Novonix (ASX:NVX) won a US$100m grant from the US Department of Energy

Today was a good morning for investors in Novonix (ASX:NVX). Its shares rose as much as 22% after winning a US$100m grant from the US Department of Energy.

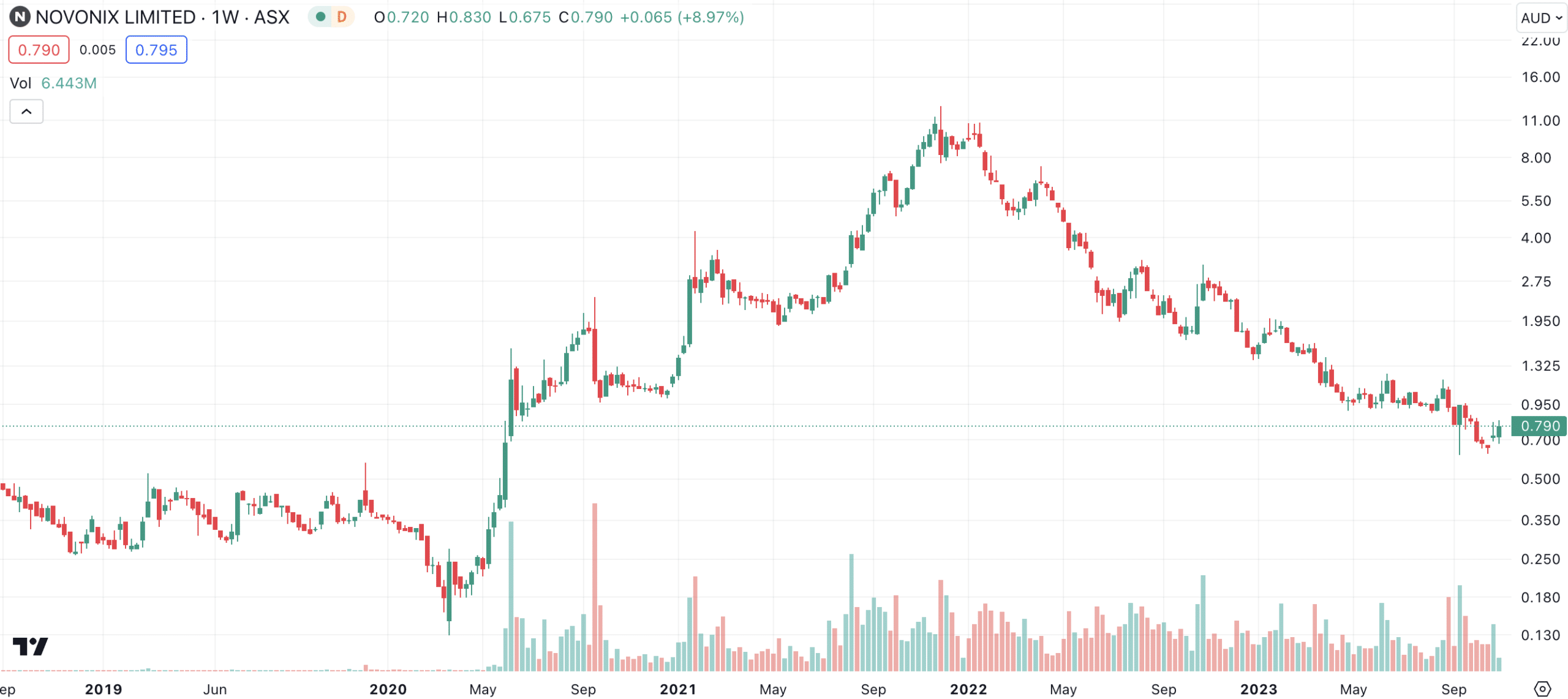

Novonix (ASX:NVX) share price chart, log scale (Source: TradingView)

All about Novonix

Novonix has multiple ventures in the battery metals space but one of these is the PUREgraphite point venture. Puregraphite develops, manufactures and sells high performance anode materials into the global lithium-ion battery market from a factory in Chattanooga, Tennessee.

The company has been seeking funding for expansion of the project and has been negotiating with the US Department of Energy (DoE) for just over year now. The DoE finalised a US$100m award that will upgrade Chattanooga to a capacity that can handle 20,000tpa of lithium.

Production is set to begin in late 2024 and comes not long after recent export controls on Chinese graphite. The US is keen to secure its own North American battery supply chain and this grant will play a part in it.

All good news?

Even though Novonix shares rose today, shareholders might be disappointed that it did not rise by more and/or that shares are down nearly half in the last year.

Obviously cooling battery metal prices in the short-term have not helped its cause. And keep in mind that the company was seeking an award of up to US$150m to build the facility to handle 30,000tpa. Investors could be forgiven for resenting that the final award was lower than they had expected.

Ultimately, we think today’s news is not to be snuffed at and investors would be hard-pressed to find other ASX companies more exposed to the US battery metals supply chain than this one.

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…