These 2 ASX200 consumer stocks are doing fine amidst the cost of living crisis

There were 2 ASX200 consumer stocks that were winners on Friday morning. The companies were Ampol (ASX:ALD) and Super Retail (ASX:SUL), both because of good trading updates.

ASX200 consumer stocks like Ampol are doing well

Some consumer items just cannot be given up and fuel is one of them. Ampol told its shareholders that its Total Fuel Sales volume for the September quarter was over 7bn Litres, a figure that was up 26% year on year. Even better for investors, the company’s margins rose 27% too, from US$10.29 to US$19.69 per barrel. Granted, this sales volume was driven mostly by international fuel sales, a figure which grew 96% year on year. Australian fuel sales only increased 11% while fuel sales from Z Energy (which Ampol only bought 18 months ago) only rose by 9%.

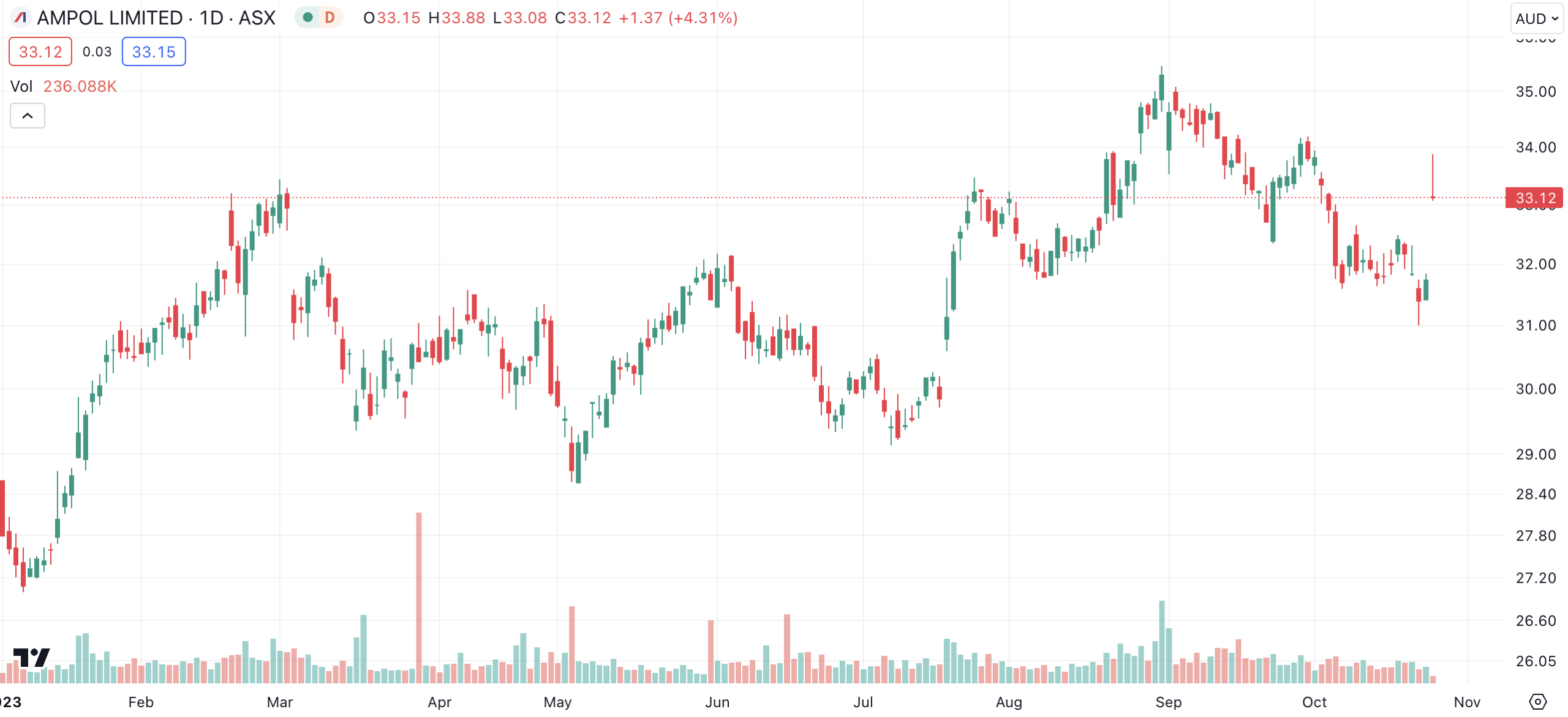

Shares in the company are up nearly 20% in 2023 and rose by over 3% on Friday morning.

