Here is why the Carsales (ASX: CAR) share price is down over 10% this week

![]() Nick Sundich, June 29, 2022

Nick Sundich, June 29, 2022

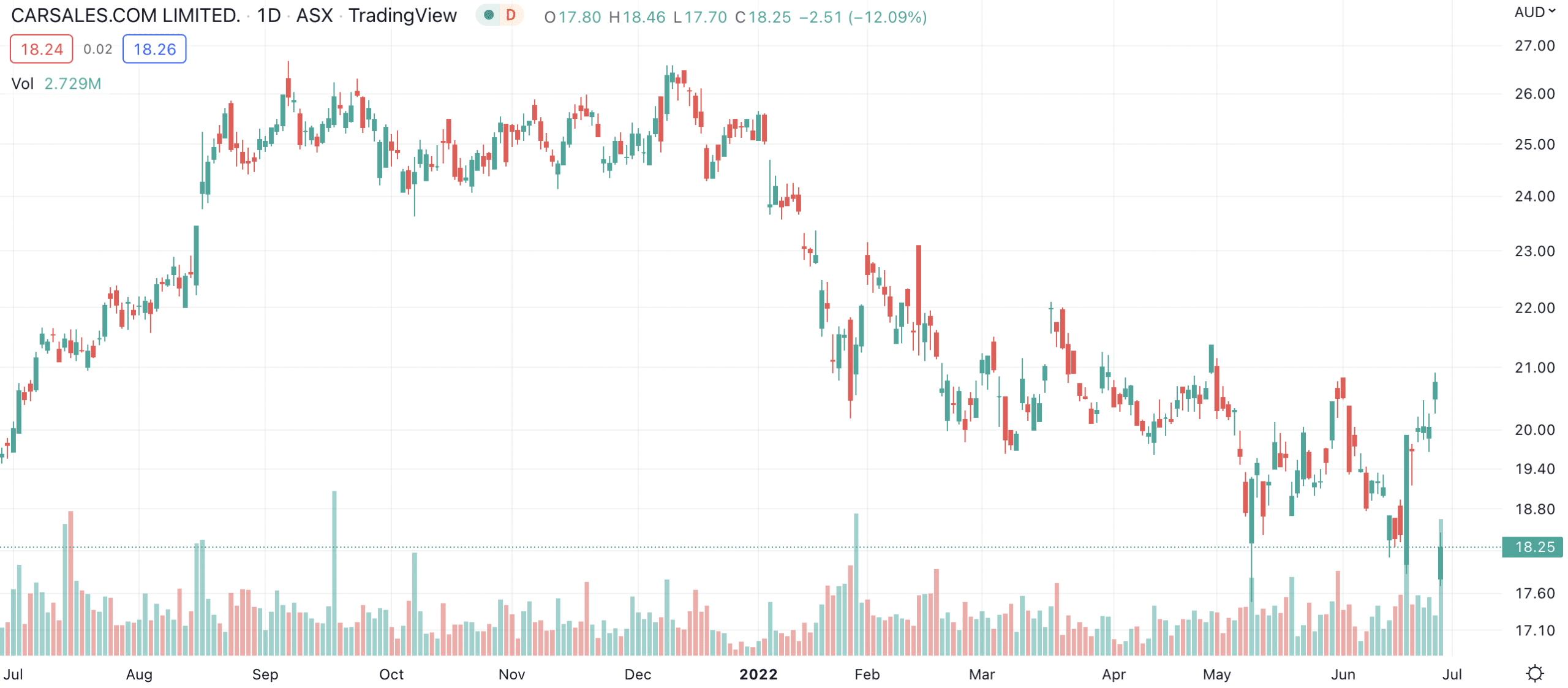

It’s been a difficult week for Carsales (ASX: CAR) shareholders. Their shares are down over 10% since it unveiled a deal to fully acquire American commercial trucks and RV listing business Trader Interactive.

Carsales (ASX:CAR) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Why is Carsales buying Trader Interactive?

Carsales bought an initial 49% stake in Trader Interactive just over 12 months ago and is now acquiring the remainder of the company’s shares that it does not already own. To fund the deal, it has completed a US$842m entitlement offer at $17.75 per share, over 14% below the share price just before the announcement.

CEO Cameron McIntyre told shareholders the enthusiasm he and his company have for Trader Interactive has only grown stronger in the last 12 months and that owning the company outright will help it unlock further value.

Shareholders were told it has a market leading position in America, where the relevant verticals are 16x as large as Australia, and there are favourable structural trends in the industry.

Why don’t Carsales shareholders like the deal?

Most prominently, the deal is being done at a near 12-month low for the Carsales and a 14.5% discount to Friday’s closing price. Investors never like capital being raised at a big discount.

But arguably, investors are also concerned about the potential of a recession in the US slowing down the growth of Trader Interactive. The company has tried to calm shareholder concerns by pointing out its acquisition of Brazilian auto marketplace business webmotors in 2013 was completed just before a four-year recession, noting sales grew 20% for each of those four years. However, it does only account for 2% of annual sales and still loses money.

We also think investors are not too keen on the 21.3x EV/EBITDA multiple that the deal was priced at. This is even higher than Carsales’ EV/EBITDA multiple for FY23 of 18.3x.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…