Beach Energy (ASX:BPT) signs massive LNG deal with BP for 2023

![]() Stuart Roberts, August 8, 2022

Stuart Roberts, August 8, 2022

Beach Energy (ASX: BPT) has secured a binding offtake agreement for its 50% share of the LNG to be produced from the massive Waitsia Gas Field in Western Australia. Waitsia LNG is expected to start shipping from the second half of calendar 2023 and BP will now take all of Beach’s share for about the first five years of the project’s life.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

The world is running out of gas

The agreement allows for Beach Energy, which is a Stocks Down Under Concierge stock, to benefit from the currently strong prices for LNG being enjoyed in Asia, but also limits the downside through a price protection mechanism.

Although no price numbers were given, we believe that the company has done well out of the BP deal, with BP likely to be concerned about realisable LNG supply in a world rapidly running short of gas.

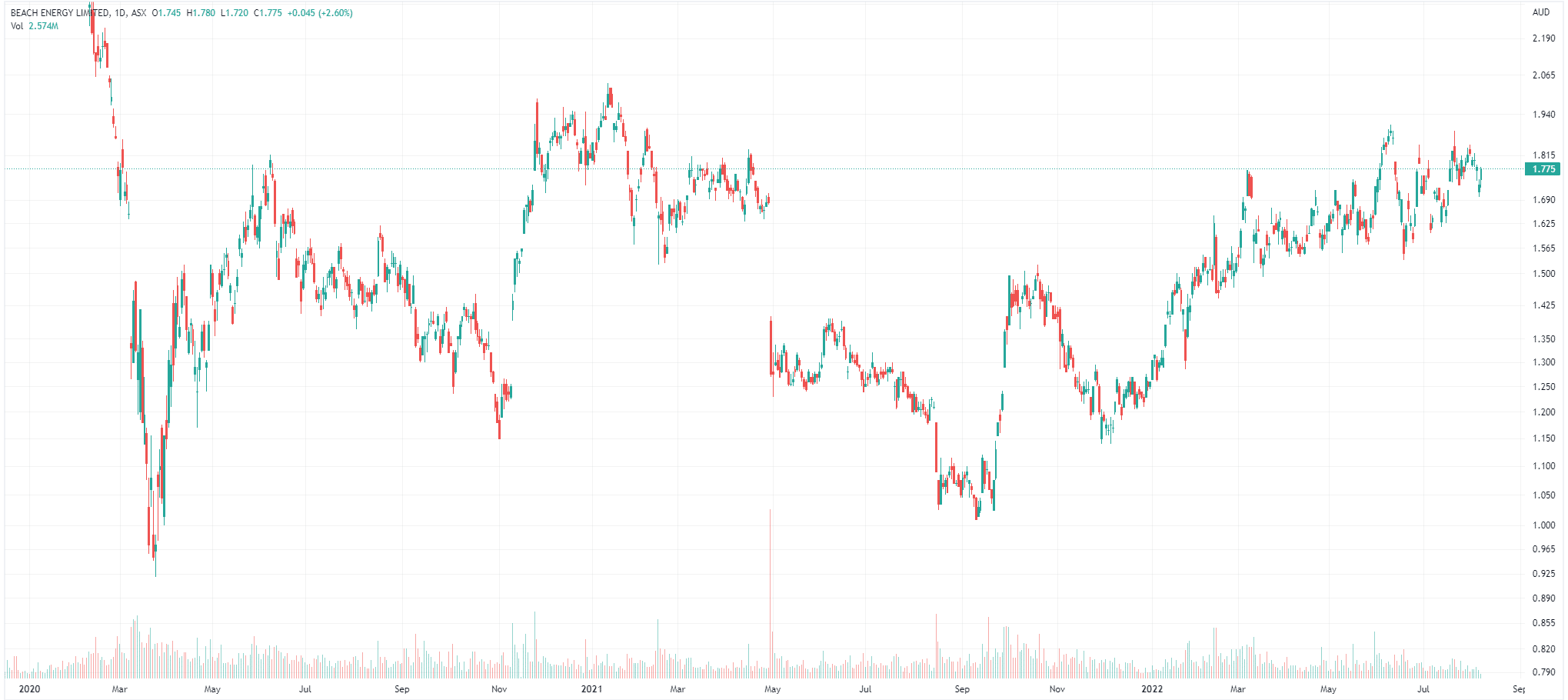

Beach Energy (ASX:BPT) share price chart, log scale (Source: Tradingview)

Beach Energy to benefit from sellers market conditions

Selling Waitsia wasn’t going to be hard given the market fundamentals post the start of the war in Ukraine, but the market will like the fact that a single customer took so much of BPT’s product. We believe it is further proof that 2022 is a seller’s market for LNG.

Beach Energy itself noted that it now has exposure to multiple oil and gas prices, which provides a certain hedge against the vagaries of individual product and region exposure.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…