Why Sezzle (ASX: SZL) is jumping over 20% higher today!

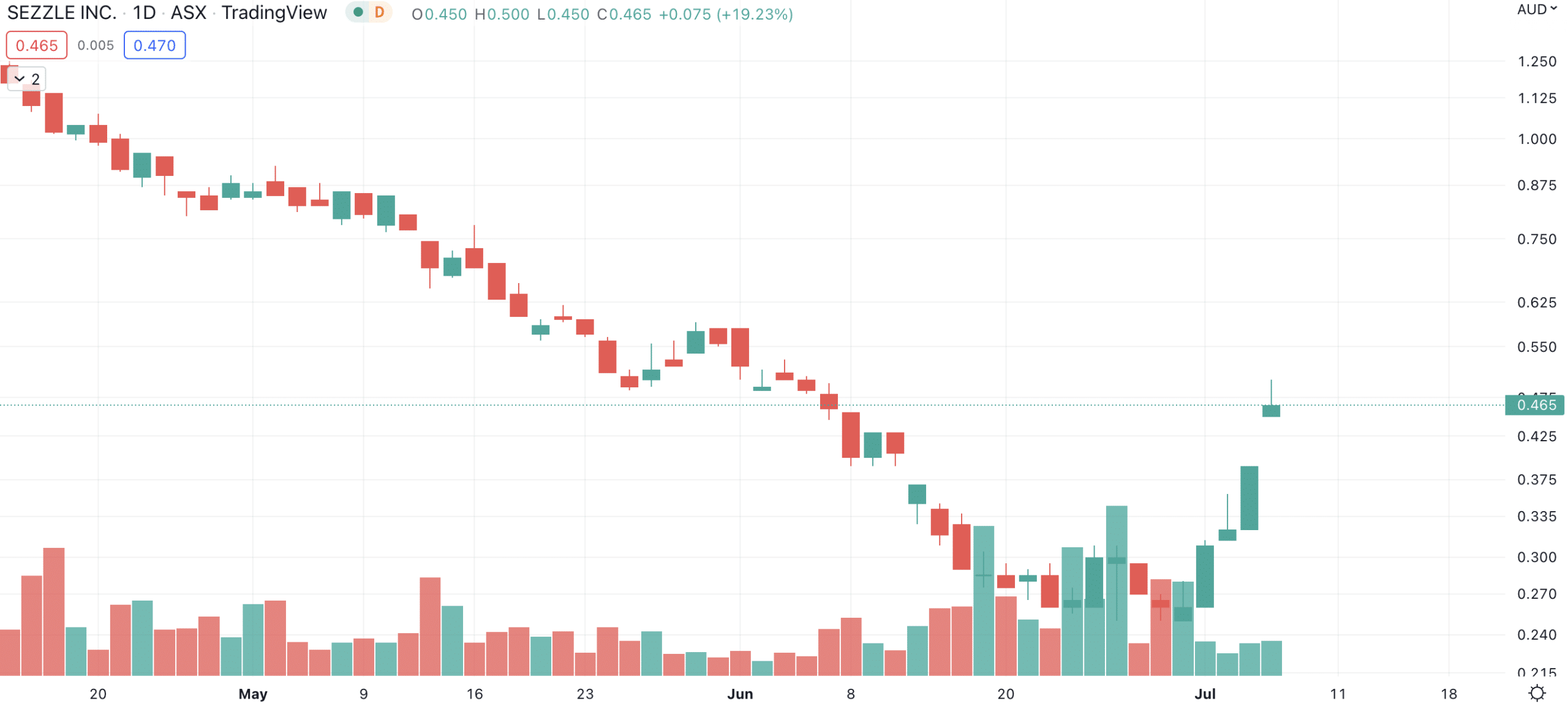

Sezzle (ASX: SZL), one of the most prominent BNPL players on ASX, is over 20% this morning. It has been a rough time for BNPL investors with all companies’ shares down substantially. Sezzle is down over 90% in 12 months. But why have shares suddenly risen this morning?

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Sezzle has had a rough time of late

Sezzle listed in July 2019 at $1.22 per share. It was a runaway success, peaking at $11.34 in August 2020. Investors were attracted to the BNPL sector, seeing it as a virtuous and more popular alternative to credit cards. Sezzle was admired for its exposure to the US market, where BNPL was a bigger opportunity, but had barely scratched the surface.

In recent months it has suffered as the hottest inflation in decades has caused consumers to cut back on spending and bad debts to rise. And investors remembered that virtually none of the ASX’s BNPL companies were profitable. Not even a merger deal with Zip (ASX: Z1P) could spare Sezzle from a share price decline.

Sezzle (ASX:SZL) share price chart (Graph: TradingView)

What now for Sezzle?

This morning, Sezzle shares have grown over 20% despite not having announced anything. Therefore, we can only speculate on why it is rising. One might argue the bulk of selling in recent weeks was by investors who wanted to claim a tax loss; and, with FY22 over, there was no reason to sell anymore.

Additionally, the Nasdaq was up strongly in the US overnight, which triggered a buying spree in ASX-listed Technology stocks this morning, including SZL and ZIP.

It is also argued that the industry was buoyed by a UBS report earlier this week that issued a 12-month price target for Block (ASX: SQ2), the owner of industry pioneer AfterPay, of US$167 compared to the current price of US$64. Beyond promoting Block as a company, the report also backed the AfterPay acquisition, arguing that over the long term it could accelerate Square’s more upmarket to enterprise-sized sellers.

Arguably, Sezzle (set to be acquired by Zip) is investor’s next best chance to capitalise on the growth in BNPL. However, only time will tell if today is just a one-off spike or the start of a broader recovery.

We think the latter is unlikely unless the Zip-Sezzle deal closes and both companies actually start to make money. In the 12 months to 31 December 2021, Sezzle lost US$72.1m from operating activities, nearly triple from the year before.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…