Major shareholders of these companies sold massive blocks of their shares this week

![]() Nick Sundich, December 14, 2022

Nick Sundich, December 14, 2022

Markets do not like it when major shareholders sell down their stakes, whether it is a founder, director or a fund manager. It is not uncommon for shares to fall more than 10% when that happens. Although that wasn’t the case for Endeavour (ASX:EDV) and Technology One (ASX:TNE) this morning, the disposals are questionable.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

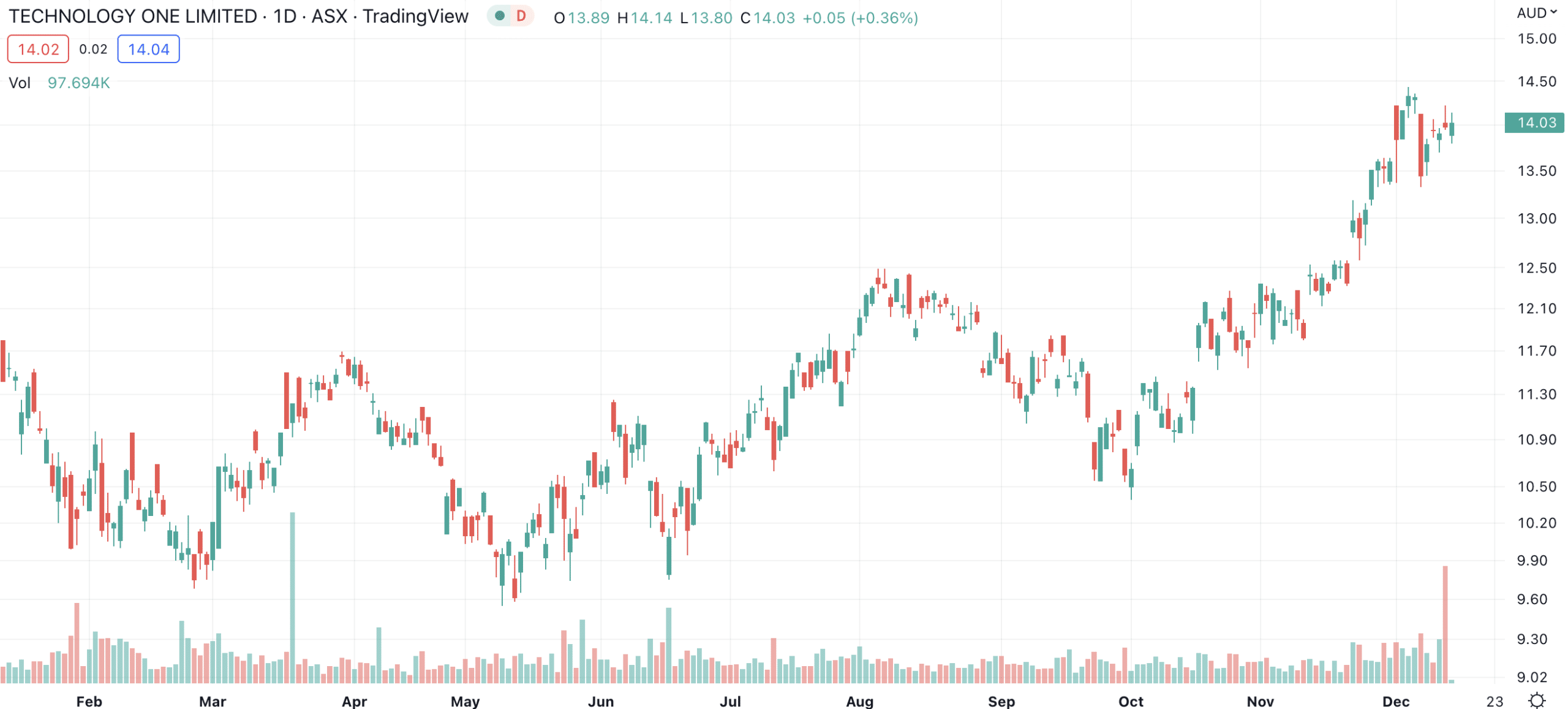

The founder sells, but Technology One’s other major shareholders stick around

Adrian Di Marco, the founder of Technology One (ASX:TNE) and a major shareholder, sold over $40m worth of shares this week. The news was first revealed in the AFR’s Street Talk column and confirmed via a ceasing to be substantial shareholder notice.

No explanation was given to the market for the sale. However, we observe that he had stepped down as Chairman of the company earlier this year.

Furthermore, having founded the company in 1987 and having been there ever since, you could argue he was entitled to sell. He still owns over 14m in shares, but is no longer a major shareholder, having fallen below the 5% threshold. Technology One shares actually rose this morning. Maybe because the market is relieved part of the overhang is now gone.

