The wait for Weebit Nano’s first revenue is over as a massive milestone is achieved!

Investors waiting for Weebit Nano’s (ASX:WBT) first revenue need not wait any longer! The ASX‘s most advanced semiconductor developer just announced that it has achieved this milestone.

Weebit Nano’s first revenue

WBTis following a licensing model for its ReRAM technology, based on royalties on sales, a figure which could be 1.5-3%, based on industry standards.

To illustrate how this might work, let’s assume a foundry can make a chip using WBT’s technology that costs US$10 per unit and WBT receives a 3% royalty on all sales of chips that use its technology. If the foundry sells 1m of these chips and generates US$10m in sales, WBT would receive US$300,000 from this customer for this product.

Weebit Nano received an initial licensing fee of US$100,000. While this initial revenue is small, it is an important milestone nonetheless – marking the company’s transition to commercialisation. It is a ‘pre-revenue’ company no longer. And more of these license fees will follow in the future.

Onwards and upwards for 2024

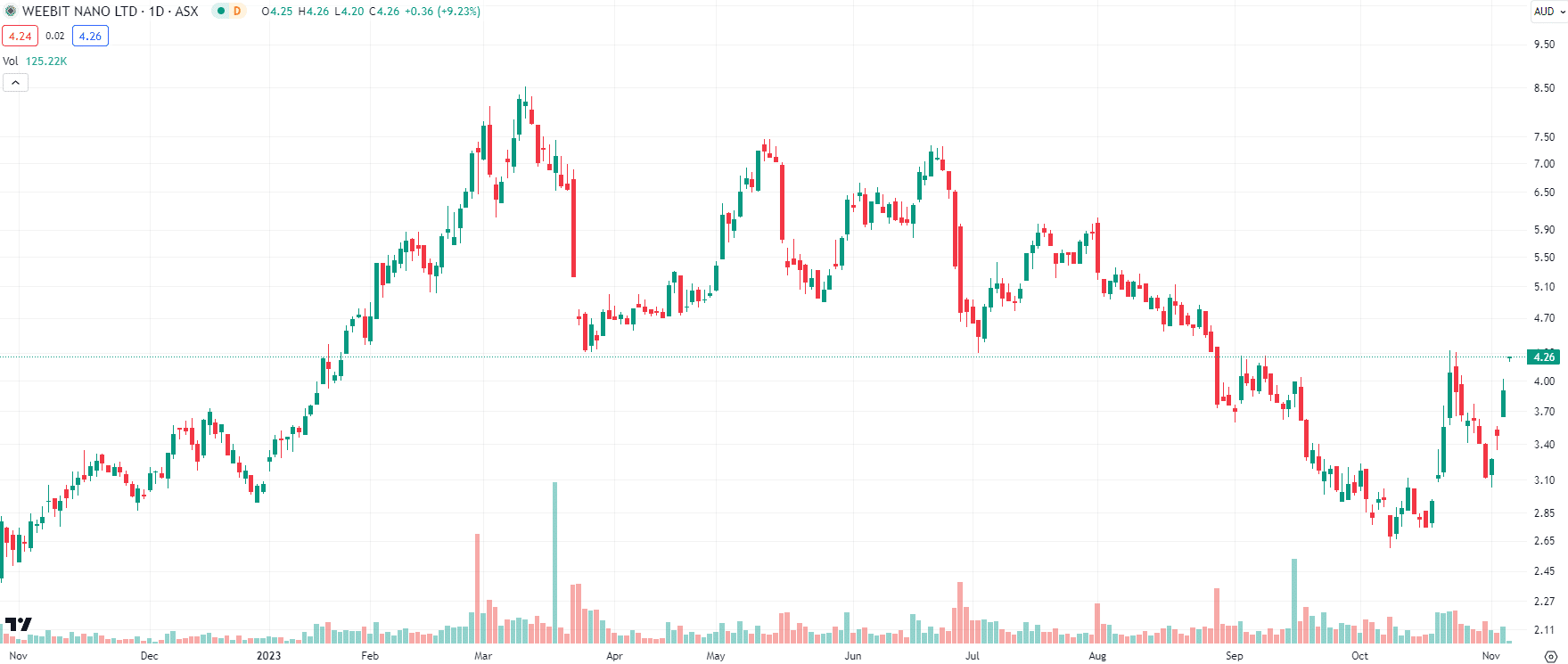

Despite the difficult year in the equity markets, it has been a year of progress for Weebit Nano and we think it has shown in the fact that shares are up over 40% in the last 12 months, even after having come down from the approximate $9 peak in March 2023.

Weebit Nano (ASX:WBT) share price chart, log scale (Source: TradingView)

Most importantly, the company commercialised its ReRAM technology with SkyWater (hence, its inaugural revenue) and signed on a second top tier fab as a partner in South Korean headquartered DB HiTek.

We believe, there is a lot more for investors to look forward to in the months ahead, including more partnerships with top tier fabs and more revenues.

Check out the research coverage of Weebit Nano by our parent company Pitt Street Research!

Disclosure: Stocks Down Under directors and staff own shares in Weebit Nano

What are the Best stocks to invest in right now?

Check our buy/sell stock tips

Blog Categories

Get the Latest Insider Trades on ASX!

Recent Posts

St George Mining (ASX:SGQ) 75% Resource Upgrade, Stock Down 15%, Why?

St George Mining Hits 70.9Mt, The Market Still Wants Confidence St George Mining announced a major resource upgrade at its…

Oil Supply Risk Rises After Iran Drone Attacks Reach Ras Tanura and UK Base in Cyprus

From Battlefield to Oil Chain, Drone Attacks Expand the Conflict Map A British military base at Akrotiri in Cyprus and…