2022 AGM season delivers disappointments for investors this morning

It is that time of year again when the majority of ASX companies hold their AGM’s (Annual General Meeting). These must be held within five months after the end of a financial year and for companies that use the 1 July-30 June financial year, the deadline is the end of November.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

What happens at an AGM?

At an AGM shareholders have the chance to meet the company’s management and hear from them about the year that has past. This is often accompanied with an insight into how things have gone so far in the new financial year.

Sometimes, it is good news. But other times, it is bad news and it was the latter for a couple of companies this morning.

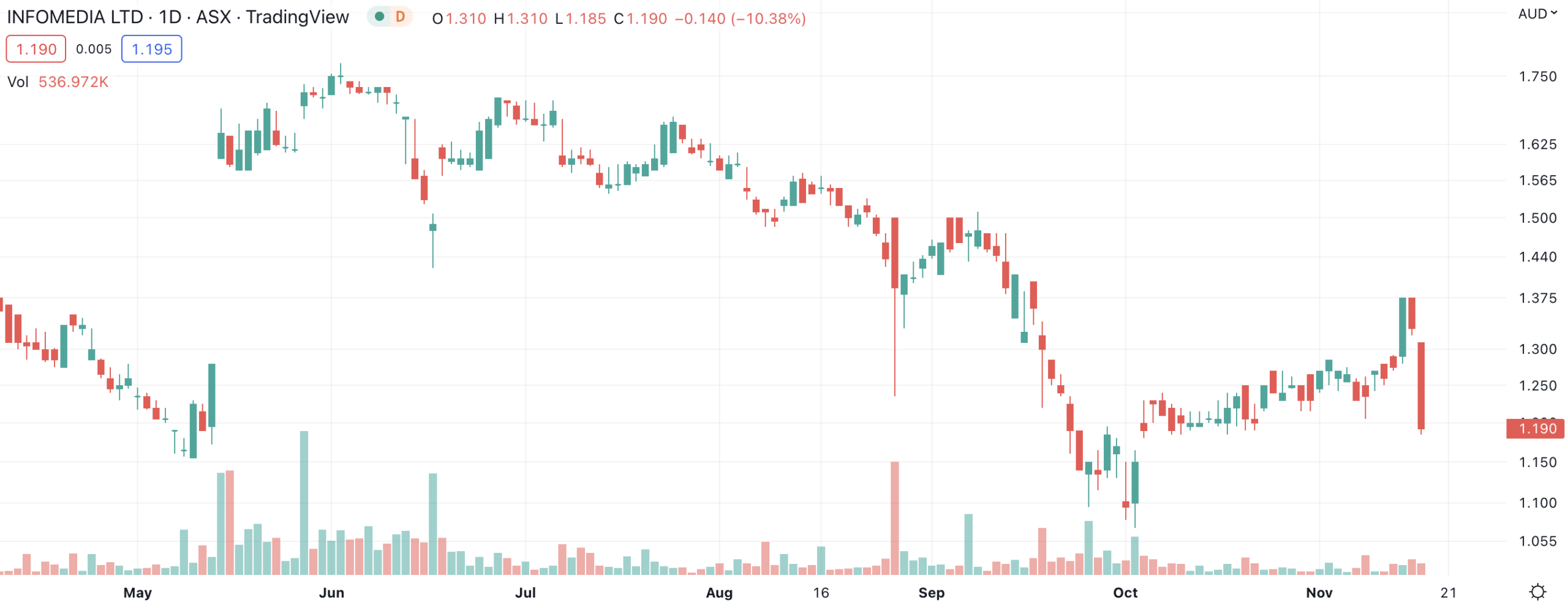

Infomedia downgrades its guidance at its AGM

One company that held an AGM today was Infomedia (ASX:IFM), which provides software to the global automotive sector. It should have been a positive AGM given its FY22 result that saw a 23% revenue growth, 29% EBITDA growth and 79% free cash flow growth.

Trouble is, the company cut its FY23 guidance barely 3 months after issuing it. It expects $129-$132m in revenue for FY23 having previously guided to $131m-$139m. But even if it achieved the lower end of its guidance it would still represent 8% revenue growth. But investors never like downgraded guidance.

We think this morning’s share price crunch may provide a good opportunity to pick up some IFM share on the cheap. After all, 3 Private Equity companies thought the stock was worth $1.70 just a few months ago. Anywhere between $1.00 and $1.15 seems cheap in that light with the company still showing at least 8% revenue growth this year.

Infomedia (ASX:IFM) share price chart (Graph: TradingView)

Medibank faces its shareholders

Another company to hold its AGM today was Medibank Private (ASX:MPL), marking the first time it has faced shareholders since the cyber breach that caused its share price to crash by ~20%.

Medibank again apologised for the incident and reaffirmed a recent trading update. The company withdrew its FY23 outlook for policyholder growth and reaffirmed it would not pay a ransom to the cyber criminals that would theoretically stop them. Nonetheless, Medibank noted that growth in Q1 was 3.2% – ahead of the 2.7% outlook it had previously given.

Medibank (ASX:MPL) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…