Scandium explorers: There’s not many of them but this company made a spectacular find

Scandium is not a common mineral that ASX explorers prospect for. But WA-focused nickel-copper explorer Golden Mile Resources (ASX:G88) just stumbled across some significant intersections at its Quicksilver project.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

What is Scandium?

Scandium is a transition metal that is used for several purposes including alloys for the aerospace industry, solid oxide fuel cells and specialised lighting.

The US government classifies it as one of 35 so-called ‘critical minerals’. It is a rare mineral in Australia, however.

Geoscience Australia estimated in 2018 that there were 12.14kt in Ore Reserves spread across just four projects in the Eastern States – three in NSW and one in QLD.

However, scandium is more common as a by-product and this is the case at Golden Mile Resources’ Quicksilver project.

Scandium is at Golden Mile’s Quicksilver project

Golden Mile reported significant intersections including wide high-grade zones at >100 ppm (parts per million).

It reported the results were near the surface, widespread and contained within the same footprint of the existing nickel-cobalt resource.

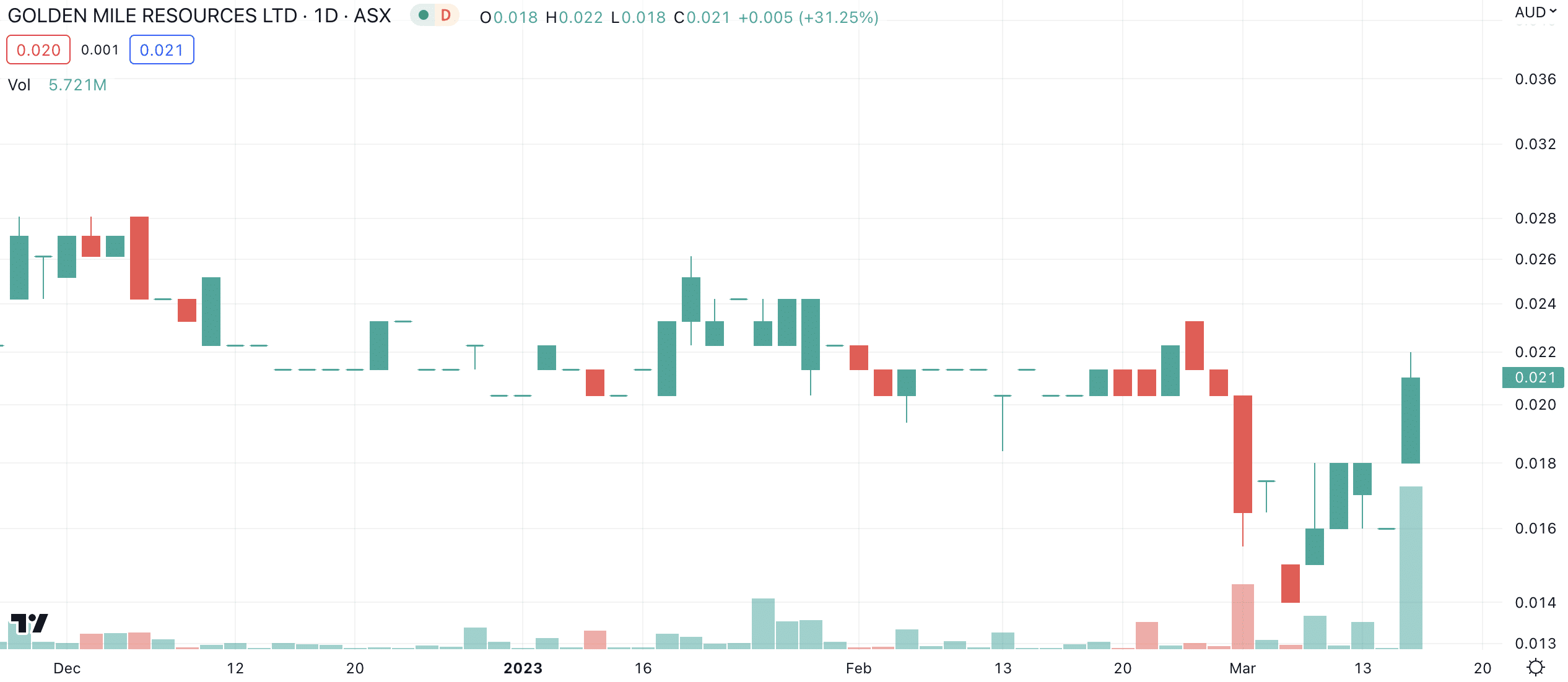

Shares rose over 30% this morning, representing perfect timing for those who have already participated in the company’s current rights offer.

Golden Mile Resources (ASX:G88) share price chart, log scale (Source: TradingView)

Quicksilver has an Indicated and Inferred Resource of 26.3Mt @ 0.64% nickel and 0.04% cobalt containing approximately 168,500 tonnes of nickel metal and 11,300 tonnes of cobalt metal.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Imricor Medical (ASX:IMR) FDA Approval Ignites Shares, but the Real Test Starts Now

FDA Approval Is a Big Win, Not the Finish Line Imricor Medical (ASX:IMR) received FDA clearance for its Vision-MR diagnostic…

How Nuclear Energy Became the World’s Most Feared Energy Source

Why Nuclear Energy Still Scares Us and What Really Went Wrong Many investors may remember periods when nuclear energy captured…

Dateline Resources (ASX:DTR) From 60c Highs to Hard Lessons

A Rare Earth Story the Market Loved Then Questioned For investors who have followed Dateline Resources (ASX:DTR), the past year…