TechnologyOne (ASX:TNE) is a great company, but is it overvalued?

![]() Nick Sundich, March 21, 2024

Nick Sundich, March 21, 2024

TechnologyOne (ASX:TNE) is one of those solid growth companies that we wouldn’t recommend investors to buy. It has been a long-term success story since it listed and no doubt has more to come. But we believe it’s growth is not enough to justify its current share price, especially considering there are other opportunities in this space.

Who is TechnologyOne?

TechnologyOne is a tech stock specialising in Enterprise resource planning (ERP) software with a focus on the education and government. This company has over 800 large scale enterprise organisations, with millions of users, as clients. Beyond the dozens of councils it has helped, other clients include Queensland Rugby League, the Te Papa Museum in New Zealand and several universities. Its products perform several tasks for customers including reducing costs, improving efficiency and streamlining processes.

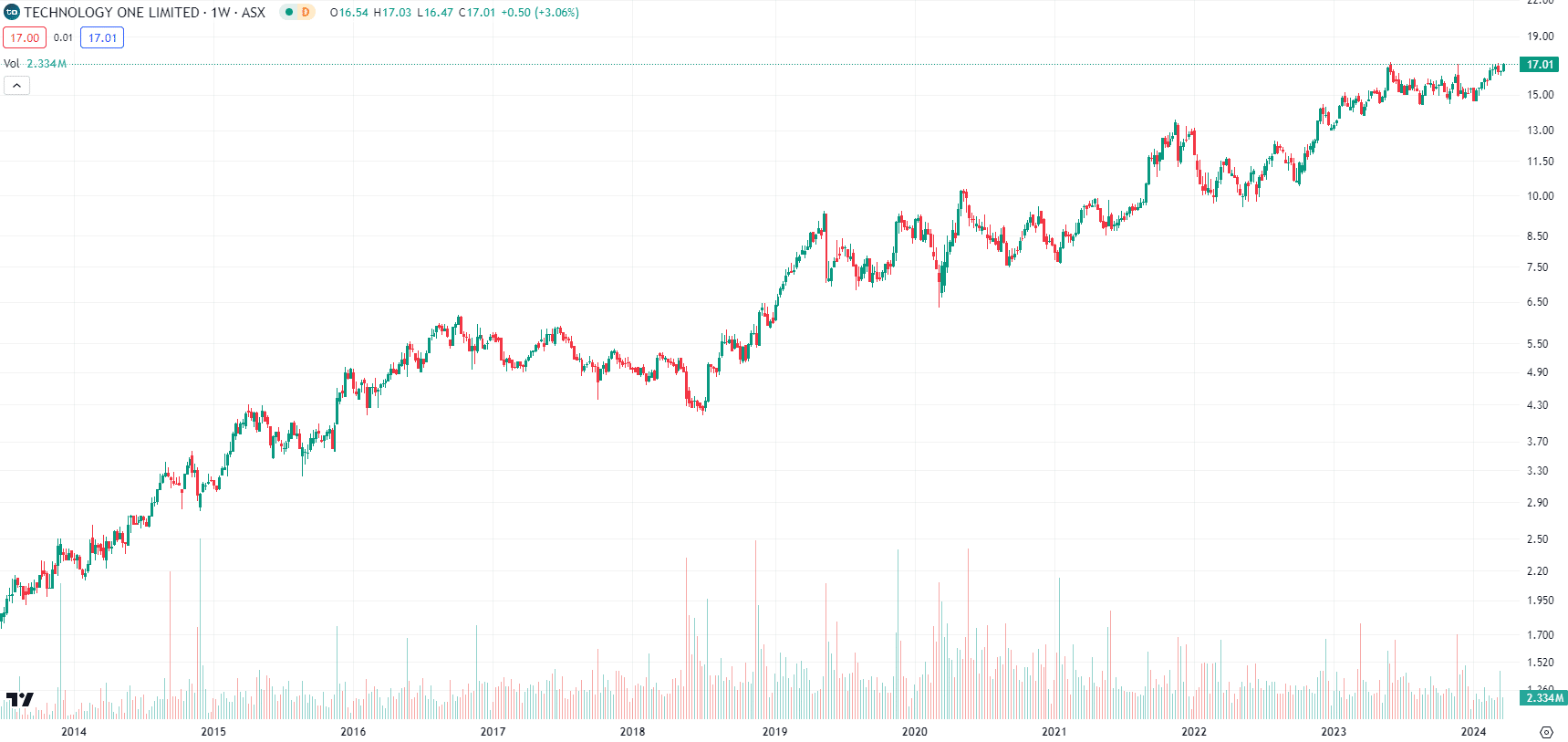

TechnologyOne was founded in 1987 and listed in 1999 at just $1 per share. Investors who have held TechnologyOne for the long term have made some hefty gains from this company. Even investors who have only been in for the short-term have done better than most other tech companies during this time.

TechnologyOne (ASX:TNE) share price chart, log scale (Source: TradingView)

A very well performing Tech stock

Why has the company done well? Most obviously it has grown its revenues and profit – for nearly fifteen years. But it is also because its key clients are transitioning towards software solutions such as those offered by the company, a trend occurring before the pandemic, accelerated by the pandemic and still ongoing. Goldman Sachs estimated in 2022 that the transition from on-premise systems to Cloud software is just 20% completed.

Did we forget to mention that TechnologyOne is profitable? This can’t be said of all tech stocks. But more impressively, it has remained profitable while transitioning its offerings to cloud software.

Solid growth

