The ASX has had a terrible past 6 months. Is 2023 going to be better?

ASX investors may not be aware of this, but the Australian bourse is actually a listed company in its own right – trading under the ticker code ASX. The company issues an activity report every month, publishing the most recent edition this morning. And the latest report revealed a stark contrast between now and 12 months ago.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Less companies listing on the ASX

Turning first to new listings and capital raisings, the month of December 2022 saw $829m in initial capital raised (IPOs) and $3.5bn in secondary capital (existing companies raising capital). These figures were down 73% and 84% compared to December 2021.

Ironically, new capital raised for CY22 was actually 40% higher than CY21, at $197.2bn. But FY23 so far (the 6 months to 31 December 2022) paints a gloomy picture. Initial capital raised was barely $2bn, down 93%, while secondary capital raised was $30.2bn, down 50%.

We would attribute the difference to resources listings and capital raisings in the first half of the calendar year – driven by higher commodity prices – that slowed down in the second half.

Fewer investors trading, but more volatility

The bourse also reported trading figures, not just for equities, but for interest rate and warrants too. The average daily number of trades in the cash market for December 2022 was 17% lower than December 2021, while the value was down 8% – coming in at $5.3bn.

Similar to capital raising figures, the numbers for the calendar year were higher (by 8% each), while the financial YTD numbers were down. Unlike capital raisings, the financial YTD figures actually weren’t that bad – at 9% down.

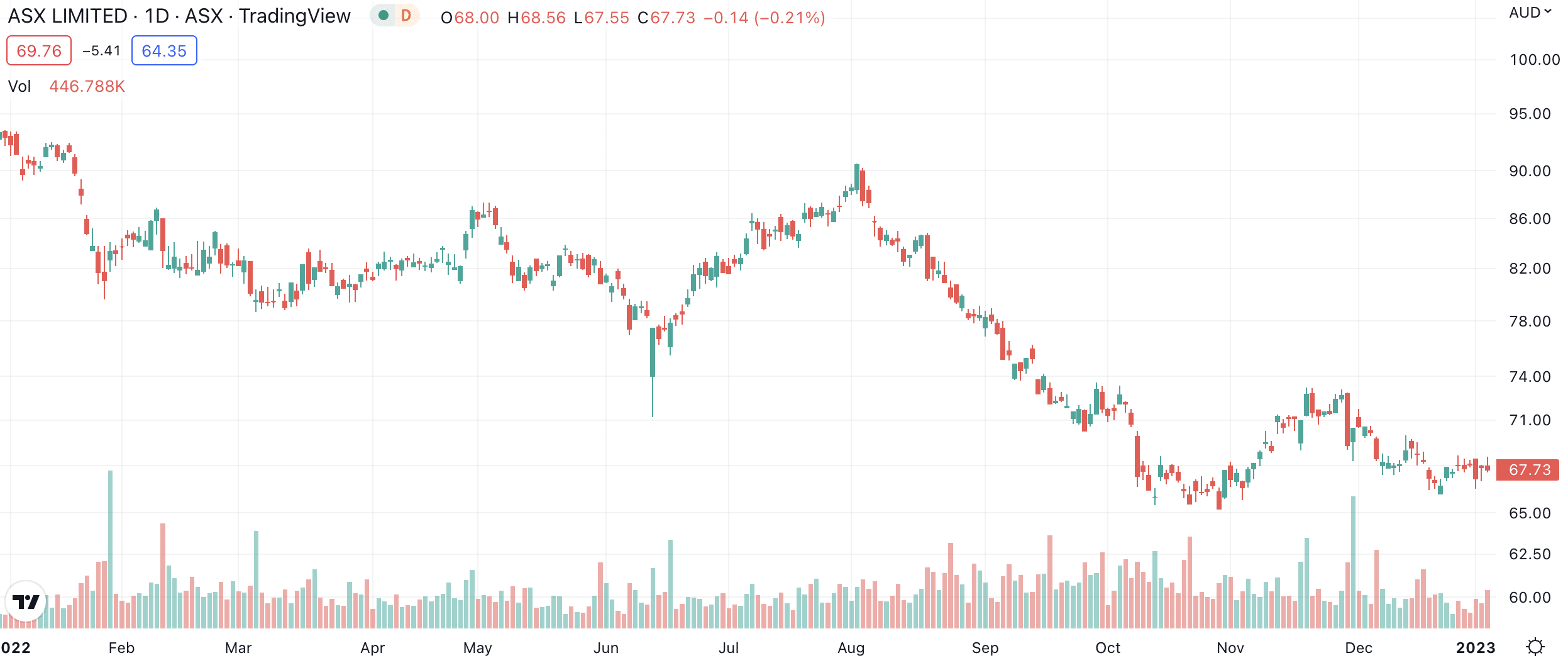

Adding insult to injury, the bourse’s share price is 25% lower than 12 months ago.

ASX (ASX:ASX) share price chart (Graph: TradingView)

Will 2023 be better for the ASX?

The exchange and its shareholders will be hoping for a better CY23. It goes without saying that this will depend on conditions in the broader equity market. And even if there are better conditions in the equity market, the dour second half of the calendar year will be reflected in the bourse’s FY23 results, which are due in August.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…