Inflation-proof stocks: Dominos’ position in the exclusive club is under threat

![]() Nick Sundich, February 22, 2023

Nick Sundich, February 22, 2023

Inflation-proof stocks are inflation-proof until they’re not. Although fast-food companies have been perceived as inflation-proof stocks, this was not true of Dominos (ASX:DMP) in 1HY23.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Dominos no longer belongs to the ‘Inflation-proof stocks’ club

Theoretically, in tough economic times, fast food retailers should perform well as people look for value and they should be inflation-proof stocks.

This rang true for McDonalds during the GFC, not not Dominos.

Dominos released its 1HY23 result and the company’s EBIT and NPAT both fell by over 21%, coming in at $113.9m and $71.7m respectively.

Although global sales grew by 1.2% excluding the impact of forex, the statutory result was a 4% decline. Online sales fell by 4.5% as consumers returned to their carry-out habits from before the pandemic.

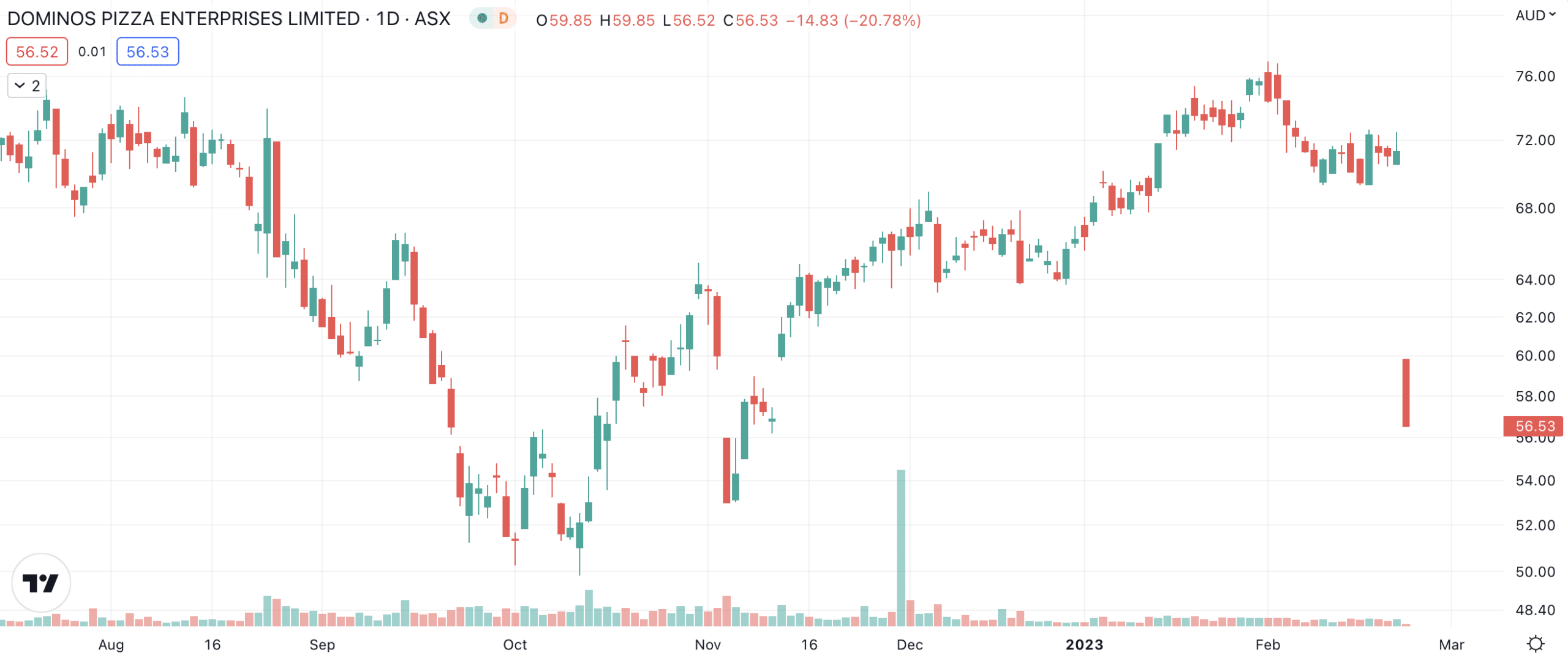

Shares in Dominos fell by over 20% at market open, as investors realised that its position as an ‘inflation-proof stock’ was under threat – to say the least.

Dominos Pizza Enterprises (ASX:DMP) share price chart, log scale (Source: TradingView)

Dominos goes back to the drawing board

Dominos admitted that its response to combating inflation had not been optimal. The company had thought it could just pass on costs to consumers while retaining the same customer numbers.

It promised shareholders it would provide menu items ‘for more price conscious customers’. This may help with sales, but will do little to help with margins.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…