Orica (ASX: ORI) is rattling the tins to expand its geological capabilities

It’s not common for large cap companies to undertake capital raisings, but Orica (ASX: ORI) has done just this. It is buying 100% of Axis Mining for $260m upfront (which is 11.8x forecast EBITDA for FY22) and a deferred payout of up to $90m up to the end of CY24. But why has it bought Axis?

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Who is Orica and why is it buying Axis?

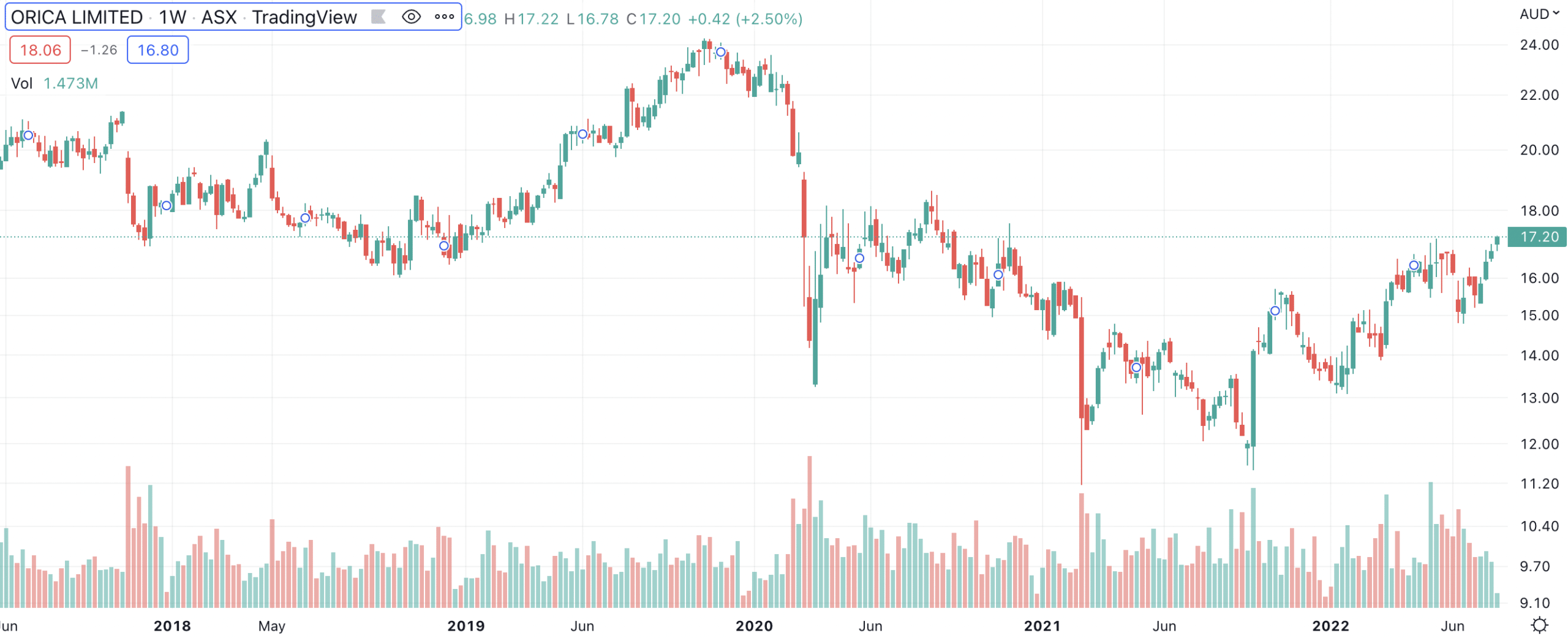

Orica is a chemicals and mining explosives company, capitalised at over $7bn and one of the largest players in its industry. Despite the commodities boom after the Corona Crash, the company has failed to reach its 2019 levels.

Arguably, one of the reasons is that it has lacked the capabilities to pounce on the current commodities boom. New mineral discoveries tend to be located at greater depths and demand more precise geophysics.

Axis helps with this, being a specialised geospatial tool that works at all stages, from understanding the initial orebody to optimising the milling process. Axis generates revenue from recurring product rental and is active in over 30 countries.

Orica has told shareholders that it would be EPS accretive in the first full year of ownership and the Return on Net Assets (RONA) will be 10-12%.

Orica (ASX:ORI) share price chart (Graph: TradingView)

Orica raising capital, and not just for the Axis purchase

The deal was announced in conjunction with a capital raising, involving a $650m placement and a share purchase plan up to an aggregate cap of $75m. You’ll notice it is raising nearly double the cost of purchasing Axis.

In addition to the purchase, Orica has told shareholders the balance of proceeds will fund incremental trade working capital requirements in the medium term due to supply chain disruptions.

Shares in Orica are in a trading halt while the deal is complete. When trading resumes, shares will likely fall purely because the $16 per share deal is at a 7% discount to yesterday’s closing price of $17.20.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…