The worst of the Megaport (ASX: MP1) massacre may be over

Megaport (ASX:MP1) shares have climbed more than 30% at one point this morning after a rough 8 months during which the shares more than halved. The catalyst was a market update that shareholders actually liked for a change. But is this just a temporary bounce or the start of a broader recovery?

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Megaport is EBITDA profitable

Megaport is a provider of middleman software that makes it easier and more secure for businesses to connect to critical Cloud-based systems. It listed in late 2015 at $1.25 that gave it a market capitalisation of just under $90m.

Currently it has a market cap of $1.3bn and a share price of around $7.80, but the stock is well down from last year after investors fled non-profitable Tech companies. But this morning, MP1 revealed it had its first EBITDA profitable quarter. It credited two specific markets – Japan and Canada.

Additionally, it sold 1,447 services (up 6% Quarter-on-Quarter), for total services of 27,383 and grew its Monthly Recurring Revenue (MRR) by 13% to $10.7m. It has a net cash position of $80m.

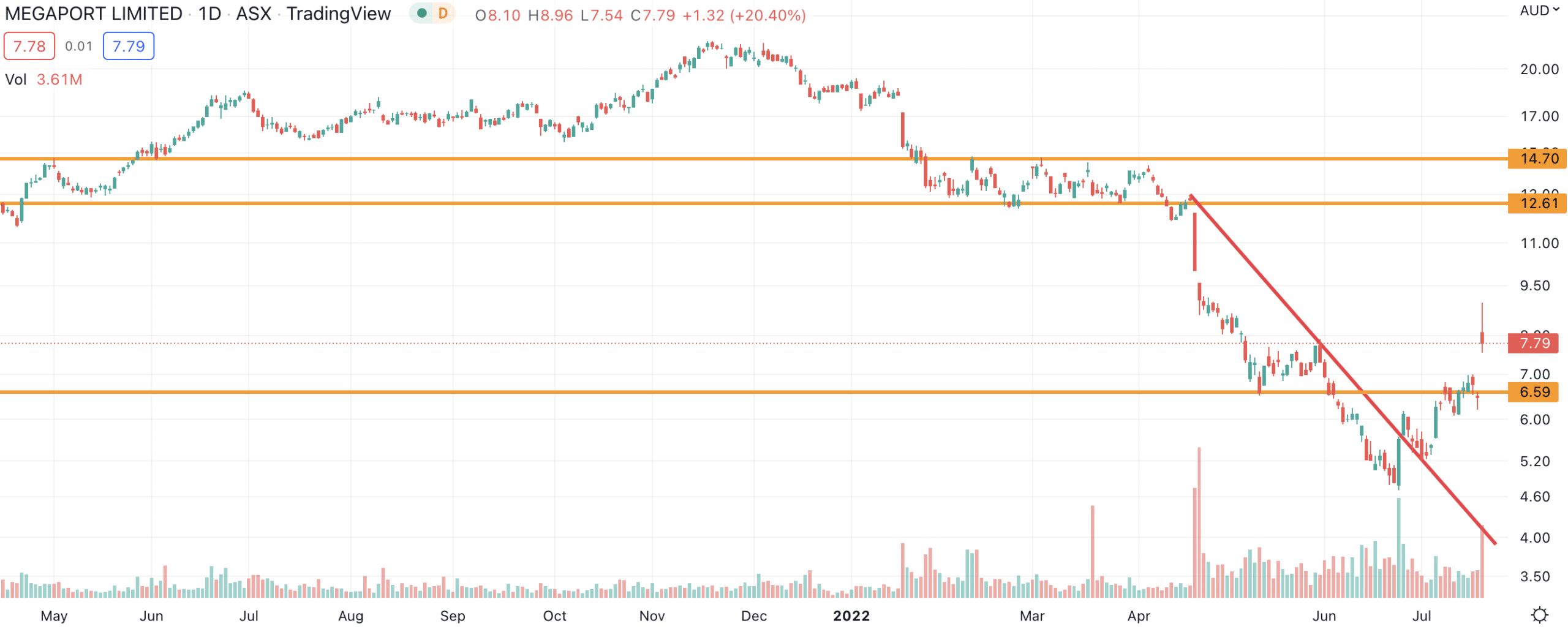

Megaport (ASX:MP1) share price chart (Graph: TradingView)

Will Megaport reach new highs?

So, is Megaport back? Well, this morning’s announcement is very good news and reminded investors that it is no ordinary Tech stock. It is exposed to a very significant market trend – the migration of businesses to the cloud, that is still at early stages (less than 20% according to Goldman Sachs).

However, investors should be aware that even though the company is EBITDA profitable for the quarter, it will likely record a loss for the full year. It hasn’t given full year guidance, but consensus estimates expect -$9.6m. It also has some way to go in order to reach NPAT profitability.

Very high EBITDA growth expected

But its path into the black looks significantly clearer than it did yesterday. The company’s EBITDA loss will be narrower than the $13.3m it lost in FY21 and consensus estimates expect $12.6m positive EBITDA in FY23 along with a 36% jump in revenue to $151m.

Still, investors should be wary that there is more work to do and MP1’s valuation is still high – at 74.4x EV/EBITDA for FY23.

However, keep in mind that the company is expected to turn an EBITDA loss of $9.6m in FY22 into an EBITDA profit of $12.6m in FY23. Moreover, EBITDA growth in FY24 is expected to amount to 233% on current consensus estimates. So, although Megaport is a long way from it’s 2021 highs, there is a lot to like about the company!

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Gold Slides After Trump Picks Kevin Warsh for Fed Chair

Trump’s Fed Pick Sparks a Rates Reset, Gold Reacts President Donald Trump has nominated Kevin Warsh to succeed Jerome Powell…

Here’s Why Gold and Silver Are Falling and What It Means for Your Portfolio

Here’s Why Gold and Silver Are Falling Gold and silver have been all over the headlines lately. Gold fell more…