Introduction to ASX Bank Stocks

ASX bank stocks refer to the shares of Australia’s major banks listed on the Australian Securities Exchange, most notably the “Big Four”- Commonwealth Bank (ASX: CBA), Westpac Banking Corporation (ASX: WBC), ANZ (ASX: ANZ), and National Australia Bank (ASX: NAB). These banks dominate the country’s financial system, controlling most home loans and deposits, and together hold nearly $400 billion in market value. For investors, they are attractive because of their consistent, fully‑franked dividend payments, which provide reliable income and benefit millions of Australians through superannuation funds. Their strength lies in Australia’s oligopolistic banking structure, which gives them stability and pricing power, though investors must also consider risks such as regulatory oversight, tighter lending margins, and exposure to housing market cycles.

Why invest in ASX Bank Stocks?

ASX bank stocks are prized for their reliable, fully‑franked dividends, often yielding above 4% and even higher when franking credits are included. This makes them especially attractive for retirees and income‑focused investors seeking steady cash flow. Beyond dividends, the Big Four banks benefit from Australia’s resilient housing market, with massive mortgage books and very low bad debt levels. Their scale and stability provide exposure to the broader economy, particularly property trends, while offering defensive qualities during downturns. Although they’re not high‑growth businesses, their combination of income, resilience, and market dominance makes them cornerstone holdings in many portfolios.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

The Future Outlook Facing ASX Bank Stocks

The RBA hiked the cash rate to 3.85% in February 2026, with inflation still above target. Rates are likely to stay high for the forseeable future, helping bank margins but also squeezing households and slowing loan growth. The main challenge ahead is margin pressure: banks face tougher competition for deposits and mortgages, limiting their ability to pass on higher costs. Earnings growth is expected to slow to mid‑single digits in FY26, down from recent double‑digit gains. On the positive side, lending remains steady, deposit growth is strong, and all Big Four banks have lifted dividends, showing commitment to rewarding shareholders even as profits moderate.

3 Best ASX Bank Shares to Buy Now

ANZ Group Holdings (ASX: ANZ)

ANZ currently offers the highest dividend yield among the Big Four at approximately 4.5%, partially franked at ~70%. When grossed‑up with franking credits, the effective yield can exceed 6–7%, making it highly attractive for income‑focused investors. The bank’s strategic focus on its ANZ Plus digital banking platform represents the most ambitious...

National Australia Bank (ASX: NAB)

NAB strikes an attractive balance between yield (approximately 4.2% fully franked), valuation (P/E ~16.6x), and operational momentum. Under CEO Ross McEwan, NAB has gained market share in business lending while keeping costs under control. Unlike Commonwealth Bank, NAB doesn’t trade at a significant premium, yet it offers similar stability and a business banking franchise that is less ..

Westpac (ASX: WBC)

Westpac reported a net profit of $6.9 billion for FY25, slightly down from FY24 but still resilient in a competitive market. The bank increased its fully‑franked dividend to 153 cents per share, including a final dividend of 77 cents, and extended its share buyback program through November 2026. For investors, Westpac offers a dividend yield of around 4.0–4.1%, fully franked, and trades at a reasonable valuation....

3 Best ASX Bank Shares to Buy Now

The Pros and Cons of investing in ASX Bank Shares

Advantages of Bank Stocks

ASX bank shares are valued for their reliable, fully‑franked dividends, averaging around 4.5% in 2024, well above the ASX 200 average. These payouts are resilient even in downturns, making them attractive for retirees and income investors. The Big Four also enjoy strong competitive advantages, with high barriers to entry and pricing power that support steady profits. Their scale and dominance mean they remain central to Australia’s financial system, offering investors both stability and dependable income.

Disadvantages and Risks

The downside is limited growth potential. Banks are mature businesses tied to Australia’s modest GDP growth, so big share price gains are unlikely. Valuations, especially for Commonwealth Bank, remain expensive, leaving little room for error. Risks such as margin pressure, regulatory scrutiny, and reputational issues could weigh on earnings. Investors should also be mindful that banking performance is closely linked to the housing market and broader economic cycles, which can add volatility.

How to choose the right ASX Bank Stocks?

