Washington H. Soul Pattinson (ASX:SOL) beat the market by a whopping 20%

It has been a difficult twelve months for ASX-listed fund managers and their shareholders, including for Washington H. Soul Pattinson (ASX:SOL). But today, the ASX’s second oldest company, released its results for FY22 (the twelve months to 31 July 2022) and it told investors that it had beaten the market by 20%!

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Washington H. Soul Pattinson is getting better with age

Washington H. Soul Pattinson grew its Pre-tax Net Asset Value (NAV) by 13.8%, which was 20.2% ahead of the All Ordinaries Index (which fell by 6.4% in that time frame).

On a post-tax basis, NAV grew by 28.5%, which implied a 34.9% outperformance of the market. It also delivered a $834.6m operational post-tax profit (up 154%) and $347.9m in net cashflows from investments (up 93%).

It paid a special dividend of 15cps in addition to an ordinary dividend of 72cps, up 16.1% and representing a yield of 3.3%.

Washington H. Soul Pattinson also boasted of its long term records with a 20-year Total Shareholder Return (TSR) of 12.2% per annum, 3.4% higher than the market.

Can it continue to beat the market in FY23?

Shares in Washington H. Soul Pattinson gained a modest 1.5% at market open this morning, showing investors were cautiously optimistic about the future.

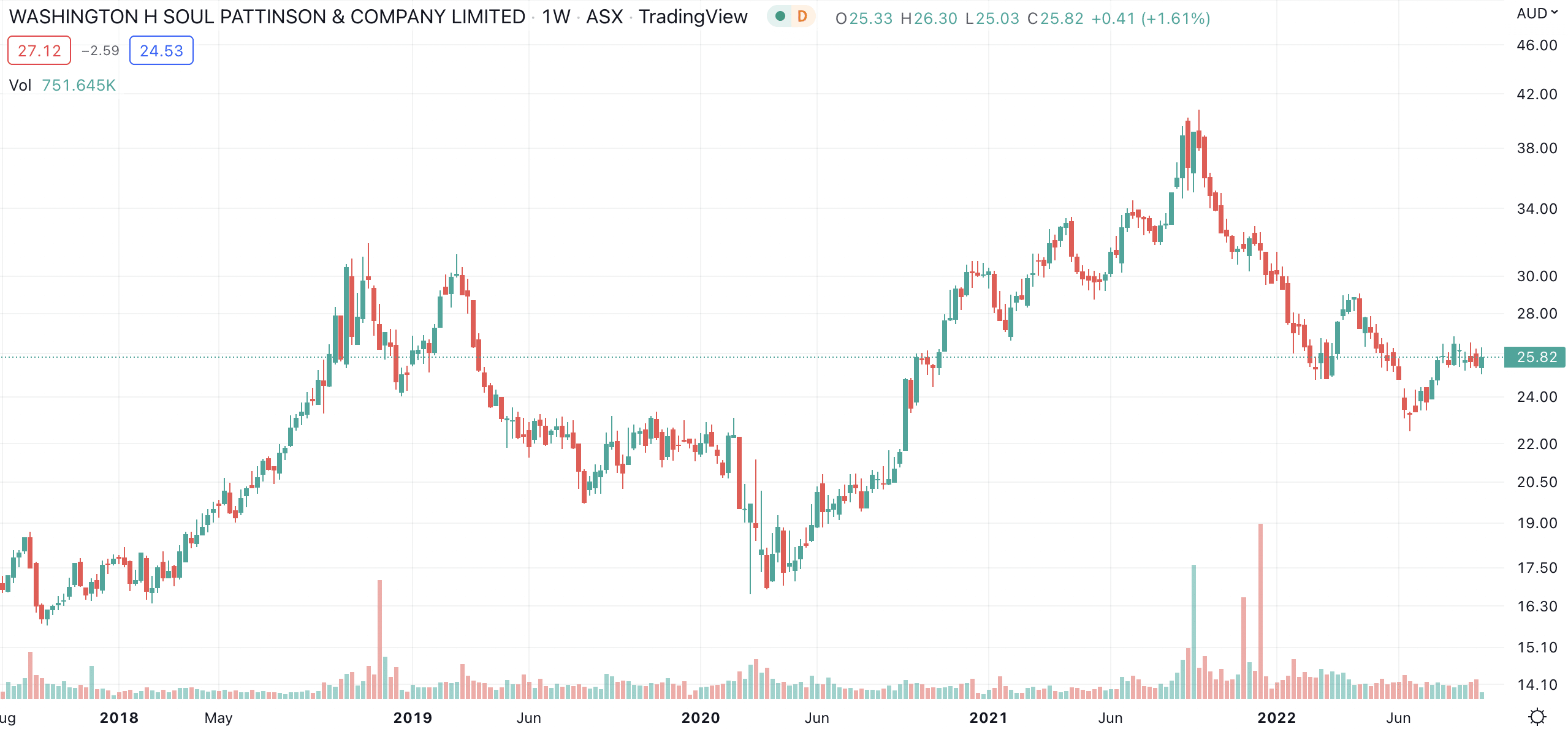

Washington H. Soul Pattinson (ASX:SOL) share price chart (Graph: TradingView)

The company’s managing director Todd Barlow was less cautious, noting that the lower valuations in asset classes represented opportunities for the future and that it had ample cash and liquidity to take advantage of them.

With a long-term track record and without the troubles facing other listed money managers, such as Magellan (ASX: MFG), it is easier to have confidence in this one relative to its peers. But a lot will depend on the decisions Washington H. Soul Pattinson money managers and analysts make in the next 12 months.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…