OpenPay (ASX:OPY) bites the dust after just 3 years on the ASX

OpenPay (ASX:OPY) has become the latest BNPL company to bite the dust on its ambitions, entering administration this morning.

The collapse occurred barely a week after its 2Q23 cash flow statement. Where did it all go wrong?

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

It is all over for Openpay

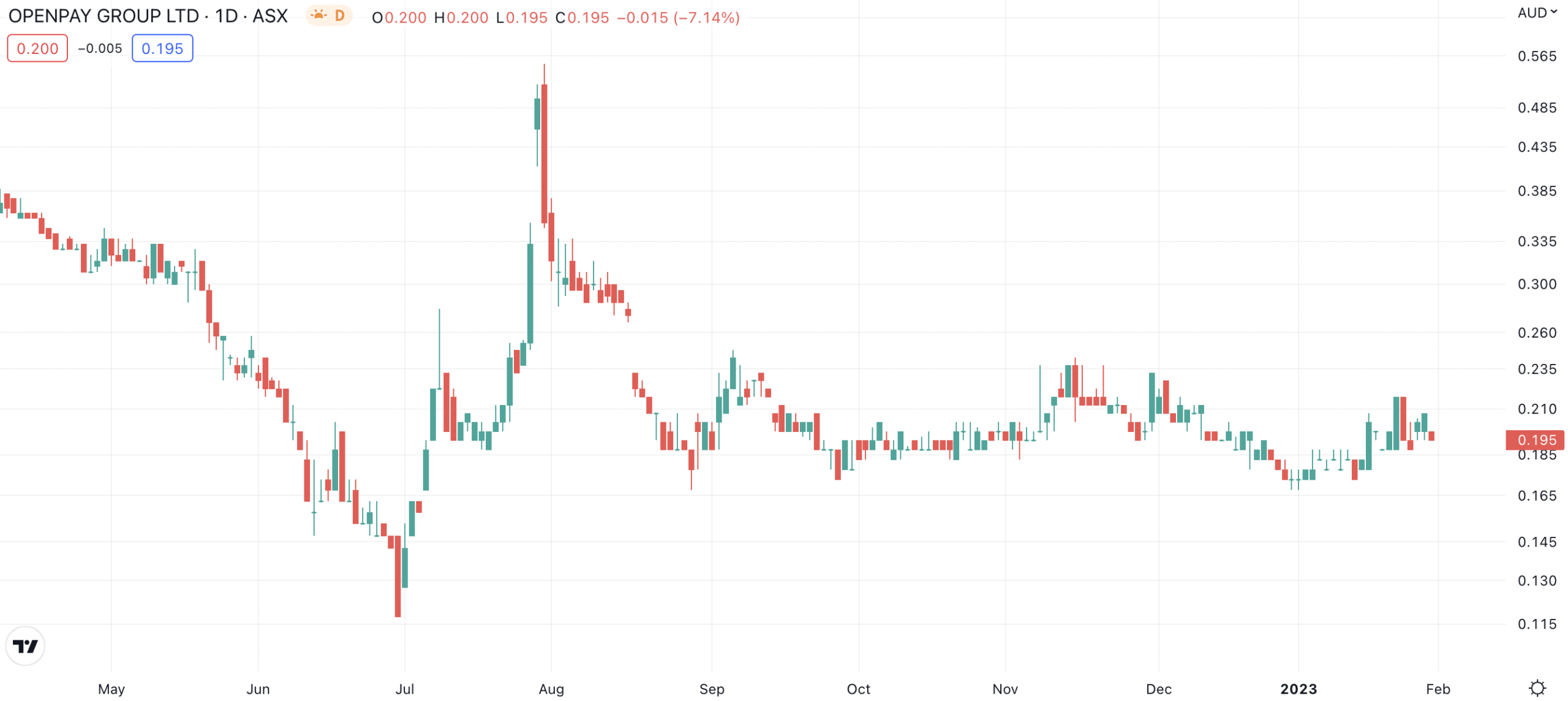

OpenPay listed in December 2019 at $1.60 a share and went as high as $4.70 a share in late 2020 as investor sentiment towards the sector ran hot. All of the platforms were seeing an uptick in usage due to the pandemic and the success of AfterPay, which was acquired by Block, led investors to look for the next big company.

But shares have been in terminal decline over the last two and a half years, exchanging hands at 20c per share on the last day the company traded.

Openpay (ASX:OPY) share price chart, log scale (Source: TradingView)

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips on the top Stocks in ASX

Things went downhill fast last week

After releasing its 2Q23 report after the market closed last Tuesday, it entered a trading halt followed by a suspension. The company breached its loan covenants due to the non-payment of a utilisation notice. Negotiations during the rest of the week have evidently come to nothing, with administrators appointed on Saturday morning.

What now for shareholders?

The administrators, McGrathNicol, are now in control of the company and no longer allow customers to use the platform for new purchases. However, they are still requiring customers to pay outstanding balances.

It is likely that investors will see their shares ‘wiped out’, with the only consolation being that they will have the ability to use the losses to reduce their Capital Gains Tax (CGT) liabilities.

Lessons learned

The harsh reality for investors is that OpenPay was never profitable and was being kept alive by external funding. Although the company had been pushing towards profitability, it had come too late for its external lenders. Investors always need to be careful about companies that are not profitable, especially those that are capitalising on short-term ‘hot themes’.

OpenPay’s demise comes a week after Laybuy (ASX:LBY) announced it was delisting. AfterPay exited the ASX 18 months ago after being acquired by Jack Dorsey’s fintech firm Block (ASX:SQ2).

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…