Lindian Resources, one of the ASX’s highest fliers in 2022, unveils more spectacular drilling results

What a year 2022 was for Lindian Resources (ASX:LIN) shareholders. The company, an-ex bauxite explorer that owns the Kangankunde rare earths project in Malawi, closed the year more than five times higher than it started after finally settling a protracted legal dispute. And 2023 could be another good year for shareholders.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Lindian Resources is all systems go on Kangankunde

The legal dispute related to the original deal Lindian Resources made to acquire Kangankunde. The original vendors tried to change key terms after the deal was signed. In return for discontinuing the proceedings, Lindian was allowed to negotiate a new deal to buy the project, that eventuated to be a price of US$30m.

Historical estimates at the project have reported an inferred mineral resource of 107,000 tonnes of Rare Earths Oxide (REO) at an average grade of 4.24%. The most recent estimate was more than a decade ago, however, and Lindian is making up for lost time by launching a new drilling campaign.

The drilling results are better than expected

In an otherwise quiet week for the ASX, Lindian just unveiled its first assay results at Kangankunde since finalising the deal.

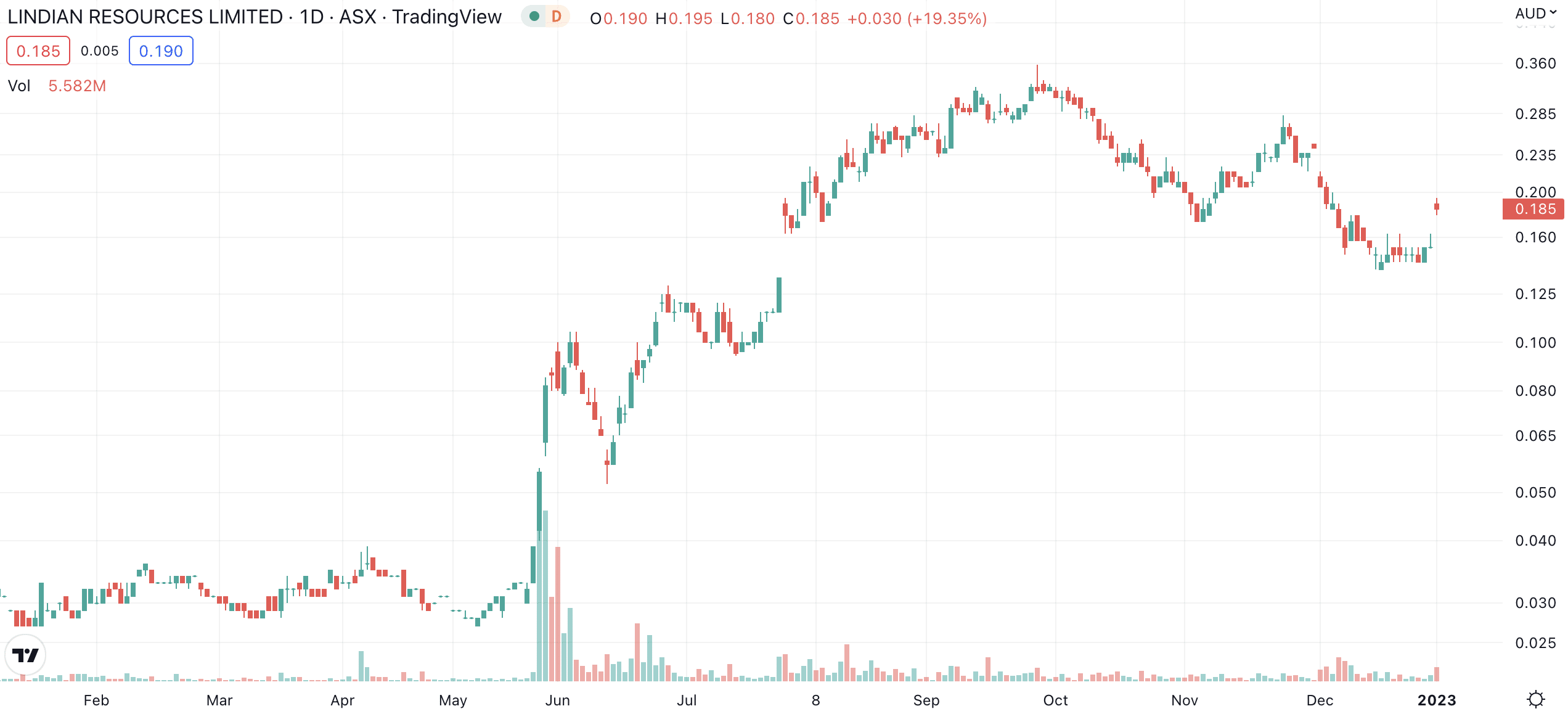

Shares rose nearly 20% this morning, given that the results were even better than expected. Both holes returned an average grade of 2.9%, with a handful of specific interceptions coming in higher.

The company told shareholders it had a further six batches of samples in process for assay and these would be reported in the coming weeks. It also announced that drilling would recommence in the coming days. providing even further cause for optimism.

Lindian Resources (ASX:LIN) share price chart (Graph: TradingView)

Rare earths are important for electric vehicles

Investors are hopeful that Lindian Resources can eventually get Kangankunde into production and supply the EV market. The average EV uses 2-5kg of rare earth magnets for features including the air conditioning system, the brakes, sensors and the exhaust systems.

Although there is a long way to go before Kangankunde becomes an EV supplier, investors have good cause to be optimistic about the future given that Kangankunde appears to be high-grade project in size, grade and quality.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

Immutep’s Phase 3 trial for Efti has gotten the chop and shares plunge >90%! What now for investors?

After nearly a week in suspense, Immutep (ASX:IMM) confirmed news about Efti that its investors did not want to hear,…

ASX Set for Another Red Day as Oil Shock Rattles Markets

Oil Above US$100 Has Markets Repricing Risk Fast It looks like there is a strong chance the ASX has another…

The Looming Demotion: Here’s Why These 8 ASX Stocks Are Being Removed from the ASX All Ords!

In a couple of weeks, some ASX Stocks Are Being Removed from the ASX All Ords. Other companies will take…