Inflation rate is coming down, but not fast enough

![]() Marc Kennis, December 1, 2022

Marc Kennis, December 1, 2022

October inflation rate was lower than September’s

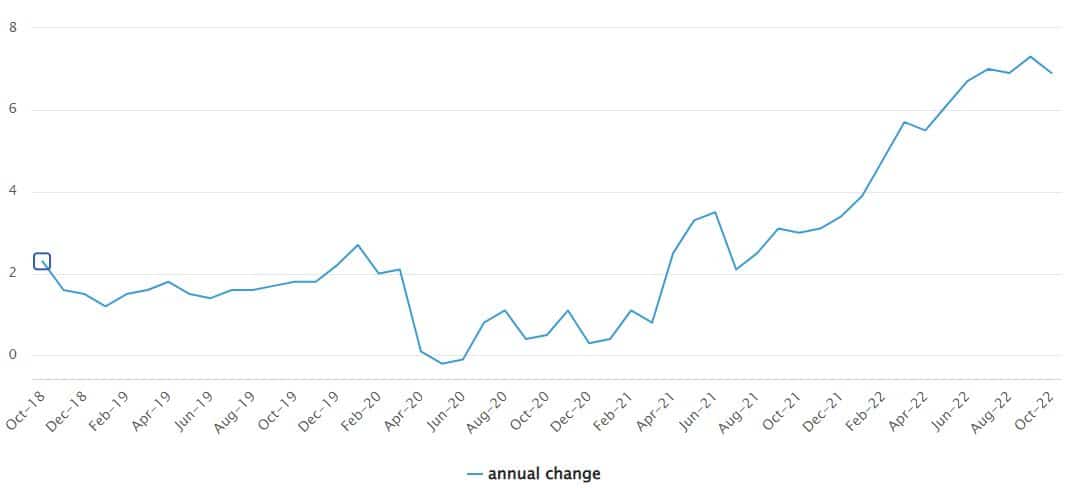

Australian Bureau of Statistics (ABS) released Australia’s year-on-year inflation to October 2022 at 6.9%, showing a significant decline in the inflation reading compared to the September print of 7.6%.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

At the first glance it seems inflation is coming down nicely, but why are our wallets getting smaller pretty much at the same pace as before? The answer lies in the way ABS calculates CPI.

Monthly CPI indicator, Source: Australian Bureau of Statistics

CPI measures the cost of living

Countries measure inflation by using an indicator called the “Consumer Price Index (CPI)” to measure the rate of change in the price of a basket of goods and services consumed by households.

So, the CPI number is sensitive to the definitions of the consumer basket by the countries’ agencies responsible for the calculation of CPI.

ABS collects prices for thousands of items grouped into 87 different categories and calculates price changes of each item from the previous period to work out the inflation rate for that period.

ABS changed weights in its CPI basket

ABS recently changed the weights of items in its CPI basket to reflect shifts in spending patterns, which was responsible for some of the decline in the reported growth of the cost of living. Based on old weights, Australia’s October inflation reading would be 7.1%, 0.2% higher than the reported 6.9%.

Interest rates have room to go higher

Although we appreciate that even a drop of half a percent in the rate of inflation is the best we have seen for months, the reported 6.9% annual inflation rate is still much higher than the RBA’s inflation target range of 2 to 3 percent.

And historically central banks have continued their restrictive monetary policies until the inflation rate has come below the interest rate. As the current interest rate of 2.85% is far below the reported inflation rate of 6.9%, we can expect the rise in interest rates to continue for the time being.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…