Is the spectacular run by ASX coal companies coming to an end?

ASX coal companies have shrugged off the push to Net Zero and delivered rewards to shareholders recently, unseen in any other sector. Stocks such as Whitehaven Coal (ASX:WHC) and Terracom (ASX:TER) have all become multibaggers – but will the run last?

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

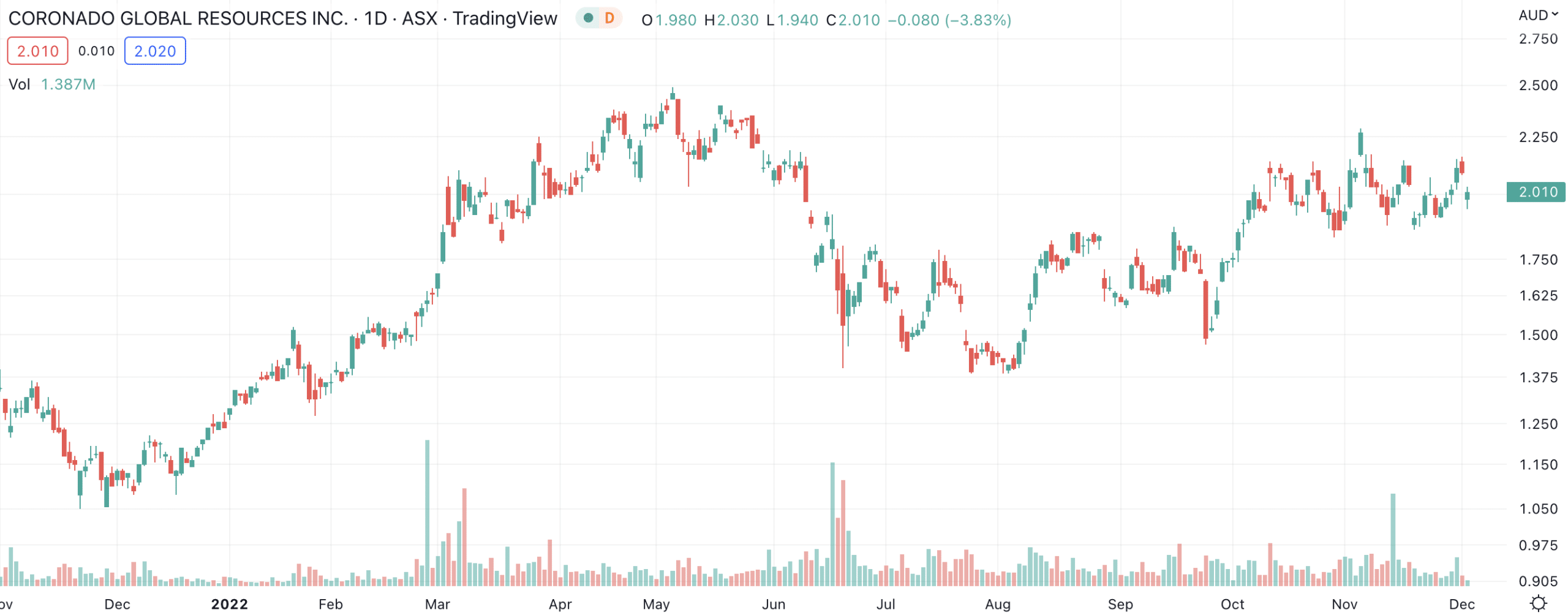

A warning sign from Coronado

After months of endless growth from ASX coal companies, there were warning signs out of Coronado (ASX:CRN) this morning. It told shareholders its Curragh coal site will not meet previous production and cost guidance due to the extraordinary rain across the Bowen Basin.

While not providing updated guidance for production and costs, CRN reiterated its capex guidance and said group sales volumes would be higher than production levels. Of course, subject to weather conditions.

The company’s 4% drop today pales in comparison to the 80% rise in the last 12 months, but it is notable because Coronado and other ASX coal companies have been almost unblemished this year.

Coronado (ASX:CRN) share price chart (Graph: TradingView)

ASX coal companies face an uncertain future

The spectacular run by ASX coal companies this year may have caused investors to forget that coal faces a difficult long-term future as the world decarbonises. To be clear, we won’t see mines shut down any time soon, but it will be difficult for companies to start new ones.

And if more companies see downgraded production as well as increased costs and if coal prices come down after being inflated due to the Russia-Ukraine war, a lot of the allure may come out of the sector.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…