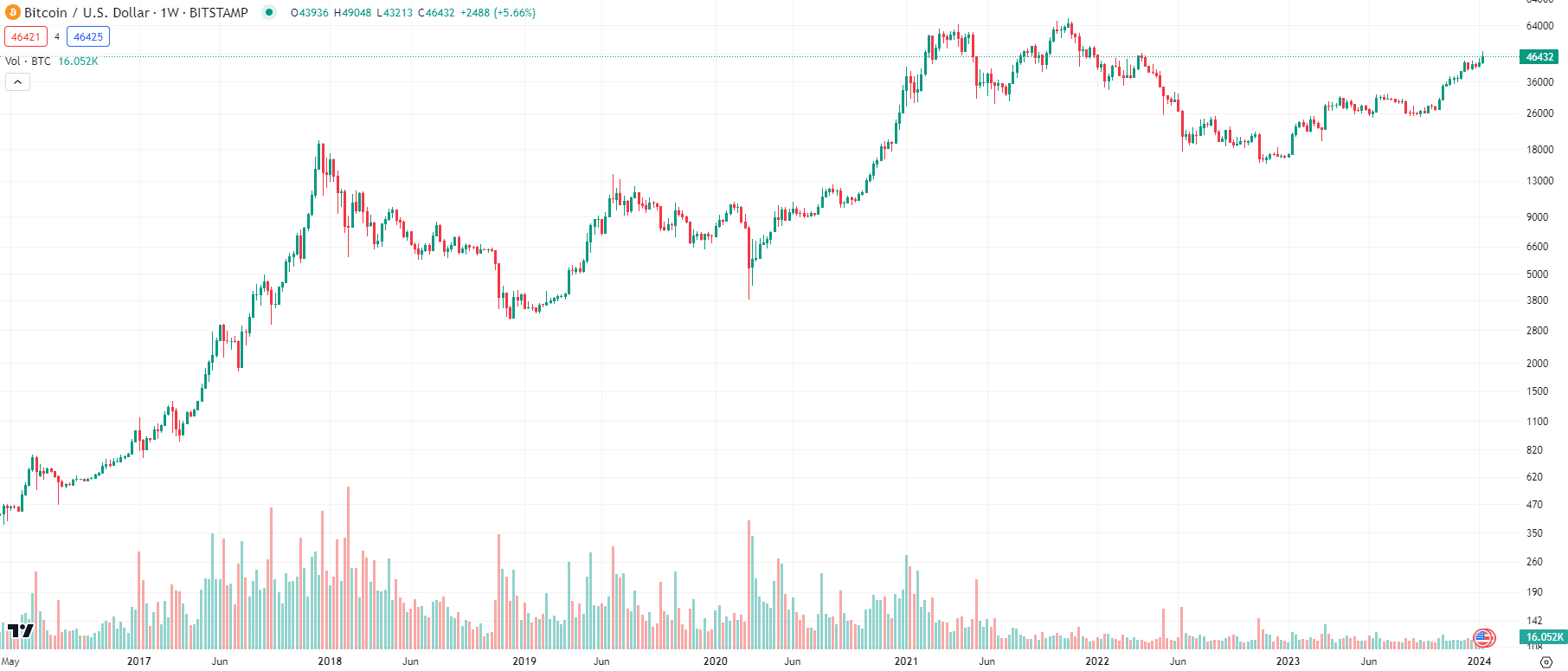

Bitcoin price in USD, log scale (Source: TradingView)

Why is bitcoin rising again?

In our view, there are a few reasons. First is the perception that the Fed is done lifting interest rates – even if not all central banks are – because inflation is under control. This does go against one of the key arguments of cryptocurrencies, that is a hedge against inflation, because it has proven not to be the case. Second is the fact that the first spot bitcoin ETF has been approved. Inevitably, this will give investors more ways to invest in cryptocurrencies generally, obviously helping bitcoin.

Thirdly, the so-called halving is set to occur next year, which will halve the number of tokens bitcoin miners receive for their work. All three halving events before (in 2012, 2016 and 2020) led to bull runs and there’s little reason to suspect it’ll be different.

So it it time to jump in?

Disclosure: We have an interest to say no, given our focus on stocks – but, we won’t give that succinct answer. We would say only if you’re comfortable with the extreme volatility and the prospect of losing all the money you put in (yes, we have seen it before).

Keep in mind that the industry is volatile, both ways. So while there is money that could be made, there’s a lot that could be lost.

I SAID YES!!!! ❤️❤️❤️???????????????????????? my wife asked if I lost all our savings on an obscure cryptocurrency

— Dr. Parik Patel, BA, CFA, ACCA Esq. (@ParikPatelCFA) September 15, 2023

We’ve been here before

In all seriousness, it is something we have seen before. Now yes, bitcoin is a more established cryptocurrency than your average Initial Coin Offering. But it is still well short of many promises that have been made. There are few places that accept bitcoin as a method of payment, it is very expensive to generate and very difficult to store if you actually possess bitcoin. The latter problem could be addressed with the aforementioned bitcoin ETF, but the jury is still out on whether it really be like any other ETF.

And yes, while Sam Bankman-Fried is behind bars, that doesn’t wipe away the impact of his crimes. And there has been little to no regulation surrounding this currency. Most importantly, it could take just one rate hike to send it into freefall. The very reason why bitcoin is rising is because of hope of things that haven’t happened but are anticipated to be, two mere hopes and one based on past precedent.

Some investors may understand and be comfortable with the risks of investing in this asset. Others may say they are, but not really be. In our view, only the former group should consider trying to profit from the current bull rally, given there is no certainty that it’ll last with a vengence.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…