Here’s why Lumos Diagnostics (ASX: LDX) has crashed nearly 60% today!

Lumos Diagnostics (ASX: LDX) shareholders are racing for the exit after the FDA rejected its application for FebriDx. FebriDx is a finger-prick blood test that can indicate if a person has a general bacterial or viral acute respiratory infection within 10 minutes.

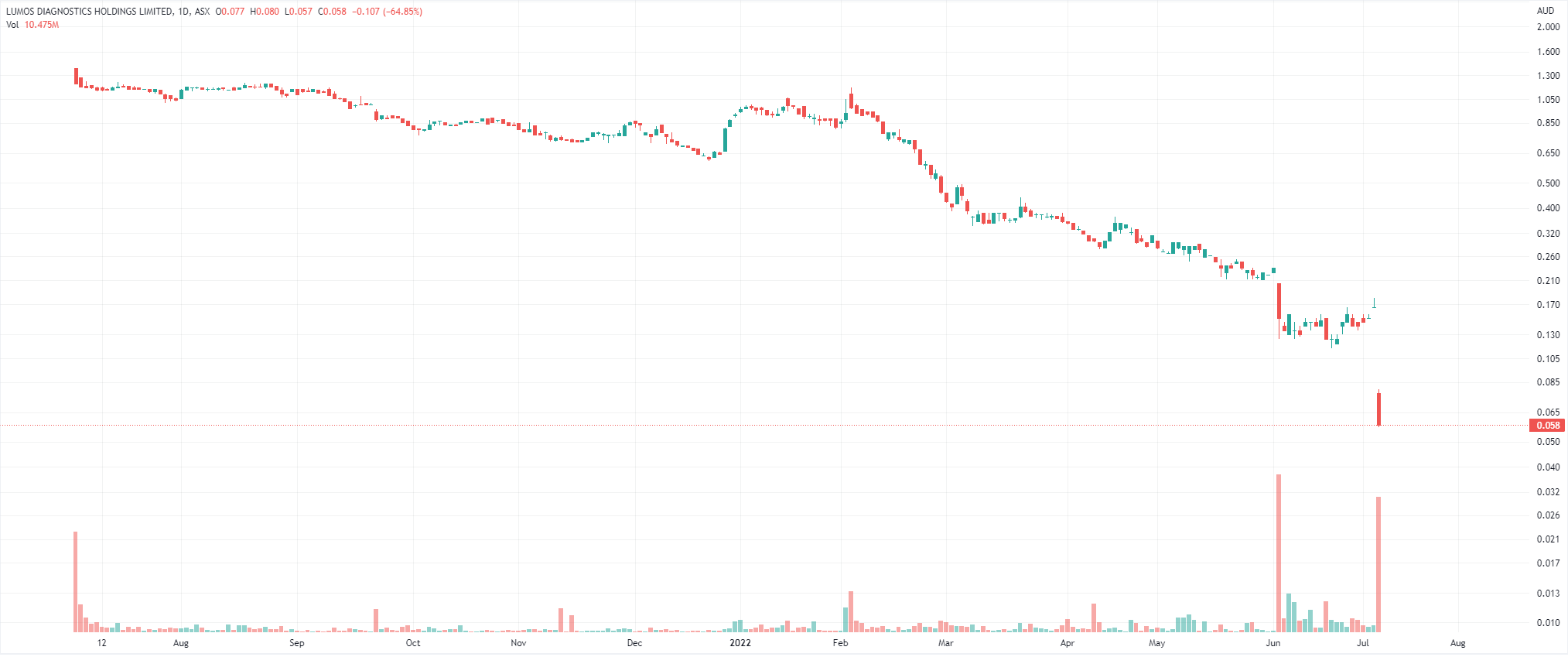

After listing in June last year at $1.25 per share, it fell as low as 16 cents last week – that is until this morning when it fell as low as 6.1 cents.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Lumos Diagnostics wanted FDA approval

Lumos Diagnostics applied for FDA approval for FebriDx so that the test could be sold in the USA. This was important for the company because of the size of the USA as a market and also because it would potentially provide an easier pathway for approval in other jurisdictions.

As one could imagine, it was taking a while for the FDA to get back to Lumos Diagnostics, given the sheer amount of applications in light of the state of the pandemic in the USA. Arguably the gloss had also come off the technology to the rise of Rapid Antigen Tests.

The FDA says no

This morning the jury came in and the verdict was no. It was not like Cyclopharm (ASX: CYC) where the FDA just wanted more information, the American regulator ruled that FebriDx did not meet the requirements – namely showing substantial equivalence to the predicate device.

The FDA was concerned about the risk of false negatives, thereby missing opportunities to treat patients or worse, cause further infections by enabling further spreading.

What now for Lumos Diagnostics?

Lumos Diagnostics is trying to put a positive face on things, reminding shareholders that it has regulatory clearance in other jurisdictions and was weighing up either an appeal or a new submission. But CEO Doug Ward admitted this was not the outcome it was seeking.

We think it is not beyond the realm of possibility that the company could make a more successful submission. But even if it does, we think a lot of gloss has come off COVID-19 health stocks generally because of the rise of rapid antigen testing, not to mention medtechs whose success is at the mercy of regulators.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Scalare Partners (ASX:SPX) Up 43% on a Huge H1, But It’s an M&A Story Now

Revenue Up 370%, The Market Loves the Tank Stream Labs Deal Scalare Partners Holdings surged 43% today after reporting a…

China’s New Submarines Could Threaten the US From Close to Home

The Undersea Arms Race Is Heating Up Senior U.S. naval officials are starting to sound the alarm over China’s rapidly…

5 ASX Stocks to Buy (and 3 to Avoid) as the Iran War Shakes the Market

ASX stocks to buy and avoid as the Iran war shakes markets The ASX 200 shrugged off the initial shock…