Cyclopharm (ASX:CYC): FDA approved for 2 years now, but a lawsuit from 4DX is the latest headache and cause for investor scepticism

Cyclopharm (ASX:CYC) is a rare species – an ASX stock that is approved in the US market. However, its share price has gone in the opposite direction. Cyclopharm has not had as fast an uplift as other companies have had and still makes most of its sales from other jurisdictions. A lawsuit from 4D Medical (ASX:4DX) is a new headache for the company and its investors.

But to understand where the company is now and where it is going, we have to look back.

What are the Best ASX stocks to invest in right now?

Check our buy/sell stock tips

Who is Cyclopharm? And what is Technegas?

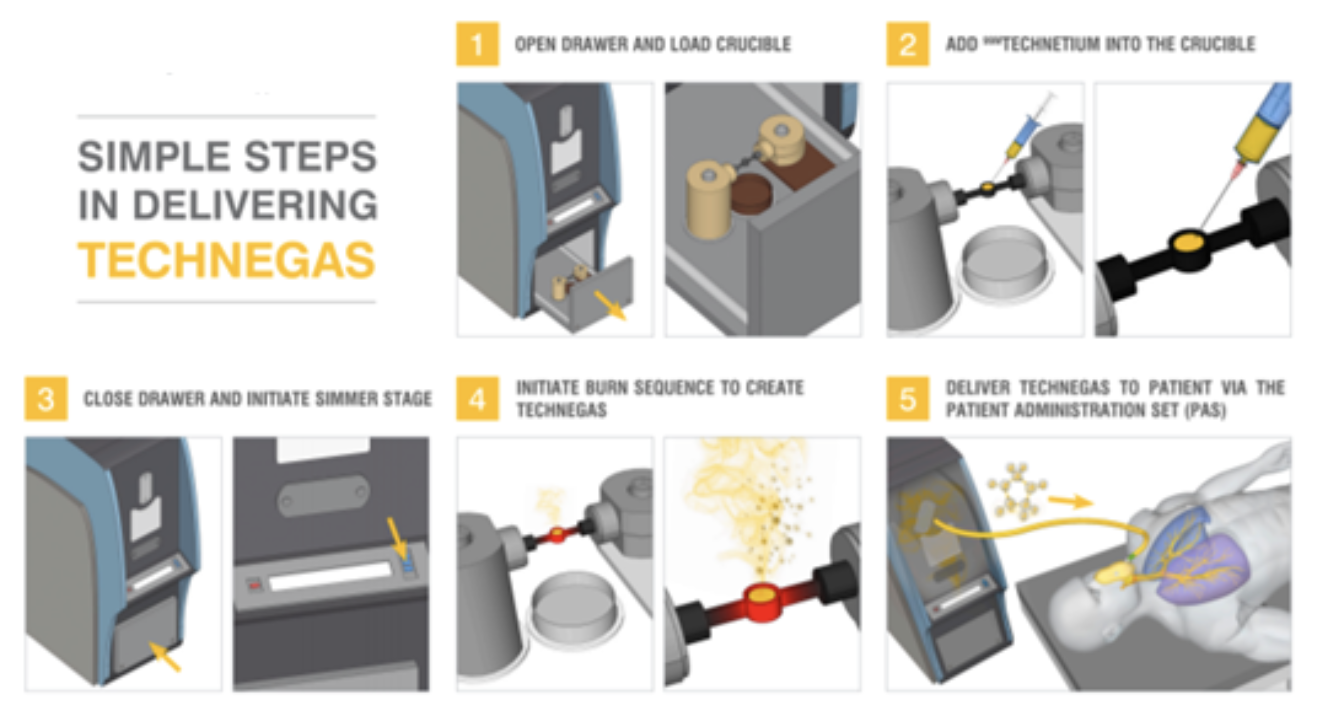

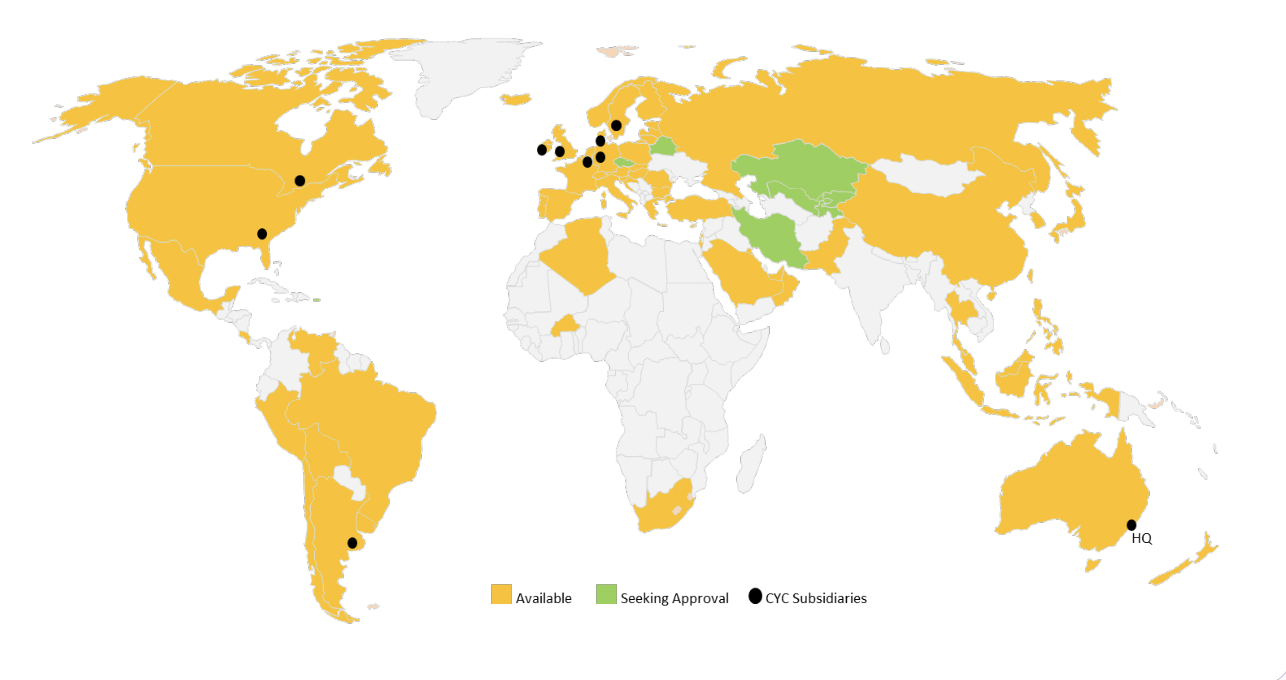

Cyclopharm is an ASX-listed medtech company that sells Technegas in over 60 countries. Technegas is a gas that patients inhale in via a breathing apparatus that makes the lungs easier to see via a special type of nuclear medical scan taken of the lungs – a Ventilation-Perfusion (VQ) scan. The company has multiple revenue streams being not only a supplier of the generator and consumables, but a provider after-sales services of the devices.

Source: Company

Technegas has several advantages including that it:

- Is more diagnostically accurate, being able to reach parts of the lungs that other types of images cannot

- Uses less radiation, and thus administers a lower dosage to patient

- Works quickly and simply enabling a rapid diagnosis, and

- Can be administered to almost all patients.

From a business model perspective, Cyclopharm is a good business because it has a multi-faceted revenue model, including a one-off installation and training fee, ongoing recurring revenues from access fees and annuity sales revenues for per-patient consumables.

Technegas is used to diagnose a lung condition called Pulmonary embolism (PE) which is a condition occuring when a blood clot (thrombus) becomes lodged in an artery in the lung and blocks blood flow to the lung.

Technegas is sold in over 60 countries, but only recently to the US