Ampol (ASX:ALD) share price chart, log scale (Source: TradingView)

Super Retail performing well too

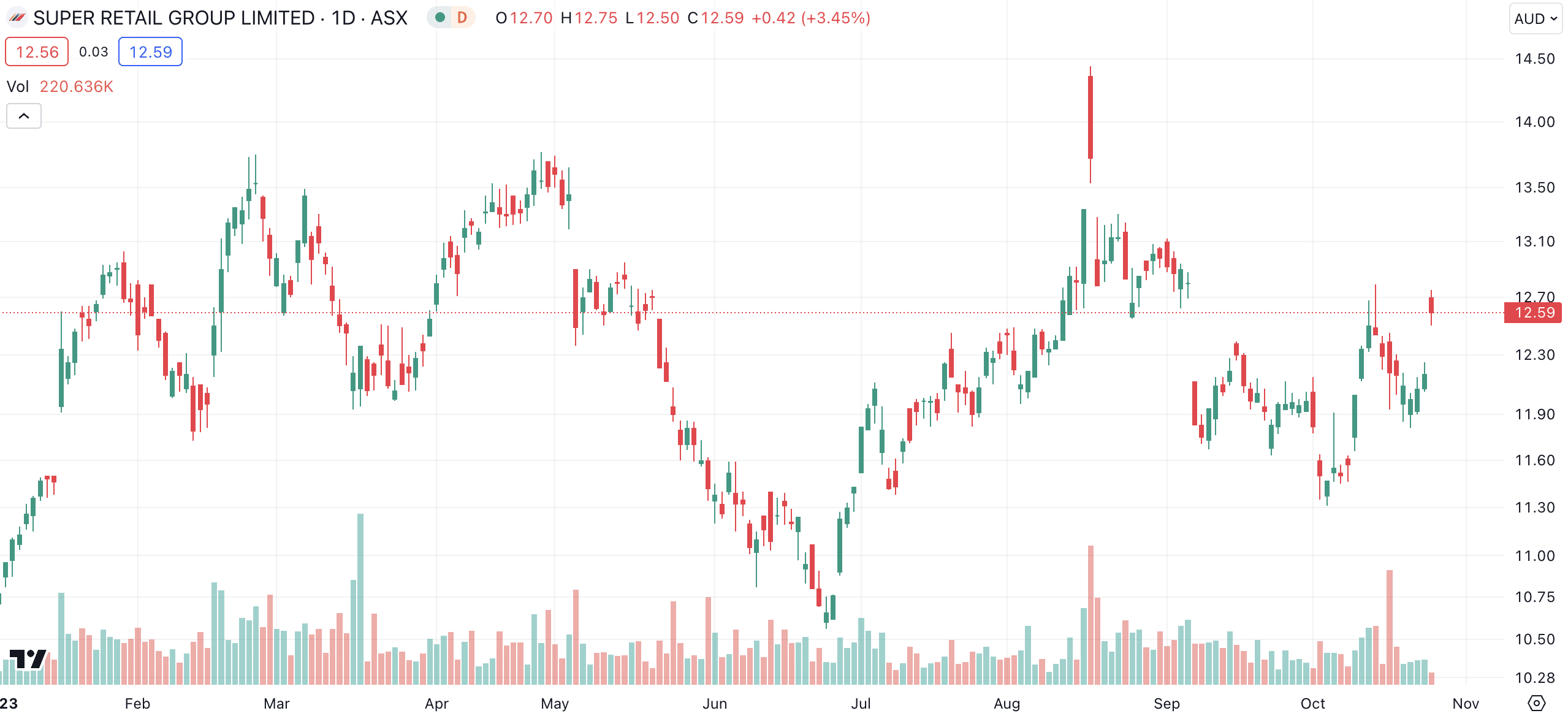

Super Retail was the other of the 2 ASX200 consumer stocks with a good trading update this morning, released on the morning of its AGM. The company is the owner of Supercheap Auto, Rebel, BCF and Macpac. It too has seen a good share price performance in 2023, with a 16% gain, as well as this morning, with a gain of over 3%.

Super Retail (ASX:SUL) share price chart, log scale (Source: TradingView)

At the group level, the company saw 4% sales growth in the first 16 weeks of FY24 compared to FY23. On a like for like basis this was only 2%, however. Not all divisions saw the same growth. The strongest growth came from BCF which rose 11% due to new stores and increased demand in boating, fishing and water sports – segments that BCF has products for. While Supercheap Auto and Rebel recorded 4% growth and 2% growth respectively, Macpac saw a 7% decline.

‘Unseasonably warm weather has affected sales of insulation and rainwear products,’ the copmpany admitted. Still, Macpac was cycling 76% growth from the prior corresponding period and sales in travel related categories mitigated the damage.

No guidance

Super Retail did not give specific revenue or profit guidance, but said it would be subject to trading in the peak Christmas holiday period. Nevertheless, it told investors to expect 24 store openings, $150m in capex and for its cost of doing business as a percentage of sales to increase.

Ultimately, while today’s updates were far from perfect, it appears investors liked them because things could have been a lot worse. Just ask companies like Universal Store (ASX:UNI) which sell truly discretionary goods and/or service customers that haven’t got much disposable income to begin with and consequently are seeing sales fall with little signs of hope on the horizon.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…