Why do some companies capitalise expenses such as R&D? Should investors even care?

![]() Nick Sundich, July 12, 2023

Nick Sundich, July 12, 2023

There’s plenty of accounting plays companies can make and one of them is to capitalise expenses.

To capitalise expenses (particularly R&D – Research & Development) means to record them on the balance sheet of a company, rather than expensing them immediately.

In this article, we look at the impact it has and if investors should care.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Just how can a company capitalise expenses?

To recap, capitalising expenses (generally) involves shifting it from the profit and loss statement to the balance sheets by representing them as assets.

Let’s say a company makes $50m in revenue, spends $25m in R&D and another $15m in selling, general and administrative expenses, thereby making a $10m pre-tax profit.

But if a company capitalised that R&D expense, it would record a $35m pre-tax profit. That $25m would be represented as capitalised R&D expenditure on the balance sheet as an asset.

The same process would go for any other capitalised expense, although R&D is the most common expense to capitalise given it lasts for the longer-term in a way that few other expenditures are.

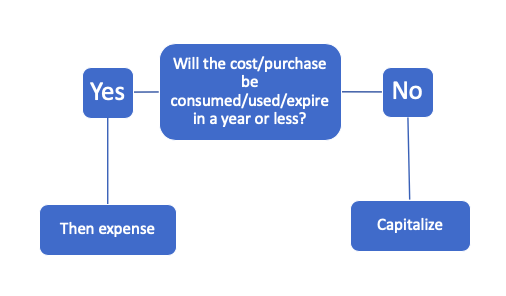

How should companies choose whether to capitalise or expense expenditure? The flow chart below provides a guide.

What do we mean by R&D? It is a broad term, but we are alluding to activity incurred on research and development activities of new products and services such as clinical trials and manufacturing of test products.

Some jurisdictions may allow expenses such as depreciation in assets used for R&D or transformation of company assets to serve R&D purposes when they may have served another purpose.

What impact does this have?

The choice to capitalise R&D expenses allows companies to spread out the cost over a period of time, reducing the immediate financial burden and providing increased cash flow.

Additionally, capitalising these expenses gives companies access to resources and capabilities that could help them develop new products, technologies or services that could potentially give them an edge over their competitors in the long run.

Capitalising expenses such as R&D can also allow companies to benefit from economies of scale due to large-scale investments in research and development initiatives, increasing their overall profits.

And finally (as depicted above), it increases the company’s profit, thereby improving its image in the sight of investors. This is even before you consider how many R&D tax incentives that are available for major companies.

Does this artificially inflate the company’s profit? Well, yes it does.

But if companies don’t capitalise R&D, the total assets and invested capital may not reflect how much the company is investing in. And investors may conclude that there are less future prospects in a company not investing in its future as much as others.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

What rules need to be followed?

As we noted above, a company can only capitalise expenses like R&D if the benefit will last beyond 1 year.

A firm can only capitalise the costs over a set period for which the expenditure will provide benefits for. And it follows from this that not all expenditure can be capitalised over the same period.

And not all costs can be capitalised – it is up to the applicable tax authority. Some R&D costs will be prohibited such as resource exploration, consumer surveys and acquiring existing patents and model products.

So what’s the big deal?

Investors need to watch how much their company is spending on R&D and see if it is capitalising R&D or choosing to expense it.

This is because it will increase profits and assets, thereby making the company more attractive to other investors.

But either way, R&D expenditure will hopefully provide your company with its future competitive advantage!

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target and stop loss level in order to maximise total returns. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 14 days … for FREE.

GET A 14-DAY FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…