Centrex (ASX:CXM) exports its first 5,000 ton of phosphate rock to New Zealand

![]() Marc Kennis, November 21, 2022

Marc Kennis, November 21, 2022

Queensland-based phosphate rock producer Centrex (ASX:CXM) announced that it just sent its first international shipment of phosphate rock overseas. Agricultural Cooperative Ravensdown, based in New Zealand, is the recipient of this first shipment that was sent FOB from Townsville. This shipment was sold back in April as a trial shipment.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

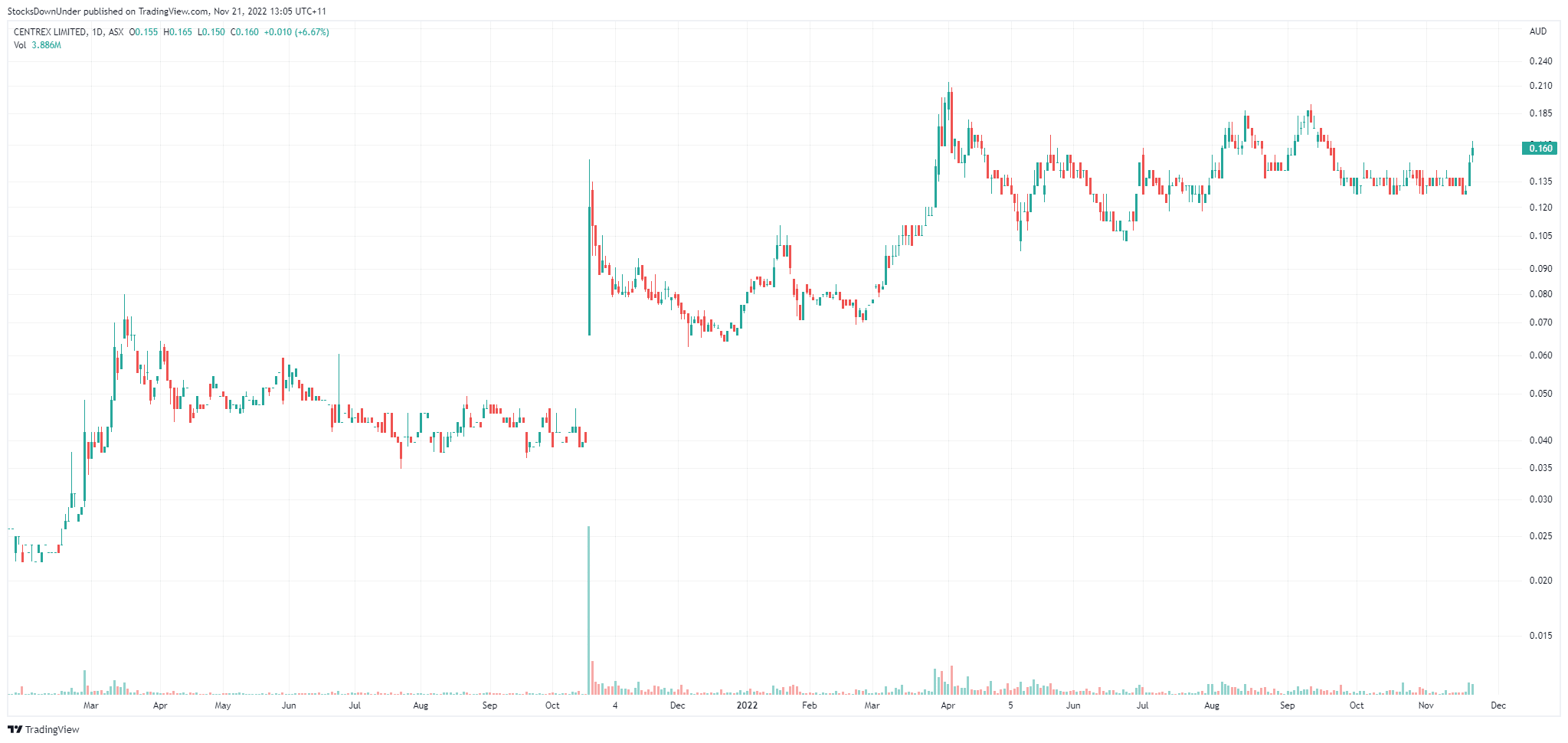

Investors were happy with the news and sent the shares 7% higher. In the last 2 months, CXM shares traded around 13.5 cents, but may head higher as the company keeps announcing good news around shipments, domestically and internationally.

Centrex is expected to partly replace phosphate rock shipments from Morocco to Australia, New Zealand and Asia. As such, Centrex will be a key contributor to reducing Australia’s dependence on overseas phosphate. This is particularly important in light of the Russian/Ukranian war that has resulted in substantial phosphate price rises.

First product out of Centrex’s Ardmore mine was shipped in early October, but we’ll have to until the company’s quarterly statement at the end of January to see what the actual selling price was. Phosphate prices have gone up very substantially in the last year, with Morocco phosphate rock prices now above US$300/tonne. If CXM can manage to sell its product at similar prices, we expect the share price will go a lot higher than where it is today.

Stocks Down Under subscribers can read our recent article on Centrex here.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…