These 4 lithium shares began 2023 with a big bang!

2023 has begun with a bang for several lithium shares. Essential Metals (ASX:ESS) kicked off the action amongst lithium shares, unveiling a $136m takeover bid on Monday. And there has been more news from the sector over the past couple of days, especially among explorers that have given shareholders some indication that all their hard exploration work is paying off.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s nothing like a project with a US$1.5bn NPV

Among all lithium shares, the biggest news came from European Lithium (ASX:EUR) this morning. This company is expecting to unveil a DFS for its Wolfsberg project in Austria, during the first quarter of 2023. In advance of the release, the company unveiled the Net Present Value (NPV), which was US$1.5bn, based on the Measured and Indicated resource of 9.7mt at 1% lithium from the 2018 Pre-feasibility Study (PFS). The stock was up more than 4% on the back of this news.

Lake Resources is expanding its resource base

Another company that’s trying to pin down just how much of a resource it has is Lake Resources (ASX:LKE). This company, which has the Kachi lithium brine project in Argentina, doubled its Measured and Indicated resource to 2.2Mt of lithium carbonate. In addition to this is a further 3.1Mt in Indicated resources.

I love the smell of good drilling results in the morning

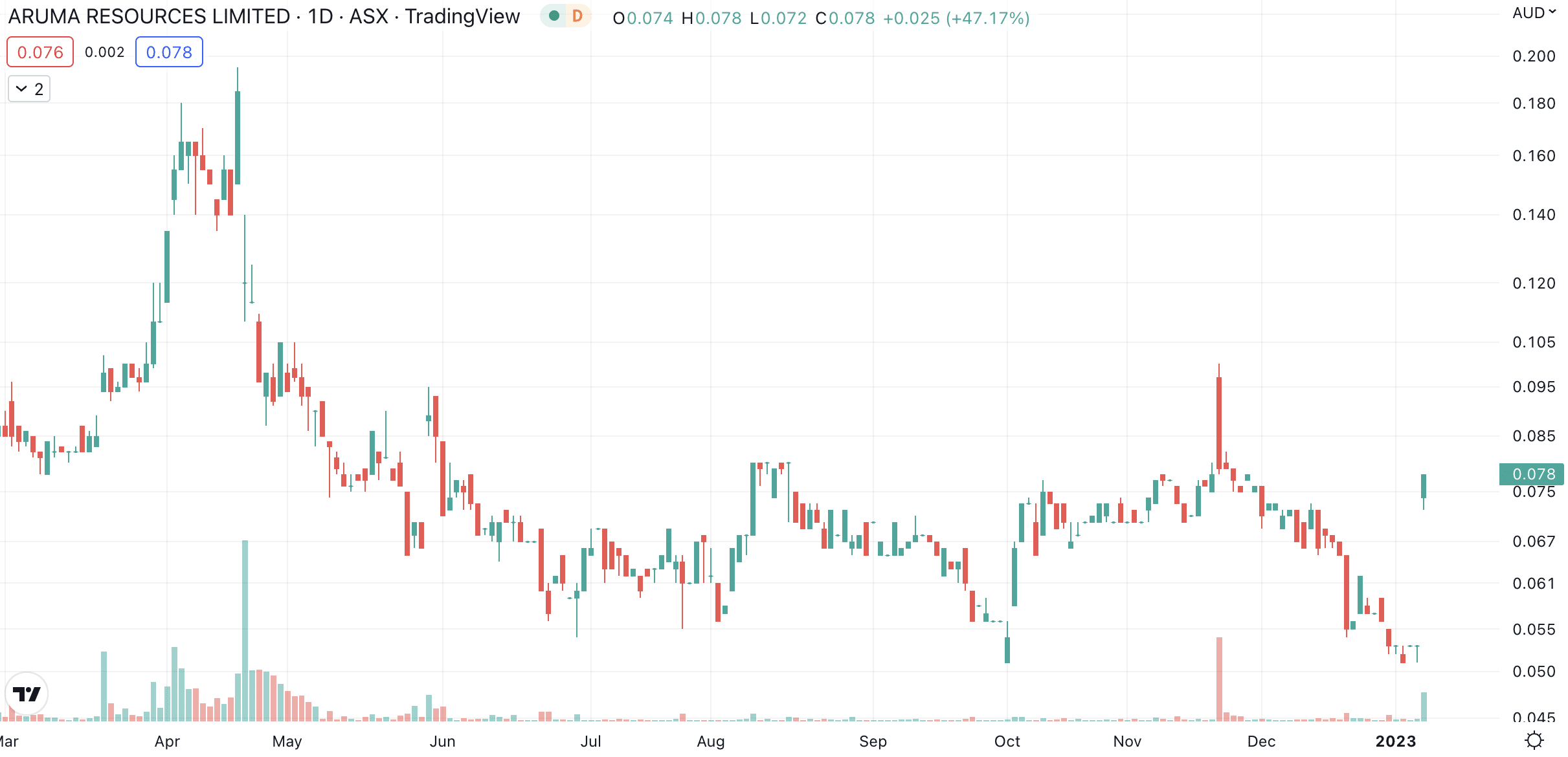

Also this morning, Aruma Resources (ASX:AAJ) unveiled drilling results at its Mt Deans project in Western Australia. Results included grades of up to 1.94% lithium with an average of 0.84%.

Excited shareholders sent Aruma’s share price up by over 45% this morning. This illustrates that there’s nothing like exploration results to get investors in lithium shares excited!

Aruma Resources (ASX:AAJ) share price chart (Graph: TradingView)

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…