Technegas was first registered as a drug in Europe in 1996, and in Canada in 2003. In the latter market, it has essentially captured the entire opportunity over the last 20 years, now being used on over 45,000 patients per annum. Cyclopharm picked up Technegas from Vita Life in 2006 via a share exchange, and listed on the ASX in the following year. It is present in over 65 countries, including the USA, which only joined the list last year.

Source: Company

The USA is the world’s largest healthcare market generally, as well as for nuclear medicine. But it also has the world’s most stringiest regulator and it has taken nearly 2 decades to obtain approval. The FDA had been convinced of Technegas’ efficacy for years, but still declined to approve it for other reasons such as certain aspects of the manufacturing of the crucibles and the dosimetry in adults and children. It is also important to note that none of these issues were ever raised in other jurisdictions where Technegas is delivered.

Throughout the pandemic, the company went to great lengths to obtain the long awaited green light, going so far as to hire ex-consultants from the FDA to review its submission and checking the FDA’s queries with regulators that had already approved Technegas several years ago. But one positive sign was that FDA officials went to the trouble and expense of a fortnight’s stint in hotel quarantine in order to visit the site. In October 2023, approval was finally obtained.

Why the US is so important

US market is a major opportunity for CYC, not just because it is the world’s largest healthcare market generally. It is also a market where Pulmonary Embolism (PE) is a major burden. The American Lung Association estimates that PE impacts around 900,000 people annually and that it 10-30% of individuals die within one month of diagnosis. Pulmonary Embolism occurs when an artery in the lungs gets blocked by a blood clot. In many cases, this blocks the flow of blood to the lung and this makes it life threatening.

In the US, about four million diagnostic procedures are conducted each year on PE patients. Out of all these diagnostics tests being conducted, 15% are based on nuclear medicine imaging and 85% of them are CTPA. These 600,000 nuclear medicine ventilation procedures being conducted every year represent a market opportunity of ~US$90m. However, CYC believes it can double the number of scans sent to nuclear medicine imaging, thereby increasing the PE market to US$180m.