In the last five years, its revenue has transitioned from one-off license fees to recurring SaaS fees. It recorded $432.2m in total revenue and $392.9m in Annual Recurring Revenue (ARR) in FY23, causing the company to bring forward its target of $500m ARR from FY26 to FY25. Its profit came in at $129.9m pre-tax and $102.9m post-tax, both up 16% and beating its guidance of 10-15% growth. The company paid a dividend of 19.52c per share, including 3c per shares as a special dividend, up 15%.

TechnologyOne has claimed that no other ERP company in the world transitioned without impacting its customers and/or its profit growth.

Future growth prospects

TechnologyOne is not satisfied with this growth. We mentioned it is targeting $500m in ARR by FY25 as well as expansion into the UK, a market 3x larger than Australia. Even in Australia, there is more opportunity to be gained. As we noted above, Goldman Sachs estimates the transition is only ~20% complete.

It also estimated that annual revenues are US$235bn compared to enterprise IT revenues of US$1.4tn and the Cloud could easily grab that and even more from non-digital spending.

Turning to consensus estimates, there are 15 analysts covering the stock and they expect $489.3m in revenue and a $117m post-tax profit in FY24 (up 13% and 14% respectively). In FY25, $550.6m in revenue and a $136m profit (up 13% and 16%).

TNE has become very pricey!

However, the company is trading at P/E multiples of 46.3x for FY24 and 39.5x for FY25. Its EV/EBITDA multiples also are priced high at 24.5x and 21.1x for the next couple of years as are its PEG multiples of 3.1x and 2.6x. Bear in mind that PEG multiples >1 are considered overvalued.

Furthermore, the mean share price target amongst analysts covering the stocks $16.37 (a 5% discount to the current share price). We have built a model for TechnologyOne and derived an implied price of $17.50 per share, using consensus estimates. This suggests some upside, but not as much compared to other tech stocks.

Better opportunities elsewhere

We like the TechnologyOne thematic, but think there are better opportunities in the sector that are more reasonably priced. One is ReadyTech (ASX:RDY) that we think can more than double from its current price. Another is Objective Corporation (ASX:OCL) that we think can gain over 30% from its current share price.

Investors should consider these companies ahead of TechnologyOne, in our view.

What are the Best ASX stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…