Is Woolworths (ASX: WOW) the superior supermarket stock in 2022?

![]() Nick Sundich, May 1, 2022

Nick Sundich, May 1, 2022

Woolworths (ASX: WOW) is a supermarket chain that is the largest company in Australia by revenue. It was listed in 1993 and at the time was Australia’s largest share market float. It owns Woolworths Supermarkets and a handful of chains in New Zealand, plus the discount retailer Big W and one of Australia’s biggest loyalty programs in Everyday Rewards. It is one of two major supermarket chains in Australia along with Coles (ASX: COL). How does WOW stack up for investors?

GET A 30-DAY FREE TRIAL TO STOCKS DOWN UNDER

Impacted by COVID without being forced to close

Throughout the pandemic, Woolworths’ grocery stores have always been able to stay open, because supermarkets were deemed an essential service. But the same couldn’t be said for Big W stores, which endured periods of closures. It was a similar case with its hospitality and liquor assets that were demerged into Endeavour Group (ASX: EDV) in June 2021.

But Woolworths’ supermarkets have been constrained during the pandemic by supply chain issues and staff shortages. These problems have become particularly prominent in the last six months since Australia moved away from the zero COVID policy.

Recovering from COVID

But overall, the supermarket chain has been resilient to COVID-19. FY20 saw an 8.1% rise in sales to $63.7bn although its profit fell 1.2% to $1.6bn and it reduced its dividend by nearly 8% to 94c.

In FY21, its sales rose by 5.7% to $67.3bn, its NPAT rose by 23% to $2.0bn and its dividend rose by 15% to $1.08 a share. In 1HY22, it made $31.9bn in sales and a $795m NPAT, up 8% and 7% before significant items.

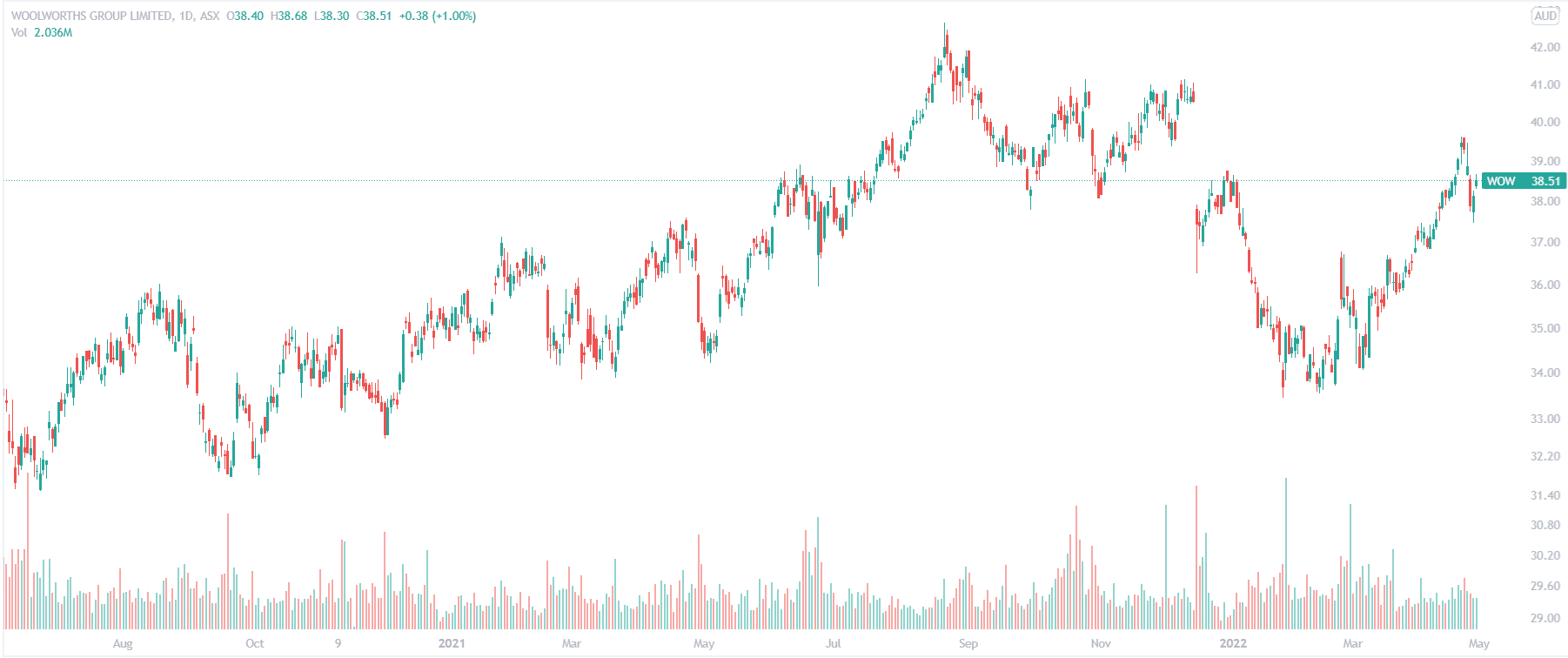

Woolworths (ASX:WOW) price chart, Log scale (Source: Tradingview)

Is Woolworths a buy?

Consensus estimates call for $60.5bn in revenue and $4.8bn in EBITDA in FY22. For FY23, the average estimates call for $62.2bn in revenue and $5.3bn in EBITDA – the latter figure representing growth of 9% from FY22.

Woolworths’ valuation is 12x on an EV/EBITDA basis and 28.3x on a P/E basis, which is above the ASX 200 average. We have also completed a DCF model for Woolworths and generated an implied price of $43.6, which would be a ~15% premium to its current price.

WOW versus COL

It is worth comparing the company to its archrival Coles (ASX:COL). Coles is cheaper at 9.1x EV/EBITDA and 22.9x P/E for FY23. However, it is expecting lower revenue and EBITDA for FY22 and FY23. For FY22, consensus estimates expect $39.3bn in revenue and $3.5bn in EBITDA, followed by $40.7bn in revenue and $3.7bn in EBITDA for FY23. Coles’ estimated FY23 EBITDA growth is 6.4%, which is lower than Woolworths’.

We prefer WOW

Based on the above valuation and growth numbers, we prefer WOW over COL. No doubt, you are paying a premium for both companies. Even if you disagree with us and would rather go with Coles, you are less likely to go wrong with a supermarket stock compared to other retailers, particularly consumer discretionary retailers. This is because supermarkets are less reliant on foreign supply chains and boast higher levels of consumer loyalty.

Recent Company Announcements

- Woolworths’ H1FY22 results

- Woolworths withdraws its proposal to buy API

- H1FY22 Trading update

- Proposal to buy API

Learn more about ASX-listed stocks with

Stocks Down Under!

Subscribe to Stocks Down Under today!

No credit card needed and the trial expires automatically.

Frequently Asked Questions about Woolworths

- Does Woolworths pay a dividend?

Yes, Woolworths typically pays a dividend. It paid $1.08 in FY21, fully franked and representing a yield of 2.9%.

- Is Woolworths Australian owned or foreign owned?

It has Australian shareholders, but some foreign shareholders too.

- Is Woolworths owned by Wesfarmers?

No. In fact Wesfarmers owned Coles (ASX: COL) for just over a decade, buying it in 2007 and demerging it in 2018.

- Does Woolworths own Australian Pharmaceutical Industries?

No. It made a bid for API in 2021, but ultimately lost out to Wesfarmers.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…