Leeuwin Metals falls on its ASX debut

Leeuwin Metals (ASX:LM1) became the ASX’s newest company this morning but it was not the best debut.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Leeuwin Metals is the latest battery metals stock

Leeuwin Metals is a battery metals explorer that holds the William Lake Nickel Sulphide Project in Canada and the Jenpeg Lithium Project in Canada among others.

The former of these is the company’s flagship asset and lies in the Thompson Nickel Belt in Canada. This area has produced 2.5mt of nickel since the first discovery in 1956.

Leeuwin Metals is 9.97% owned by Glencore, one of the world’s most eminent mining companies.

The company came to the ASX to raise money to explore for critical metals.

A retreat on debut

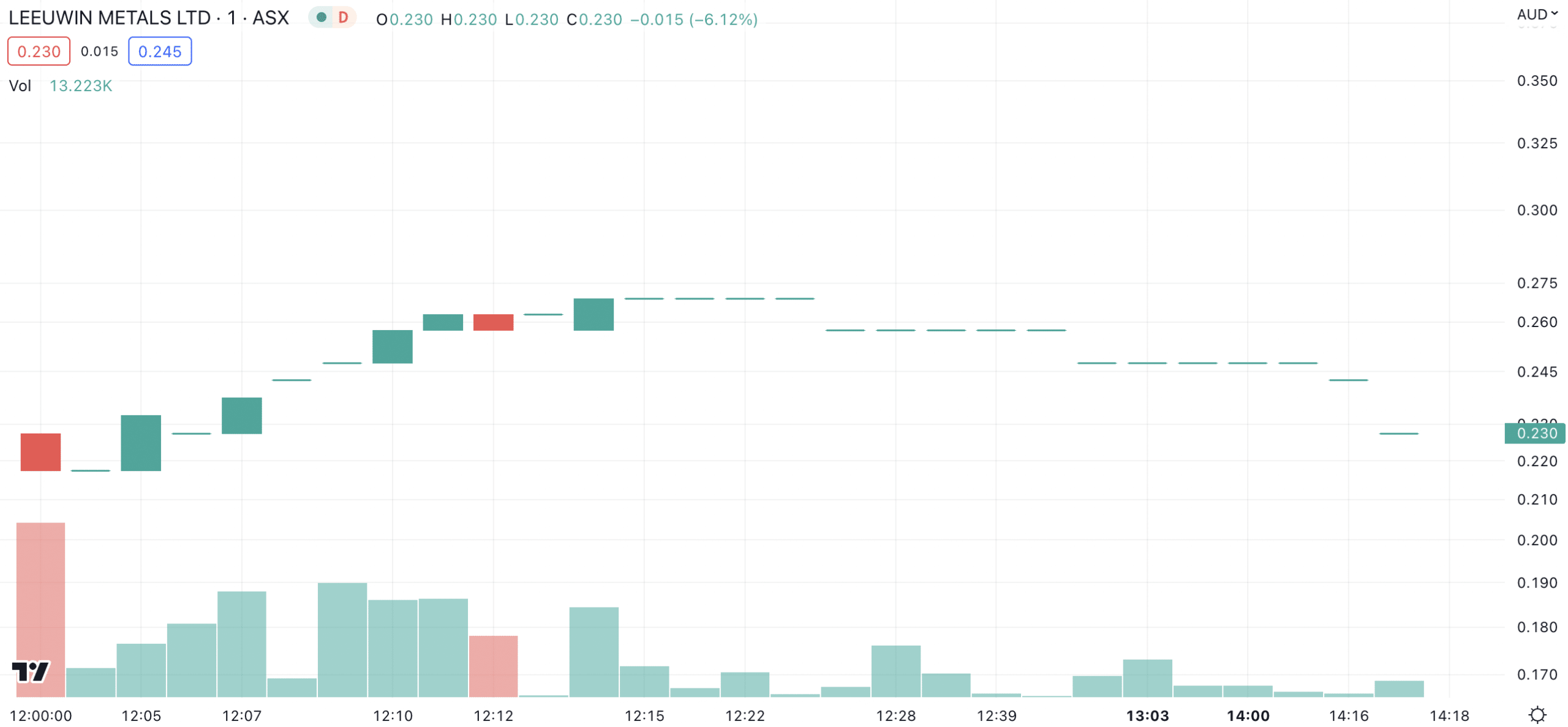

Leeuwin Metals raised $8m at 25c per share, but shares retreated upon its ASX debut.

Leuuwin Metals (ASX:LM1) share price chart, log scale (Source: TradingView)

It is a difficult time to be a pre-revenue company on the ASX at the moment. But investors with a long-term view may see the current market conditions as a good buying opportunity.

After all, there aren’t too many other explorers partially owned by Glencore.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…