The bigger opportunity for Cyclopharm in the long term will be applications of Technegas beyond PE. CYC is targeting new applications through clinical studies that are focussing on diagnosis of Chronic Obstructive Pulmonary Disease (COPD), asthma and other respiratory diseases, like Long-Covid. It may be a faster process to obtain FDA approval for those other conditions. For now, COPD is the company’s main focus.

Rolling out in the USA…

While awaiting FDA approval, CYC management did the groundwork to ensure a hassle-free entry and rapid expansion post Technegas’ approval. Management took steps to ensure that Technegas will be reimbursable by health insurers from day one making its adoption easier by patients and hospitals. It plans to supply Technegas generators to US hospitals through a service model rather than an upfront sale of generators.

Through this model, the company will retain ownership of the generators over their lifecycle and charge an ongoing annual fee attributed to preventative maintenance, raining and product support. This approach will result in accelerated consumables revenue and provide a more predictable revenue base over the generators’ lifecycle.

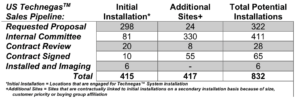

CYC obtained over 400 expressions of interest from US hospitals for Technegas. Furthermore, it had several dozen generators stocked up at its Sydney headquarters, all ready to be shipped to the US. The company rationalised its supply chain pre-COVID so it has been unaffected by supply chain issues post-pandemic. Technegas has been awarded a ‘Transitional Pass-Through’ (TPT) status by the Center for Medicare and Medicaid Services (CMS), providing for Technegas to be fully reimbursable for a maximum of 3 years.

We last updated this article in August 2024. Cyclopharm told investors just a couple of months prior that it had a target of 300 generators in place by December 2025. And this was not even its entire sales pipeline.

Source: Company

2025: some good signs…

There have been some good signs such as contract signed with individual providers such as with HCA Healthcare to deploy Technegas in up to 169 nuclear medicine departments, and with the USA’s Veterans Health Administration. Technegas was given Transitional Pass-Through status in the US, enabling full reimbursement as well as good sales in other jurisdictions leading to total CY25 revenue of $27.6m. There was some more research that showed the potential of Technegas in ‘Beyond PE’ applications.

The company made $827,000 in revenue from 17 operations in CY24 and the US$1m milestone was reached in late March 2025, at which point it had 27 Technegas systems. In 1H25, the company made US$15.4m revenue and $1.24m in the US for the period (representing a doubling of sales and installations in 6 months). Installations stood at 35 as of June 30, 2025.

If investors ever worried about Trump’s tariffs, they shouldn’t have as it has a manufacturing facility in the US and a substantial amount of inventory offshore. And recurring revenues should start flowing in as the generators in place are used and so are consumables that will need to be replaced after each scan.

But some troubling ones

However…the company now anticipates 250-300 installed Technegas systems, during the second half of 2026. Investors hate it when companies backtrack on targets, especially when they are withdrawn because it appears companies won’t make them. Argue all you like about whether or not getting 35 installations in less than 2 years is impressive or not, but it is unlikely to reach 250-300 in just 12 months unless sales ramp up substantially more than right now. Also, the company is loss making with over US$7.5m in the red for both 1H24 and 1H25.

The loss for CY24 was US$13.1m, representing a near -50% margin. Let’s look at some individual expenses. The cost of materials and manufacturing was US$9.6m, but this was down $600k from the year before and still leaves a >60% gross margin. But employee benefit expenses surged from US$11.7m to US$16.1m and administration expenses rose from US$7.7m to US$11.4m. The company will need to be profitable eventually, and maybe it might if sales grow more substantially than right now.

CYC investors received a fresh headache in the form of a lawsuit from 4D Medical. We cannot say too much more because the company did not point out what specific comments were made, and we could not discern for ourselves. Even if this lawsuit comes to nothing or is settled out of court, the lawyers will likely be bigger winners than any of the plaintiffs.

Source: Company

Cyclopharm is undervalued

With a market capitalisation of >$90m as of October 8, 2025; it is arguable that Cyclopharm is way undervalued. There are companies that are still at the clinical stage that have higher market capitalisations like Immutep (ASX:IMM), Imugene (ASX:IMU) and Clarity Pharmaceuticals (ASX:CU6). As for companies that have recently commercialised drugs in the US, there are some with capitalisations in the multi-billions of dollars like Telix (ASX:TLX) and Neuren (ASX:NEU).

Our friends at Pitt Street Research have written multiple reports on Cyclopharm in the past, with the most recent one valuing the company at A$429.1m in a base case and $600.7m in an optimistic case, equating to $3.86 and $5.41 per share respectively, accounting for the current number of shares on issue. This was using a 9x EV/Sales multiple vs a 5.6x multiple it was valued at during the period when the report was issued.

We think for Cyclopharm to get out of its rut, it needs to start ensuring revenues are growing faster than costs and make some progress towards reaching the goals it has set itself. Yes, this may happen as recurring revenues from existing generators flow through, but seeing will be believing for investors.

Pitt Street Research/Stocks Down Under staff and directors own shares in Cyclopharm

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…