Block (ASX:SQ2) attacked by a short-seller

Jack Dorsey-led fintech Block (ASX:SQ2) has been attacked by short-seller Hindenburg Research.

Hindenburg has essentially alleged the entire company is a fraud while SQ2 has predictably denied the allegations and threatened legal action, as most companies in this position do.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Hindenburg’s allegations

Hindenburg Research claimed to have conducted a 2-year investigation into the company, interviewing former employees and industry experts, reviewing regulatory and litigation records and financial modelling.

Among its allegations were that it overstated its user counts, understated customer acquisition costs and failed to take action against criminal activity being done using the app.

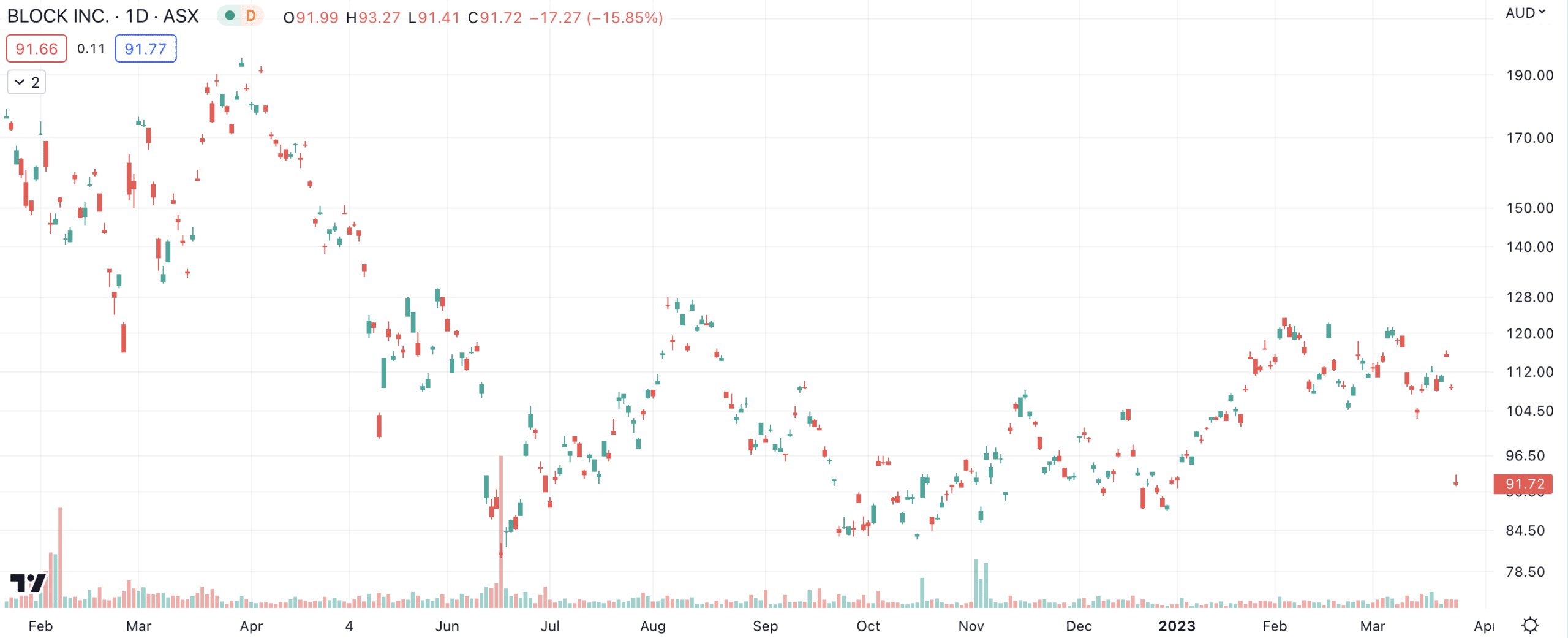

The report led to the company’s shares falling over 16% this morning. It debuted on the ASX in February 2022 after acquiring Afterpay.

Block (ASX:SQ2) share price chart, log scale (Source: TradingView)

Block response

The company released a short statement on its website in which it denied the allegations and said it would explore legal action against Hindenburg.

‘We are a highly regulated public company with regular disclosures, and are confident in our products, reporting, compliance programs, and controls,’ it said.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

WiseTech Global (ASX:WTC) CEO Buys $1m of Shares, Here’s What It Signals

WiseTech $1m Insider Buy, The Synergy Curve Is the Thesis WiseTech Global (ASX: WTC) has just given investors a simple…

Block (ASX:XYZ) Up 28% as a 40% Headcount Cut Rewrites the Earnings Outlook

Jack Dorsey Goes Lean, The Market Pays Up Block shares surged 28% following the announcement that the company intends to…

AML3D (ASX:AL3): Order Book at $16.5m, The Growth Runway Stays Intact

A $150m to $200m Navy Opportunity, But Execution Comes First AML3D has reported its interim half-year results, and while revenue…