Dimerix (ASX:DXB) signs a A$230m deal!

![]() Nick Sundich, October 5, 2023

Nick Sundich, October 5, 2023

Dimerix (ASX:DXB) achieved one of the most important milestones a biotech must achieve before commercialising a drug or medical device. No, it is not medical approval or clinical trial results (yet). Rather, it signed a deal that will help it commercialise its kidney disease drug and receive plenty of money in the process.

SIGN UP FOR THE STOCKS DOWN UNDER NEWSLETTER NOW!

Who is Dimerix (ASX:DXB)?

Dimerix is an ASX biotech that is focused on kidney disease. Its flagship asset DMX-200 is targeting a condition known as Focal Segmental Glomerulosclerosis (FSGS).

When you have FSGS, the filters (glomeruli) of your kidneys become inflamed and are damaged by scarring. This makes the filters “leaky” and allows protein from your blood to collect in your urine (proteinuria). For patients with FSGS, the kidneys’ ability to purify (clean) the blood is impaired. This can lead to kidney failure that may eventually requires dialysis or a kidney transplant.

The company is currently in a Phase 3 trial and results are expected in mid-March 2023. It has other assets in the pipeline but DMX-200 was the most advanced, even before today’s announcement that sent shares up over 70%.

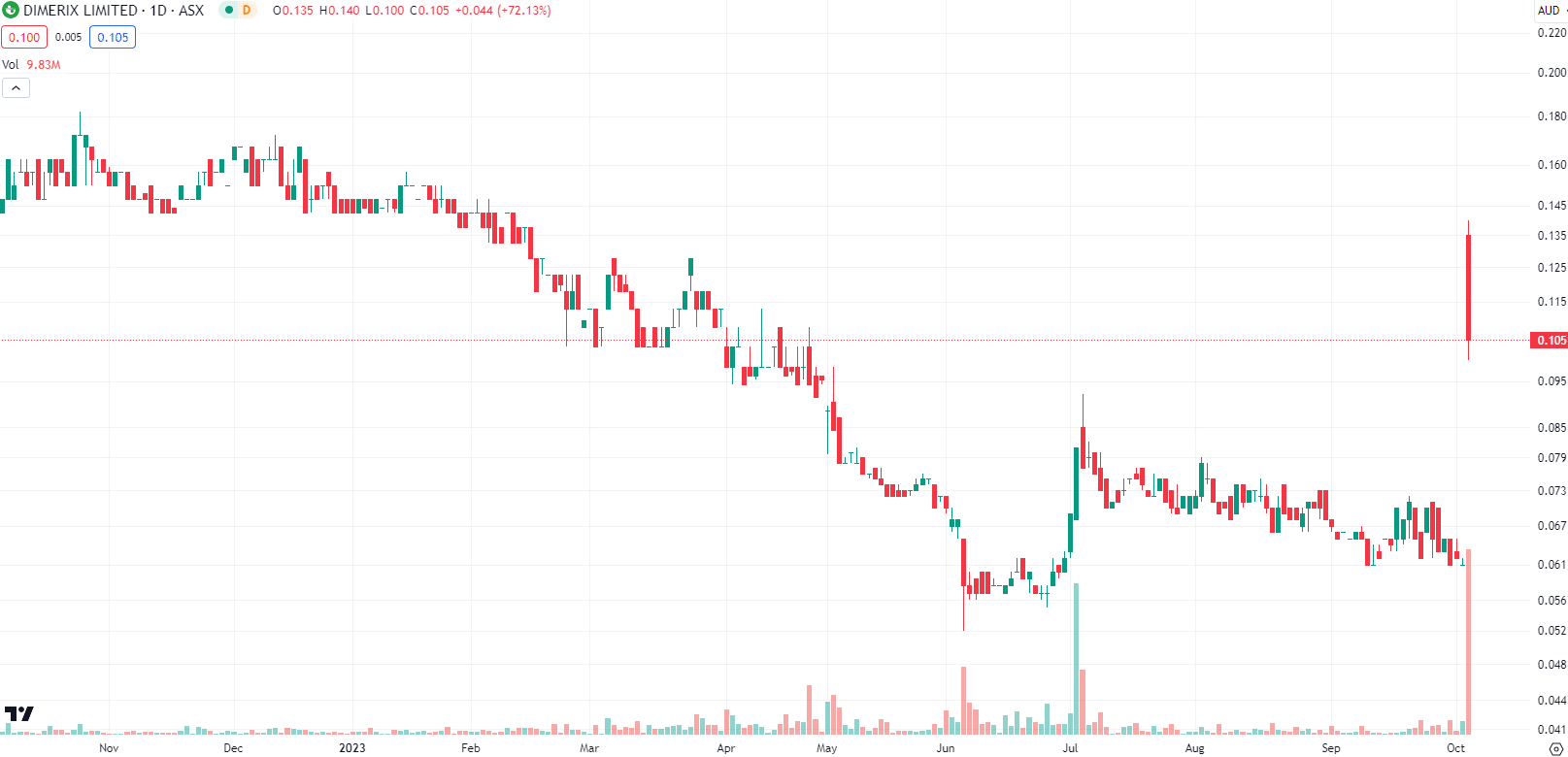

Dimerix (ASX:DXB) share price chart, logs scale (Source: TradingView)

A deal for commercialisation

Dimerix entered an exclusive license agreement with a London-headquartered biotech company known as Advanz Pharma. Advanz has rights to commercialise DMX-200 in the European Economic Area, the UK, Switzerland, Canada, Australia and New Zealand as well as a right of first offer to commercialise DMZ-200 for other indications in any of these territories. Dimerix retains rights outside these territories and will receive $10.8m in upfront payments and up to A$219m in potential milestones. As well as this, the company will be entitled to tiered royalties on net sales (which it has indicated would be a mid to high-teen percentage).

The company has told shareholders there was a total market for FSGS of US$3bn – between the US, EU/UK and Japan.

Of course, all this will be nothing if it fails the Phase III stage and/or cannot get regulatory approval in any of these jurisdictions. And DXB-200 wouldn’t keep as much money as it would if it commercialised it alone, assuming it was successful. But a partner like Advanz will ensure it can get to market if approved. And shareholders don’t have too long to wait before Phase III results.

What are the Best biotech stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…