The Guzman y Gomez ASX IPO gained over 35% on its first trading day – but will the hot run last?

![]() Nick Sundich, June 20, 2024

Nick Sundich, June 20, 2024

The Guzman y Gomez ASX IPO was a spectacular success. After months of rumours, and a few weeks marketing (and criticism), the company debuted on June 20, 2024 and debuted at $30 – well up from the $22 it raised capital at.

Guzman y Gomez share price chart, log scale (Source: TradingView)

Guzman y Gomez began in October 2006, opening its first store in the Sydney suburb of Newtown. It was founded by Steven Marks and Robert Hazan who were native New Yorkers that had moved to Australia and missed the type of Mexican food you could get over in the States.

The company now has over 200+ restaurants, under both franchisee and corporate models. It has stores in 4 countries – Australia, Singapore, Japan and the US, although 185 of its 210 stores are in Australia with another 16 in Singapore. It hit $759m in sales in the last fiscal year. The company is aspiring for over 1,000 stores in the next 20 years, and that is just in Australia. It is aspiring to open 40 restaurants per annum within 5 years. This IPO will mark an opportunity for its employees and franchisees to own shares in the company – indeed, there will be an offer just for the company’s employees and franchisees.

All of that is well known. But every company that lists has big growth ambitions. No company will list saying they have no ideas for the future. Yet some fail, and others burn. Why has Guzman y Gomez done so well on its listing day?

5 reasons why the Guzman y Gomez ASX IPO did so well

1. Guzman y Gomez is a (partially) founder-led company and has an interesting board

Steven Marks is, as noted above, co-CEO of Guzman y Gomez and will still own 9.9% of the business. Founder-led businesses can be good investments because the can treat the company as ‘their baby’, at least moreso than a CEO who owns no shares and is just paid a cash salary. Of course, one issue can be a lack of control, although we don’t suspect it will be here given Marks doesn’t own a majority and this isn’t a dual-class share structured company here.

Turning to the rest of the Guzman y Gomez board, the company has been chaired since 2019 by Guy Russo. Russo, who holds 5.6%, also serves on the board of Scentre and is former CEO of Kmart & Target, not to mention McDonalds Australia. Overall, existing substantial shareholders, the board and senior management will own over 60%. Other directors include former Bunnings NZ CEO and Head of People Jacqui Coombes, and former CEO of Jetstar (and current boss of e-commerce tech company Rokt) Bruce Buchanan.

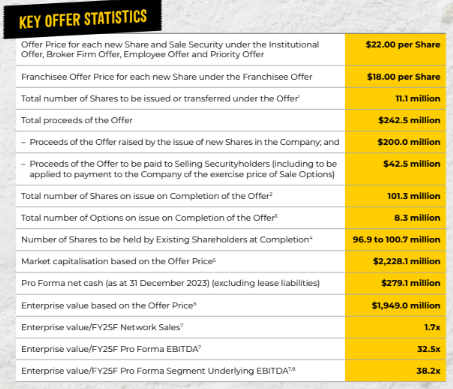

2. If Guzman y Gomez investors looked at the multiples, they thought it was worth it

The company listed with a valuation ~$2bn. Specifically, it will commence trading with an Enterprise Value of $1.95bn and a Market Capitalisation of $2.23bn, with the difference being the company’s $279m in pro forma net cash. Obviously this is higher since it listed. The price was an FY25 EV/Sales of 1.7x, an EV/EBITDA (Pro Forma) of 32.5x, and an EV/EBITDA (Pro Forma Segment Underlying EBITDA) of 38.2x. It has estimated Pro Forma EBITDA to be $59.9m in FY25, up from $29.3m in FY23.

Source: Company

One controversial aspect was that it excluded lease liabilities. Not that there’s anything illegal about that because EBITDA is not an accounting metric, it can be whatever a company wants it to be. Nonetheless, it is intended to be a measure of core operations and lease liabilities are surely a part of that. The company argued it was adhering to accounting rules requiring lease liabilities to be depreciated and so not included in EBITDA. If you did include it in EBITDA, the multiple would be 47.5x.

Investors obviously did one or more of the following:

- Overlooked this issue,

- Thought the company would grow into its valuation considering everything else, or

- Believed precedent (as we’ll address in the next point) showed this company could do well.

