PointsBet (ASX:PBH) launches in Louisiana

PointsBet (ASX:PBH) has launched into its latest US state, in Louisiana, which marks PBH’s 12th online sportsbook operation in the USA and the 4th under partnership with Penn National Gaming. At first glance, the state of Louisana may not seem that important given its small population, but there are other reasons why this is an important state.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Louisiana an important state for PointsBet

Louisiana is not a populous state, with barely over 4 million people. In that respect, this morning’s news is not as big for the company than a more populous state, such as California or Texas.

But it is home to one of America’s tourist hotspots in New Orleans. Sure, its no Las Vegas, but it is a significant tourist hotspot, offering a bigger market than would otherwise be the case.

Unlike Vegas, New Orleans is a passionate sport city home to the Saints in the NFL and the Pelicans in the NBA, not to mention several college football programs, including the LSU Tigers. Importantly for PointsBet, its own brand ambassador Drew Brees used to play for the Saints.

So when will PointsBet shares take off?

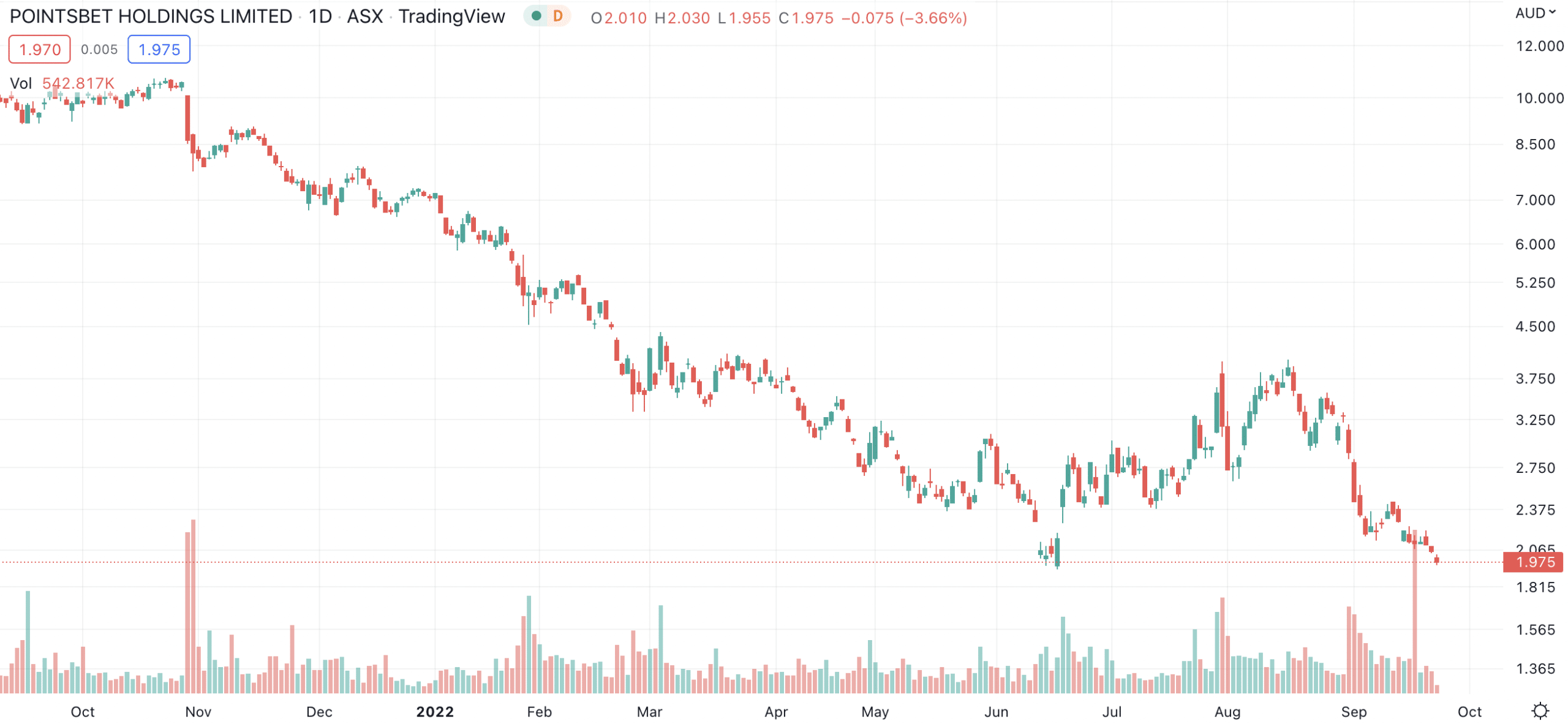

PointsBet shareholders are still waiting for the company to return to its highs of last year. The company will surely grow its revenue as it launches into more US States. It has launched in New Jersey, Iowa, Indiana, Illinois, Colarado, Michigan, West Virginia, New York Pennsylvania and Kansas with more inevitably to come.

PointsBet (ASX:PBH) share price chart (Graph: TradingView)

However, the company’s bottom line is still running at a loss. This is because it has invested significant amounts of money in its marketing campaigns to attract new customers. And in the current inflationary environment, investors want little to do with non-profitable companies.

That said, it is not often you come across a company with such a rare market opportunity in the American sports betting market as PointsBet. It could be one to look at if you have faith that management and the company’s marketing campaigns will eventually deliver. However, judging by the share price it appears investors don’t have that faith just yet.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

6 ASX Stocks to Watch in February 2026: Uranium, Gold, Banks and Healthcare Lead the Way

February 2026 is shaping up as a pivotal month for ASX investors. Gold has smashed through $5,100 per ounce for…

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…