US CPI data led the ASX 200 to a 1.5% gain this morning

![]() Nick Sundich, November 15, 2023

Nick Sundich, November 15, 2023

The latest US CPI data led to a strong session in New York, and the ASX is following suit with a gain of over 1.5% in both the ASX 200 and All Ords. Was it really as good news as you would imagine from the gain that has occurred?

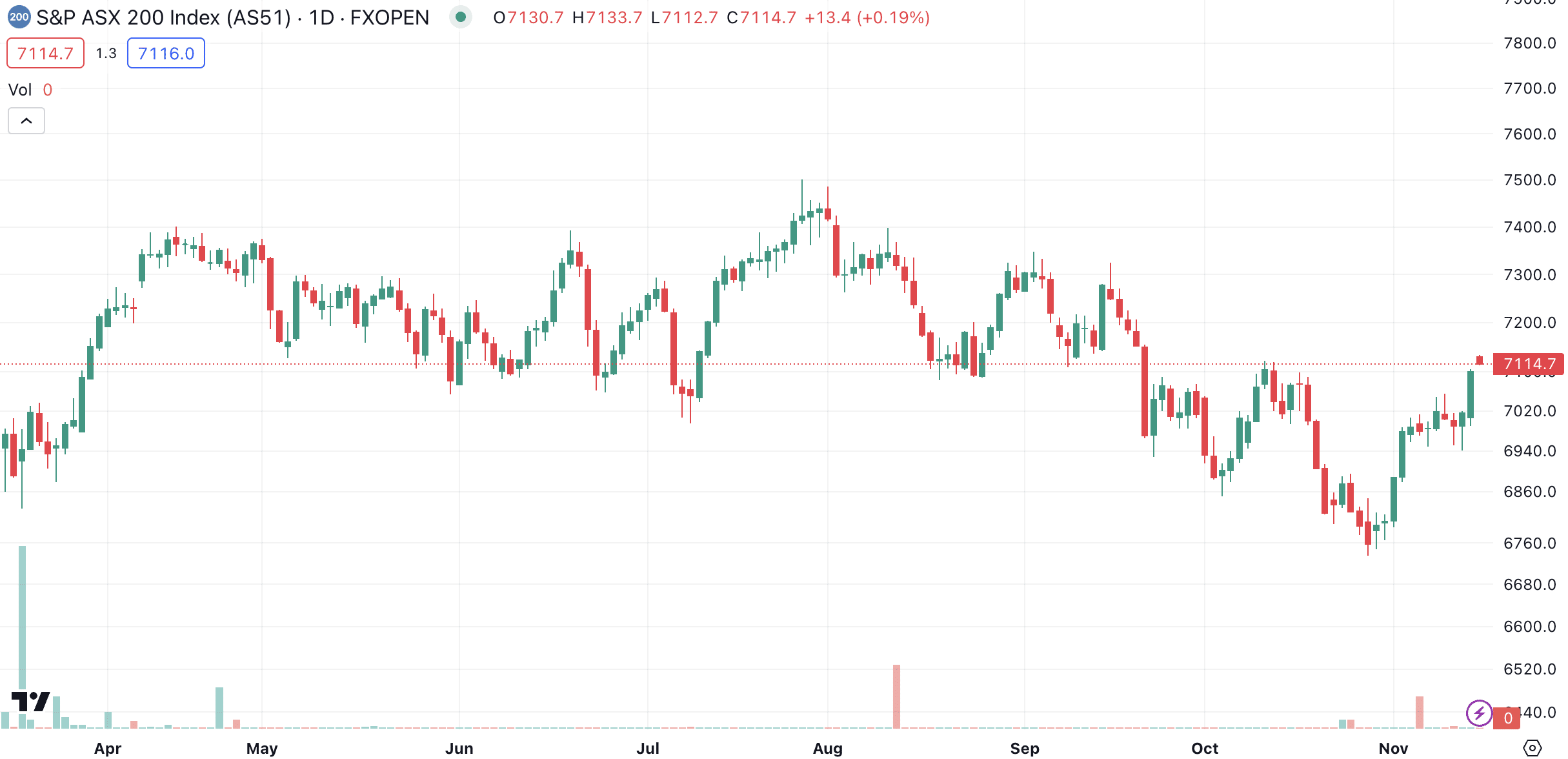

ASX 200, log scale (Source: TradingView)

US CPI data looks good

Simply put, yes. Inflation in America was 3.2% higher in the 12 months ended in October, down from 3.7% in both September and August.

Comerica Bank chief economist Bill Adams declared that the inflation fever had broken, not just because inflation was lower but because prices were essentially flat.

This will mean that there will likely be no further rate hikes, and rate cuts may occur sooner.

What does this mean for Australia?

In our view, not much, given inflation is proving much harder to tame. It wouldn’t surprise us to see more rate hikes from here.

Nonetheless, the US CPI data could be good news for some ASX stocks that are heavily focused on the US, because it could mean that better times are ahead. At the same time, it could be bad news for stocks that have gained from high inflation, particularly discount retailers and utility providers.

What are the Best ASX Stocks to invest in right now?

Check our ASX buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…

Here’s why drug reimbursement is so important for ASX healthcare stocks

Let’s take a look at the concept of drug reimbursement, something that is crucial for ASX healthcare stocks looking to…