$GYG pic.twitter.com/r43h80SnrI

— Kerry Sun (@K3rry_Sun) June 20, 2024

3. There’s precedent for next generation fast food companies to do well

It has been little over a year since Mediterranian chain Cava Group listed on the NYSE and it too was priced at US$22 per share. Well now, it is over US$95 per share, putting at at an EV/EBITDA for FY25 of 82.2x. This makes Guzman y Gomez look cheap in comparison, doesn’t it? And Chipotle Mexican Grill (NYSE:CMG) is up over 60% in 12 months and has an EV/EBITDA of 35.3x.

Conversely, McDonalds is less than 15x EV/EBITDA and Dominos Pizza Enterprises in Australia is 12x, with both of those companies sold off at the same time these chains have been doing well. We know fast food chains are often perceived as immune to bad economic times. This has not been the case during the current bout of inflation, with consumers cutting back spending, and companies wither having to alienate customers by raising prices, or keep prices the same and keep them – but either way sacrificing margins. Perhaps consumers just want something different rather than more of the same.

4. Guzman y Gomez is looking at innovative ways to drive growth

There aren’t many other fast food chains on the ASX, only Collins Foods (ASX:CKF) and Dominos (ASX:DMP). Guzman y Gomez’s growth strategies appeared a breath of fresh air compared to these two. We see four in particular.

First, increasing its reliance on drive-by restaurants. Guzman y Gomez has 88 of its 185 restaurants in Australia as so-called drive through restaurants and it plans to increase this in the times ahead. It plans to open 30 new restaurants in the next 12 months, 20 of which will be set up for drive-by. This model is a win-win situation because customers can remain in their cars, and don’t need to take up space in the restaurant. Indeed, the company’s restaurant margin is 21.6% for drive through restaurants and just 19.8% for ‘strip restaurants’.

Second, increasing its sales during breakfast time, when people are commuting in their cars. It only represents 6% of Australian sales, but has been the fastest growing ‘day part’ (the company’s speak for segments of the day when sales are made) since FY20. Just consider the fact that McDonalds and Hungry Jacks have 81% and 91% of its restaurants in the drive-by format.

Third, a digital strategy. We’re not just talking about ordering online, we’re talking about loyalty programs and engaging apps. For QSR Restaurants, digital apps and loyalty programs make it easy to purchase and purchase repeatedly. They can also provide customised experiences by providing tailored recommendations and promotions, as well as to save their favourite orders. GYG’s program rewards guests with GOMEX points that can be converted to dollars for use in transactions.

As of March 2024, 2 years since GYG launched its app, it has had 1.7m downloads. The average spend per app is 17% higher than in restaurant purchases.

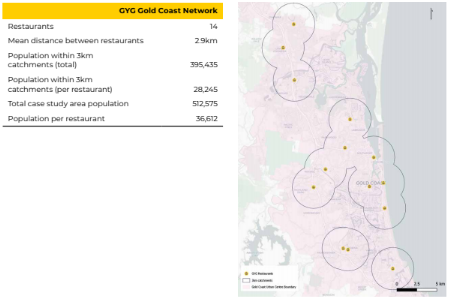

And finally, rather than planting its flag in the ground where there are no flags, the company wants to put more flags in the ground where their are already flags.

In its prospectus, Guzman y Gomez noted the Gold Coast as its most developed network region where it has 14 restaurants with an average distance of 2.9km between them. The company thinks there could be further stores there and growth could come as the population increases. 395,435 people live within 3km of a restaurant, equating to 28,245 per restaurant.

Source: Company IPO prospectus, p.89

5. FOMO

Despite the good story behind the company and its growth plans, you cannot deny some of it was FOMO (Fear of Missing Out) from retail investors. The company many continue to grow from here, but as Collins Foods’ IPO in 2011 showed, it can take only one missed forecast for the tide to swing the other way and send the stock into doldrums for years. More recently, Airtasker’s IPO in 2021 had a lot of FOMO, going from $0.25 to $1.50 in barely a week, before retreating as the hot money chasing it moved elsewhere.

Investors should do their research, not just on what they hear in the media, but on finer details that you would only get from reading the prospectus and doing your own research into the market opportunities the company has before it. But it will be an interesting stock to watch in the coming months, and will no doubt be rewarded if it can meet its performance targets.

What are the Best ASX fast food stocks to invest in?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…