Xero’s FY23 results were spectacular for the company, but here’s why it might be great news for other tech stocks too

Xero’s FY23 results were released yesterday and the market responded favourably – at least if yesterday’s share price movement is any guide.

Xero (ASX:XRO) share price chart, log scale (Source: TradingView)

Do you need solid trading & investment ideas on the ASX? Stocks Down Under Concierge can help!

Concierge is a service that gives you timely BUY and SELL alerts on ASX-listed stocks – with price targets, buy ranges, stop loss levels and Sell alerts too. We only send out alerts on very high conviction stocks following substantial due diligence and our stop loss recommendations limit downside risks to individual stocks and maximise total returns.

Concierge is outperforming the market by a significant margin!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Xero’s FY23 results impress

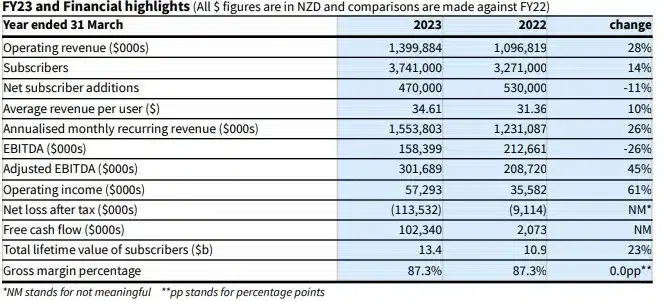

As you can see in the figure below, the results in a nutshell were that subscribers were up, the average subscriber was paying more than last year and, as a consequence, revenues were up.

Source: Company

Delving into other critical figures hidden elsewhere in the report, churn was only 0.9%, which was great not just because it was low for a software company, but because it was unchanged from the year before in spite of inflation.

The company’s non-ANZ revenues recorded strong growth of 30%. And its ARPU was now higher overseas than in ANZ. The company recorded 12-14% subscriber growth in the UK, North America and the Rest of the World.

Xero’s operating expenses as a % of operating revenue fell from 84% to 80.7% and its operating income margin rose from 3.2% to 4.1%, even including restructuring costs. The net cash position increased by $46.2m to $97.4m and it has total liquid resources of $1.1bn.

What about next year?

One thing that may have left shareholders disappointed was that there was a lack of guidance for FY24. Nevertheless, the solid performance in high inflationary time are seemingly a sign of confidence for them. Consensus estimates for FY24 (drawn from 16 analysts) call for $1.6bn in revenue (up 19%) and $445.1m in EBIDA (up 81%). These put it at an EV/EBITDA of 34.1x, a multiple that investors may consider high at first glance.

But perhaps you get what you pay for. On an EV/EBITDA-to-EBITDA-growth basis it is undervalued, at just ~0.43x.

Looking further ahead to FY25, consensus estimates call for $1.8bn in revenue (up 13%) and $551.7m in EBITDA (up 24%). In FY26, $2bn in revenue (up 11%) and $660.2m in EBITDA (up 20%).

Xero’s EV/EBITDA for those years looks more reasonable at 25.8x for FY25 and 21.6x for FY26, illustrating its growth prospects are not just a short-term fad (as has been the case with plenty of other tech companies’ growth in recent years).

Why these results are good news not just for Xero

Obviously Xero investors are happy, but we think tech investors more broadly should be happy too. Xero’s results, and the investor reaction to them, indicates that tech companies can still perform in this environment.

Specifically, those that have 4 things:

- Strong customer bases,

- A track record of long term growth,

- Dominant positions in the market, and

- Growth potential going forward.

Xero has all of these and there are plenty of other tech stocks that do too – TechnologyOne (ASX:TNE) is one that we think meets these criteria. But companies that are in competitive environments and that customers can easily give up and/or switch to competitors likely won’t do so well.

Xero is reporting now because it uses the NZ financial year, which ends on March 31. Investors in other tech stocks will need to wait until August to see their companies’ FY23 results.

Stocks Down Under Concierge is here to help you pick winning stocks!

The team at Stocks Down Under have been in the markets since the mid-90s and we have gone through many ups and downs. We have written about every sector!

Our Concierge BUY and SELL service picks the best stocks on ASX. We won’t just tell you what to buy – we give you a buy range, price target, a stop loss level in order to maximise total returns and (of course) we tell you when to sell. And we will only recommend very high conviction stocks where substantial due diligence has been conducted.

Our performance is well ahead of the ASX200 and All Ords.

You can try out Concierge for 3 months … for FREE.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…