Leeuwin Metals falls on its ASX debut

![]() Nick Sundich, March 29, 2023

Nick Sundich, March 29, 2023

Leeuwin Metals (ASX:LM1) became the ASX’s newest company this morning but it was not the best debut.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Leeuwin Metals is the latest battery metals stock

Leeuwin Metals is a battery metals explorer that holds the William Lake Nickel Sulphide Project in Canada and the Jenpeg Lithium Project in Canada among others.

The former of these is the company’s flagship asset and lies in the Thompson Nickel Belt in Canada. This area has produced 2.5mt of nickel since the first discovery in 1956.

Leeuwin Metals is 9.97% owned by Glencore, one of the world’s most eminent mining companies.

The company came to the ASX to raise money to explore for critical metals.

A retreat on debut

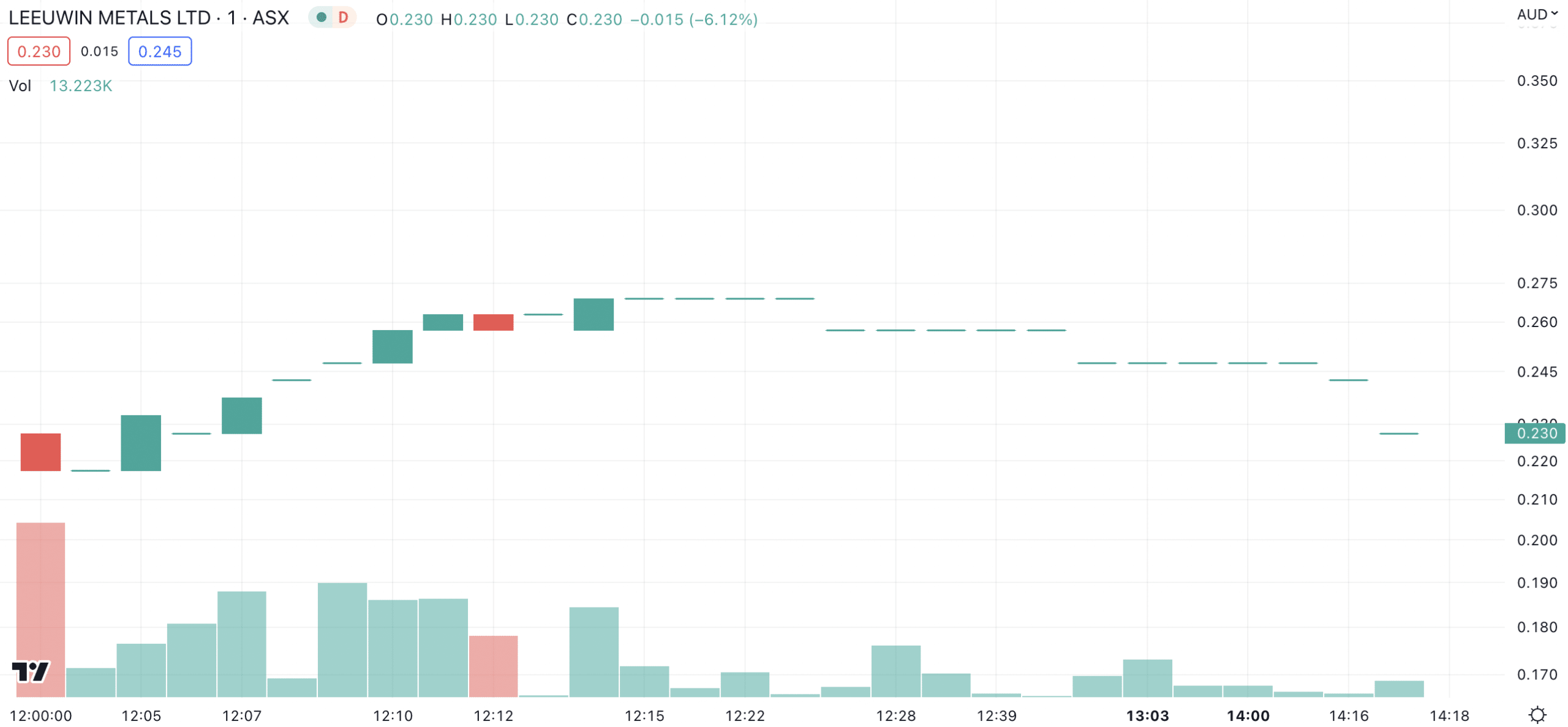

Leeuwin Metals raised $8m at 25c per share, but shares retreated upon its ASX debut.

Leuuwin Metals (ASX:LM1) share price chart, log scale (Source: TradingView)

It is a difficult time to be a pre-revenue company on the ASX at the moment. But investors with a long-term view may see the current market conditions as a good buying opportunity.

After all, there aren’t too many other explorers partially owned by Glencore.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…