Technology One (ASX:TNE) share price chart (Graph: TradingView)

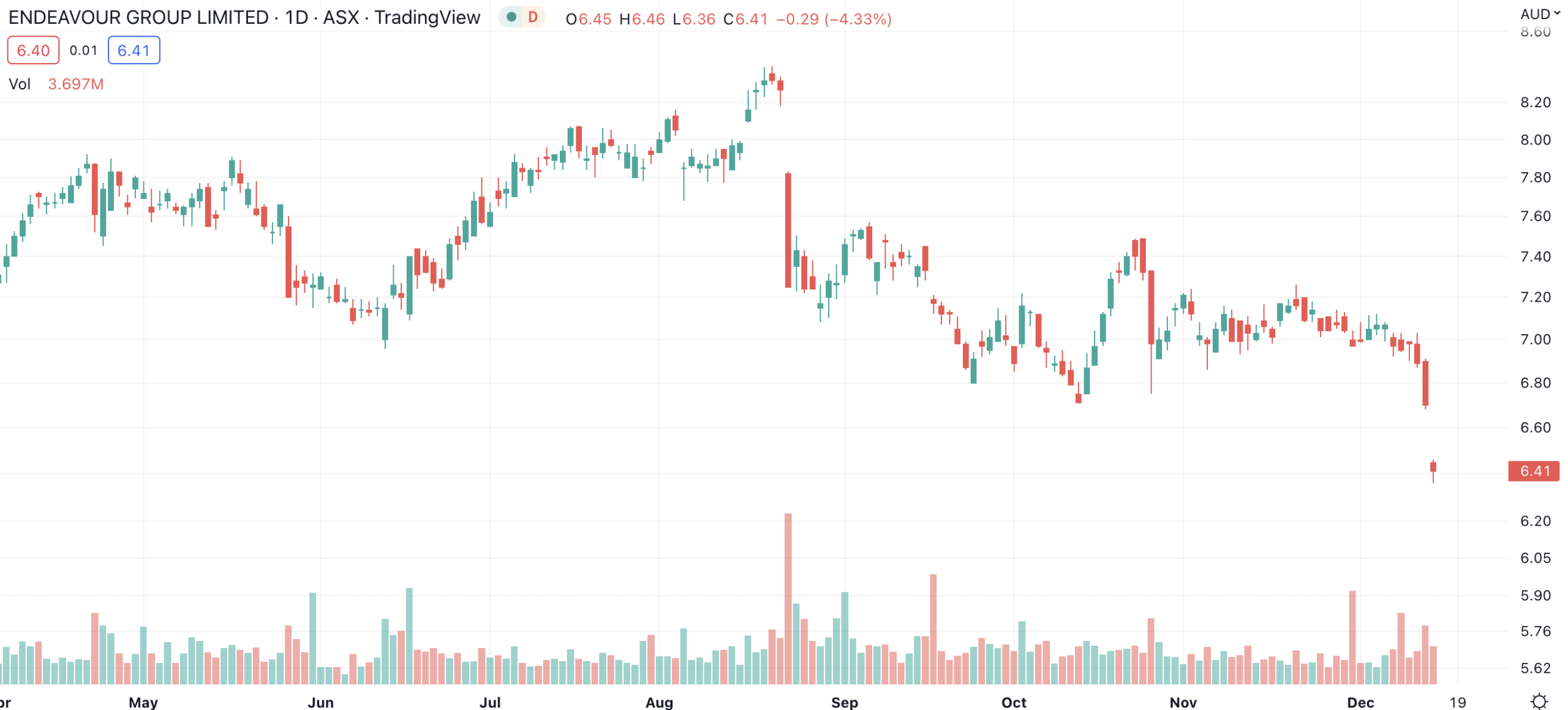

Woolworths sells some of its Endeavour shares

The prominent major shareholder of Endeavour, Woolworths (ASX:WOW), decided to sell some of its shares – a stake of 5.5% in the company. The deal has not been completed, but WOW will retain a 9.1% interest once this occurs.

Why is a major shareholder of the calibre of Woolworths selling though? There is speculation that it is trying to buy PETstock for $600m, as pet ownership continues to increase.

The sale of Endeavour shares (which would be $635.3m at the reported $6.46 price) would suggest a potential deal is near. Unlike Technology One, Endeavour’s shares fell quite a bit this morning.

In our view, you could understand a founder seeking to reap rewards after more than 3 decades of hard work. But a major shareholder selling a company just to buy another? That draws a lot less sympathy, at least from us.

Endeavour (ASX:EDV) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…