Oliver’s Real Food returns to trading after a 2-year suspension; so does a brighter future await?

![]() Nick Sundich, March 1, 2023

Nick Sundich, March 1, 2023

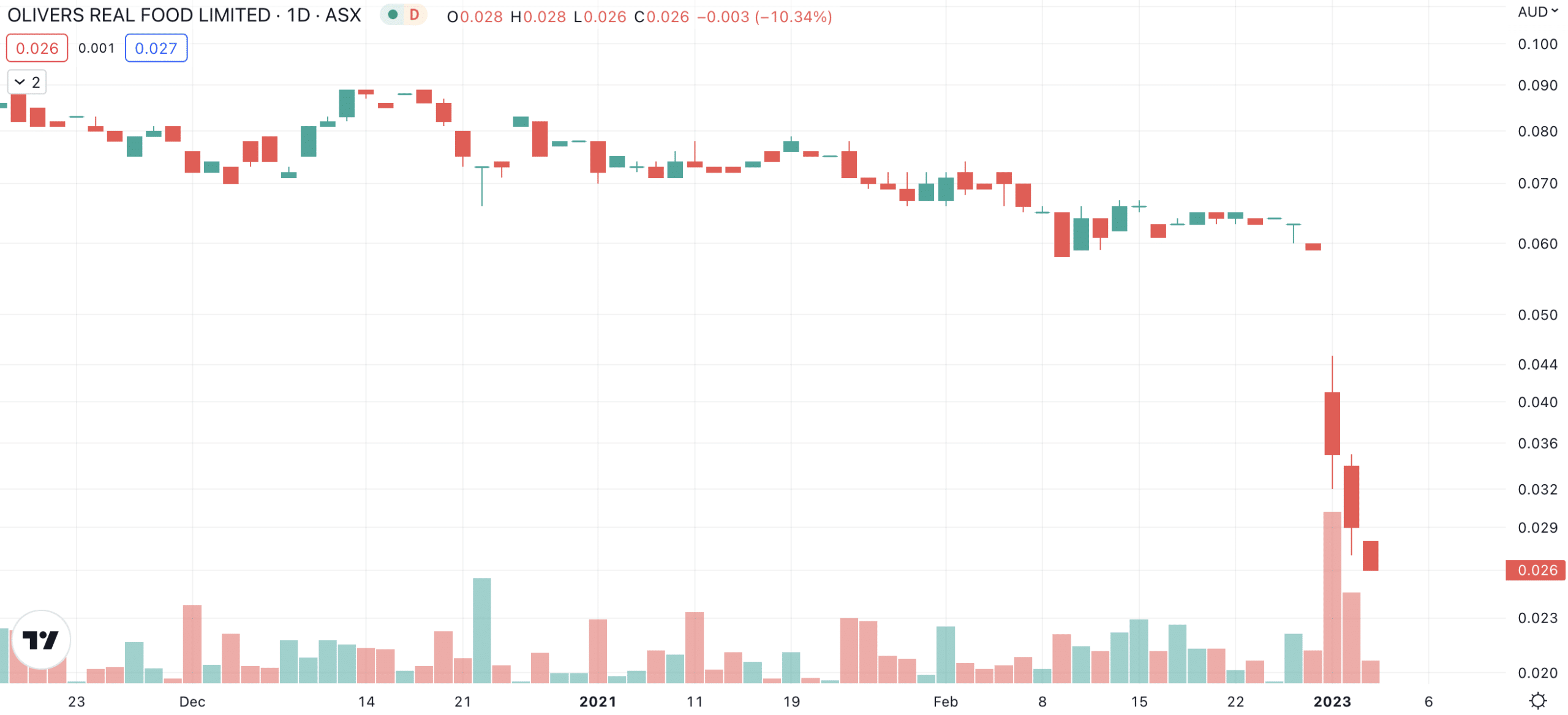

Oliver’s Real Food (ASX:OLI) is trading on the ASX once again after being suspended for 2 years. Although it was not a triumphant return, the company claims that better days are ahead of it.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Oliver’s Real Food has been a disappointment since it listed

Oliver’s Real Food was founded in 2003 and listed in 2017. It operates ‘healthy’ fast food outlets that tend to be at highway stopovers.

Despite different management teams, pivoting from outright owned stores towards distributing its products at EG-owned petrol station and the closure of stores deemed unprofitable, it has bled cash for so long.

One of the key reasons for its struggles was the pandemic, given the lower passenger numbers on major highways, although many problems preceded the pandemic.

Does a better future await?

Given Oliver’s Real Food’s 63% share price decline, it appears investors do not think so – or perhaps they just want to claim tax losses.

But, in reinstating the company to trading, the ASX deemed that the company’s financial position was sufficient to warrant listing.

And its 1HY23 results were not bad. Revenue was up 76.2% to $12.7m and net operating cash flow swung from negative $204k to $488k.

Oliver’s Real Food recorded a statutory NPAT of $6.3m although this was a small loss of $103k, but for the impact of the write back of lease liabilities.

The company told shareholders it has no plans to undertake capital raising and that it had no need to.

Its auditors have expressed an opinion it could continue as a going concern for the next 12 months with its current reserves.

And the company has claimed several initiatives over the last couple of years would help it. Among these measures: equipment upgrades, launching frozen ready-made meals and introducing self-service kiosks and online ordering.

But in our view, it is way too early to make conclusions about whether or not these efforts will turn things around once and for all.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…