Centrex (ASX:CXM) starts shipping with phosphate rock prices booming

![]() Stuart Roberts, August 9, 2022

Stuart Roberts, August 9, 2022

Centrex (ASX: CXM), developer of the Ardmore Phosphate Rock Project in northwestern Queensland, released a project update this morning.

The company is now shipping rock from Ardmore to Townsville at a rate of 10,000 tonnes per month and it intends to get this to 30,000 tonnes a month during the course of calendar 2023. It also expects that its first phosphate rock exports will be made next month.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Phosphate rock price keeps on rising

Encouragingly, the price of phosphate rock as per the benchmark price, which is rock FOB North Africa as measured by the World Bank, has now reached US$320 a tonne, as against the mere US$125 a tonne at which Centrex did its Definitive Feasibility Study for what it is now calling ‘Ardmore 2.0’ where 800,000 tonnes per annum are produced .

That study placed a pre-tax NPV of $166m on Ardmore on a 10% discount rate. Centrex is currently doing Front End Engineering and Design on Ardmore 2.0 ahead of a Final Investment Decision (FID). In the meantime, the company is also contemplating an expansion of the original pilot plant, which it calls Ardmore Stage 1.5 and expects to be able to give an update on this in the near future.

Centrex price target of $0.21 at a minumum

Our minimum target price for CXM, one of our Stocks Down Under Concierge stocks, remains 21 cents.

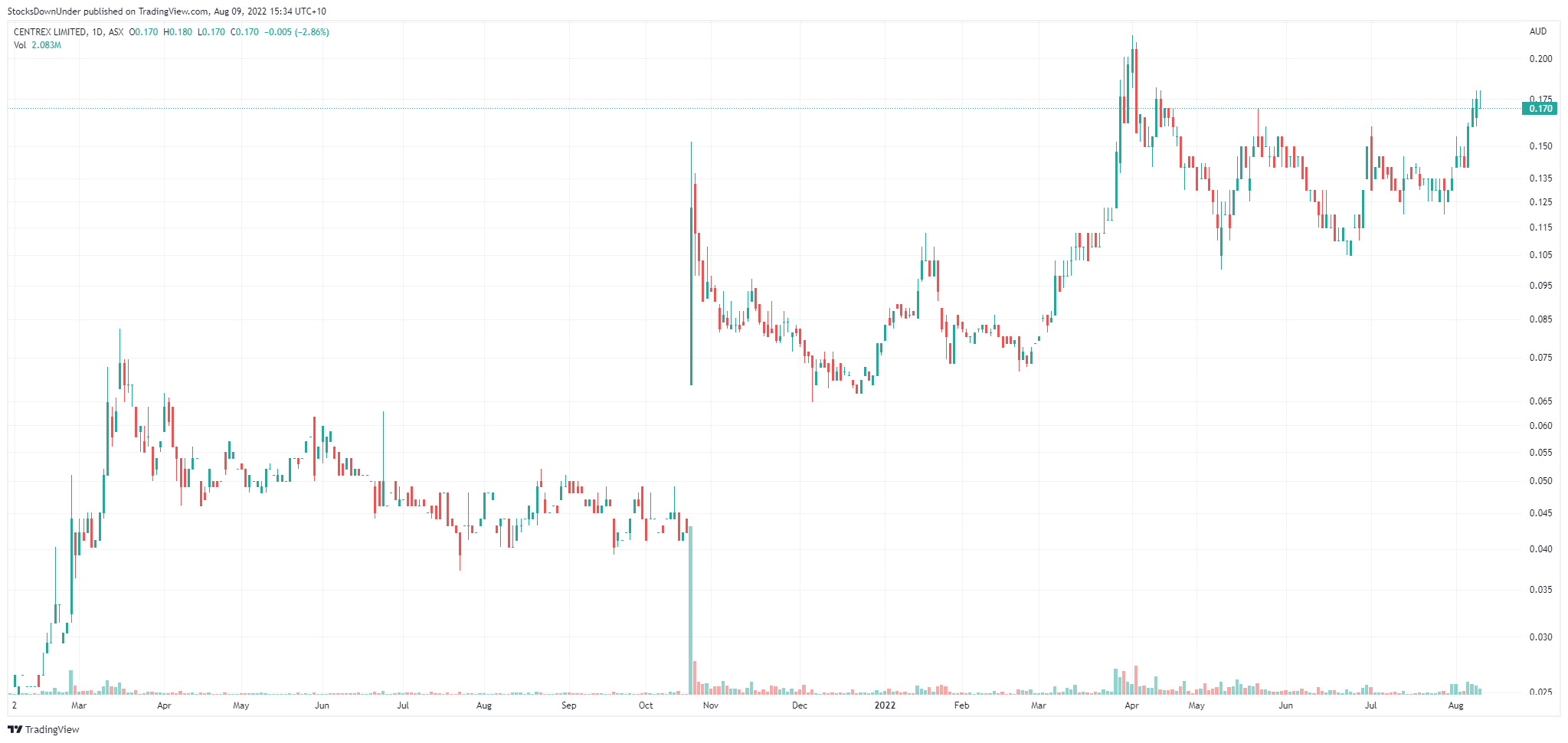

Centrex (ASX:CXM) price chart, log scale (Source: Tradingview)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…