Investors should compare dividend yields, payout ratios, valuations, capital strength, and efficiency. ANZ offers more flexibility with a lower payout ratio, NAB and Westpac provide fully‑franked dividends, and Commonwealth Bank commands a premium for its strong capital position and technology, though at higher valuations. Looking at CET1 ratios and cost‑to‑income efficiency can help identify which banks are best placed to sustain dividends and weather downturns.

Are ASX Bank Stocks a good investment?

For income‑focused investors, bank stocks remain solid long‑term holdings thanks to high dividends and defensive qualities. Capital appreciation will likely be modest, so selective positioning is key. ANZ offers yield and transformation potential, NAB is balanced, Westpac has turnaround momentum, and CBA remains premium but pricey. Dividend income provides a cushion while investors wait for clarity on interest rates and margins. In uncertain markets, these stocks act as reliable anchors, making them suitable for retirement portfolios or as stabilisers against more volatile growth holdings.

FAQs on Investing in Bank Stocks

ASX bank stocks are shares of Australian banks listed on the Australian Securities Exchange, most notably the Big Four Commonwealth Bank, Westpac, ANZ, and NAB.

Our Analysis on ASX Bank Stocks

Judo Capital (ASX: JDO) Surges on 53% Profit Jump – Is the Challenger Bank a Buy?

Judo Capital Surges After 53% Profit Jump Judo Capital Holdings (ASX: JDO) surged as much as 12 per cent on…

Bendigo Bank (ASX:BEN) Beats on Profit but Reveals $90m AUSTRAC Bill- Is This the Risk Income Investors Are Ignoring?

Bendigo Bank AUSTRAC Risk: Is the Yield Worth It? Bendigo and Adelaide Bank (ASX: BEN) fell over 2% on Monday…

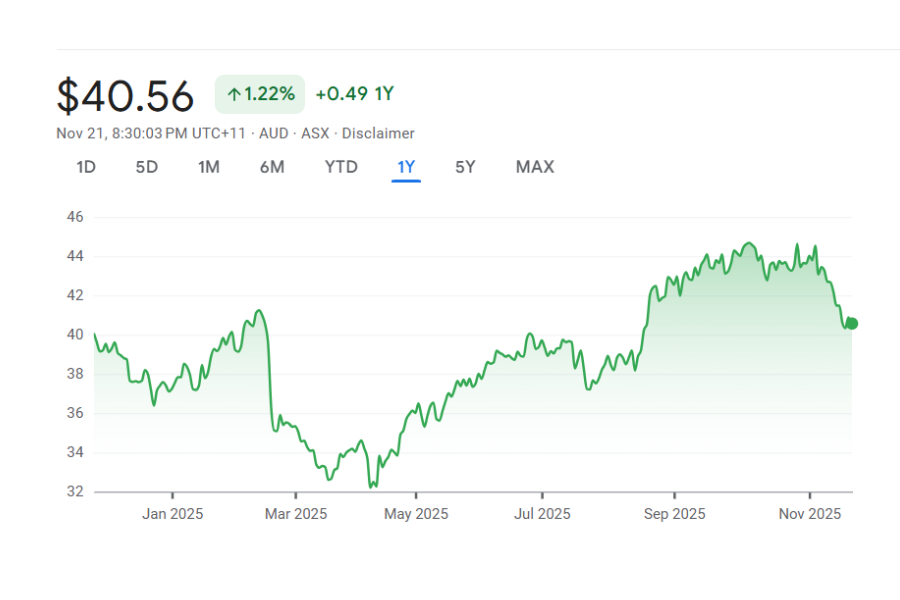

ANZ (ASX:ANZ) Hits Record High After Profit Surges 75%, But Is It Too Late to Buy?

ANZ Shares Hit Record High After Profit Surge ANZ Group (ASX: ANZ) surged 8.25 per cent to A$40.20 on results…

Commonwealth Bank (ASX:CBA) Reports 6% Profit Growth and Raises Dividend- Buy, Hold, or Take Profits?

Commonwealth Bank Beats Forecasts, But Is It Too Expensive? Commonwealth Bank (ASX: CBA) shares jumped 6.8% to A$169.56 on Wednesday…

The 50% CGT discount on shares: Here’s how it works, and if it is under threat

The 50% CGT discount on shares is one of the key mechanisms that helps investors keep as much of their…

Are Seamless Payment Gateways the Key to Unlocking Value in ASX Digital Stocks?

The digital entertainment landscape on the Australian Securities Exchange (ASX) has undergone a dramatic transformation over the last eighteen months.…