Australia’s interest rates at 10-year high levels

![]() Marc Kennis, December 6, 2022

Marc Kennis, December 6, 2022

RBA increased the cash rate to 3.10%

Today, 6 December 2022, the Reserve Bank of Australia (RBA) increased the target cash rate by 0.25% to 3.10%, leaving the country’s interest rates at a 10-year high level. The increase, however, was widely expected, which justifies the stock market’s fairly neutral response to the RBA’s announcement.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

What is the target cash rate?

People commonly refer to the RBA target cash rate as the current interest rate. But the cash rate is the interest rate the banks charge when they borrow or lend funds to each other and it represents an almost risk-free interest rate. The banks would then add a premium to this rate when lending to consumers and companies to account for the additional risks taken as well as to cover their costs of operations and to make some profits.

Why does the RBA keep increasing interest rates?

According to today’s RBA cash rate statement, the RBA believes that some of the ongoing high inflation is due to “strong domestic demand relative to the ability of the economy to meet that demand.” To back this argument, the RBA refers to the current low unemployment rate of 3.4%, which is the lowest rate since 1974. Very low unemployment levels lead to increasing wage pressure, which then forces businesses to increase their prices, which in turn increases overall inflation.

So, the RBA is trying to reduce demand for goods and services in the country by increasing borrowing costs to discourage businesses and individuals from spending.

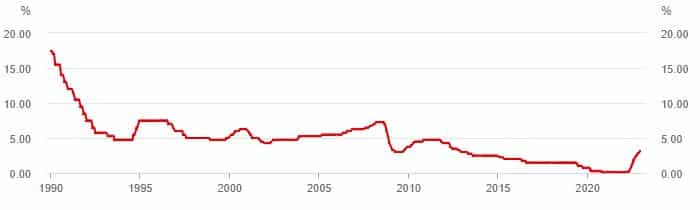

Target Cash Rate, Source: RBA

How much higher can interest rates go?

The RBA expects another increase in the target cash rate in its next meeting on 7 February 2023. But it does not give an idea of the possible magnitude of that hike, which will depend on the incoming data about the domestic and global economy.

Historically, central banks have kept increasing interest rates until inflation rates dropped below interest rates. This is because central banks’ duty of maintaining price stability comes before their duty of maximising economic growth, although the Fed in the US has a double mandate. The Fed needs to optimise economic output and balance that against inflation.

Current inflation is way above the RBA’s target

As the current inflation rate of 6.9% remains to be significantly higher than the current cash rate of 3.10% and the RBA’s target inflation rate of 2-3% range, we think RBA is likely to maintain its tightening monetary policy for the time being. Although some pundits are now expecting the RBA to take a breather in early 2023.

At Stocks Down Under we believe that the worst of inflation expectations are behind us now.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…