Vicinity Centres (ASX: VCX) is seeing people return to the CBD…slowly

Today’s most peculiar company to report FY22 results was Vicinity Centres (ASX: VCX). It has over 60 shopping centres under management, including flagship stores in major CBDs. The company’s books, and share price, were hit by COVID-19, but things are turning around now.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

It’s a better time to be in the Vicinity of these Centres

By any measure, FY22 was easily its best financial year since the pandemic began. The company recorded an NPAT of $1.2bn, FFO of $598m (or 13.1cps) and it paid a distribution of 5.7cps. In FY20 it made a $1.8bn loss and a $258m loss in FY21 as a result of lockdowns that impacted store trading and visitor numbers.

For FY23, it is expecting AFFO (adjusted funds from operations) of 10.9-11.5cps and a distribution of 95-100%. Assuming the midway point (11.2cps), this gives us a P/FFO multiple of 18x and a yield of 5.3-5.5%. With an NTA of $2.36, the stock is trading at a ~15% discount.

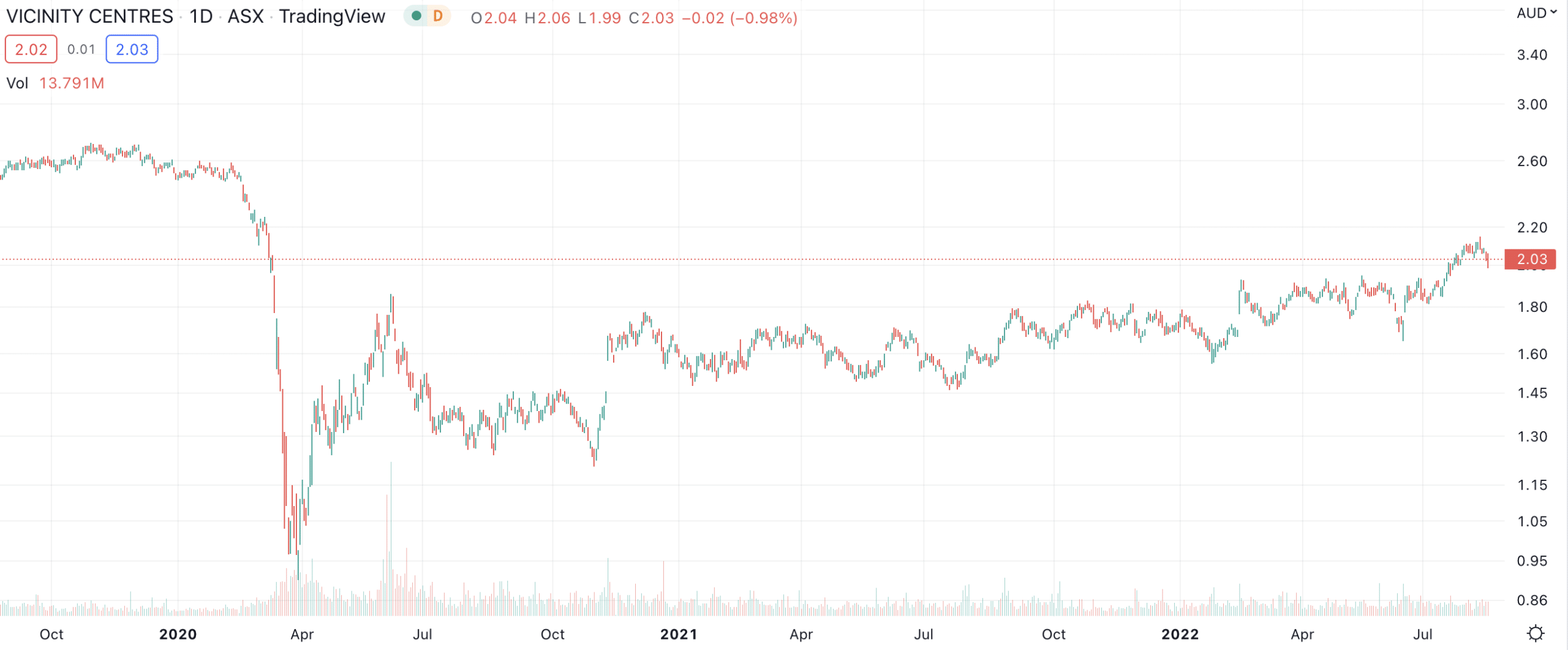

Vicinity Centres (ASX:VCX) share price chart (Graph: TradingView)

Will FY23 be another solid year?

The guidance the company has given suggests FY23 will be a good year for shareholders. But Vicinity Centres itself admitted that this depends on when and where inflation peaks, although it forecasts a ‘soft landing’ over the next 12-18 months.

It reports that weekend visitation numbers are back to pre-COVID levels, but mid-week numbers are not, even though international borders have re-opened. Vicinity Centres expects this to occur in FY24.

What if CBDs never recover?

Vicinity Centres’ management told analysts on the conference call that it will strive to make sure its properties will be the premier assets in the CBDs.

So, even if CBDs don’t fully recover for some years, it may nonetheless benefit as retailers seek to consolidate. It also observed it owned most of its land so has significant flexibility and would not hesitate to undertake acquisitions that would be quickly earnings accretive.

Investors may prefer Scentre Group (ASX: SCG) – which we covered in July last year – on the basis that it was not hit by COVID-19 as badly because it doesn’t have properties in CBD locations reliant on international tourism for foot-traffic to the same extent Vicinity does. But we think there is still upside left in Vicinity even if the recovery is more gradual than anticipated.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…