Things were going so well for Redox (ASX:RDX), Australia’s largest chemicals importer, until its 1H25 results

It was a golden run for chemical importer Redox (ASX:RDX) from when it listed on the ASX in July 2023…until its 1H25 results. It is easy to forget how big a of a deal it was – it raised $402m for a $1.34bn valuation, making it the biggest IPO in 18 months at the time, although it has since been surpassed by Guzman y Gomez (ASX:GYG).

At the time Redox listed, the IPO market was all but dead, at least in respect of non-resources companies, and it was hoped the listing would perform well and the IPO market would revive. Redox shares were flat for the first 6 months or so, only to gain over 90% in CY24, then start 2025 well…until its 1H25 results. What went wrong. Let’s go back to the beginning.

Meet Redox

Redox is a chemicals importer based near Campbelltown in South Western Sydney. This company sells chemicals, ingredients and other raw materials to over 6,000 manufacturers. These include food ingredients, pharmaceuticals, flavours, specialty chemicals, fertilisers, pigments, plastic polymers and many more, totalling over 500,000Mt sold per annum.

The company is not a manufacturer, but a distributor, so it is essentially a middle-man, although in the era of supply chain issues, this isn’t the worst space to be in. But it does not just transport and deliver the goods, but also performs any necessary mixing and blending as well as technical support, so it can create value beyond the original manufacturers.

A typical Redox customer makes end products like detergents, shampoo or even food. They lack forecasting abilities and an R&D or storage budget necessary to do much other than manufacture. They need storage, technical help to use products and need just in time delivery. Meanwhile, a typical supplier makes several products which, are used in many disparate industries, has many competitors and is hence unwilling to give credit to buyers. They too experience costs too high (and a logistics capacity too low) to serve customers in their own right.

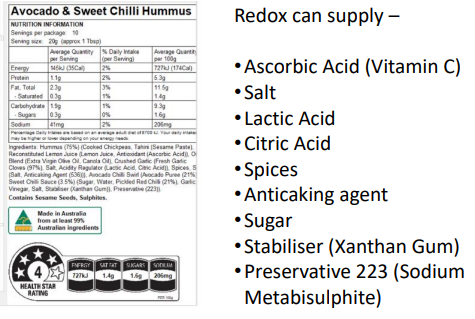

Although costs are a risk, Redox is better able to absorb costs and negotiate good prices with suppliers because it is a market leader. And, as the company shared in a recent presentation, it could supply most of the ingredients in a typical Hummus.

Source: Company

Redox was founded in 1965 by Roland Coneliano and it has stayed in the family to this very day – the family still owns over two thirds of the business. On a CAGR basis, it has grown sales at 11.9% annually over the last 30 years. Redox is the largest company of its kind in Australia with eight warehouses in Australia and operations in New Zealand, the USA, Malaysia and (from 2024 onwards) Canada, although 85% of its revenue came from Australia in FY23.

At the time of its IPO, the company told investors to expect $1.33bn in revenue and a $97.4m profit for FY24 which would have been 9% and 20% higher than FY23. It also told investors to expect potential M&A going forward given that the industry is highly fragmented as well as its first dividend in March next year from its 1HY24 profit. The plan was to pay 70% of its profit.

Redox’s financial performance: good in FY24, but not in FY25

Let’s look at FY24. Although its revenue was down 10% and its ROIC was down 2.5 percentage points, investors weren’t too concerned about the result because its gross margin rose by 2.6 percentage points and its profit margin by 1.5. Its underlying profit (excluding forex) was $95m, $10m higher than the year before.

Considering the industry conditions, with subdued demand, trade uncertainty and normalising chemicals prices, things were pretty good – albeit not good enough to give any specific guidance for FY25.

Investors took the company’s 1H25 result pretty badly. Even though sales rose 8.6%, its profit fell $7m and its gross margin to 21.6% (down 1.5%). This was due to higher volume, lower margin sales and lower margin acquired businesses. Its healthy net cash position of $138m was little consolidation, not further acquisitions. Still, it paid an interim dividend of 6c per share, 78% of its net profit.

‘We largely expect macroeconomic and geopolitical headwinds to continue into 2H25, however we are well positioned as demand recovers,’ the company said.

‘We operate in a large, attractive sector and as the fundamentals of the business are strong, we remain well placed to continue to grow strongly’.

Seemingly investors begged to differ, or perhaps they were just rushing to sell due to fear of Trump’s tariffs. The ASX went so far as to send the company a query letter, asking if perhaps investors expected better and perhaps should’ve given guidance earlier. The company retorted that it gave no guidance and it was not that far from consensus estimates.

Shares fell further in June. Despite no news out of the company, it seems investors were worried by one bad report from Morgan Stanley which was worried about external macroeconomic factors. Nonetheless, all analysts covering the company expect a higher share price – ranging between $2.68 and $4.40 with the mean price being $3.57.

A cheap price, for a reason

Considering analyst’s estimates, the company’s P/E is 14.2x for FY25 and 12.6x for FY26. But these estimates, despite calling for 11% and 6% revenue growth over the next couple of years, expect the company’s EPS to retreat from $0.18 to $0.15 in FY25, then modestly recover to $0.17 in FY26. These would amount to profits of $78.8m and $89.3m respectively.

The company hopes to grow both in Australia and in North America, but it is the latter that presents a bigger opportunity, with chemicals being an A$191bn market and ingredients a further A$31bn in the US alone, compared to A$28bn and A$8bn in Australia respectively. The company is active in 35 states with 16 sales representatives across 5 cities and 12 warehouses in the lower 48 states (all the states except for Hawaii and Alaska). It can also use these as a springboard into Canada with established customers in 4 major provinces.

But investors might be continue to weary of this company given the macroeconomic conditions. They also may remember what happened to peer chemicals company DGL (ASX:DGL) that crashed back to earth after a strong debut.

The issues with DGL were that margins were decimated and that the company was only growing through M&A. We believe the polar opposite is the case with Redox, but seeing will be believing for many investors. And so we will be watching this one with close interest but not recommending investors buy it right now.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Nvidia (NASDAQ:NVDA) New Rubin Chip Is Here, A 25% Higher Price, A 10x Better Outcome

Rubin Is Here, The Real Story Is Cost per Token Nvidia has now unveiled its new Vera Rubin chips, and…

Objective Corporation (ASX:OCL) is a superb ASX 200 tech stock

Objective Corporation (ASX:OCL) is one of a kind. There are few companies with a 2-decade listed life without raising a cent…

AI-Media Technologies (ASX:AIM): Investors are panicking that it’ll be a victim of AI

AI-Media Technologies (ASX:AIM) is not the only ASX stock with investors panicking that AI will make it go the way…