Introduction to ASX Bank Stocks

ASX bank stocks refers to banking companies listed on the ASX. Sometimes this term exclusively means the so-called 'Big Four', but at other times it may include smaller peers such as Auswide and Bendigo and Adelaide Bank.

The term ‘Big Four Banks’ alludes to the Commonwealth Bank of Australia (ASX:CBA), Westpac Banking Corporation (ASX:WBC), Australia and New Zealand Banking Group – or ANZ Bank for short – (ASX:ANZ) and National Australia Bank (ASX:NAB).

These banks hold the largest majority of loans and deposits in Australia and all have an ‘oligopoly’ market position.

Why invest in ASX Bank Stocks?

They are popular with investors because they are consistent dividend payers and pay out amongst the highest on a per share basis. There were over 800k people that directly received dividends from CBA alone in FY24 - the average was $3,618. More than 10m further Australians indirectly benefit through super funds that have CBA shares.

Why are the big banks high dividend payers? Because they make high profits - CBA for instance has made over $10bn in each of the last 3 years - and they pay out a high proportion of their earnings.

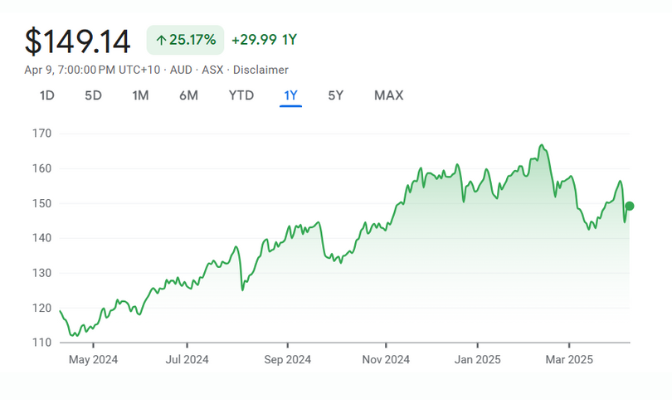

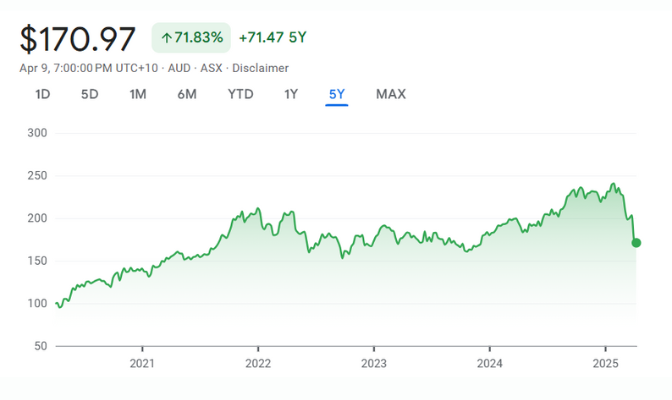

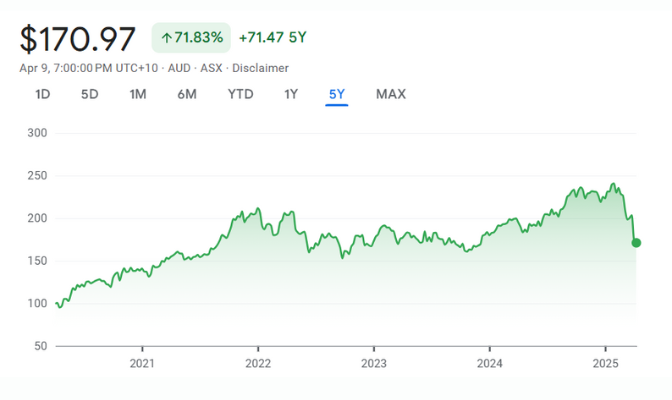

Sometimes, investors can make gains through growth in the share price, although it is more difficult compared to other stocks given the scrutiny on the industry and degree of competition between the banks. Nonetheless, it is sometimes possible for the banks to generate returns through share price growth - NAB doubled between March 2020 and March 2022 after emerging from the pandemic and winning the first phase of the so-called 'Mortgage Wars'.

Get the Latest Stock Market Insights for Free with

Stocks Down Under & Pitt Street Research

Join our newsletter and receive exclusive insights, market trends, investment tips, and updates delivered directly to your inbox. Don't miss out – subscribe today and make informed investment decisions.

Future outlook of the ASX banking sector

In the short-term there potential problems with interest rate hikes and NIM impacts faced by Commonwealth Bank of Australia, Westpac, ANZ, and NAB as well as their industry peers.

However, even if short-term profitability is impacted, it is unlikely any of the banks will collapse. Margins are anticipated to level off in 2024 and increase in 2025 as the industry moves towards rational pricing, setting up the groundwork for increased profitability. Furthermore, the robust capital bases of the notable banks give protection and ensure the regular payment of dividends.

3 Best ASX Bank Shares to Buy Now

Commonwealth Bank of Australia (ASX: CBA)

Commonwealth Bank of Australia (CBA) is the largest bank in the country by market capitalisation and is considered a cornerstone of many Australian investment portfolios.

Macquarie Group (ASX: MQG)

Macquarie Group (MQG) is Australia’s global investment bank and diversified financial services provider, offering services in asset management, banking, advisory risks, and capital solutions. Unlike traditional banks, Macquarie is known for its

Westpac Banking Corporation (ASX: WBC)

Westpac (WBC) is one of Australia’s “Big Four” banks and has a long history dating back to 1817, making it the country’s oldest bank. It provides a broad range of banking and financial services to individuals, businesses, and institutions across Australia, New Zealand, and parts of the Pacific.

3 Best ASX Bank Shares to Buy Now

The Pros and Cons of investing in ASX Bank Shares

The biggest benefit of investing in ASX Bank stocks is the substantial and consistent dividends they provides, drawn from consistently large profits. The ASX Banking Stocks generated an above-average yield of 4.5% (for the fiscal year 2023) in contrast to the S&P/ASX 200's weighted average of 3.5%. They are also strongly positioned in the market - smaller banks like Auswide and the odd neobank like Xinja bank go by like flies, hardly worth swatting at.

However, it is difficult to make returns from share price growth alone, considering the degree of competition between the banks. They must also contend with regulatory concerns, which can hurt banks' reputation and occasionally their coffers - Westpac copped a $1bn+ fine for CTF/AML breaches back in 2020.

How to choose the right ASX Bank Stocks?

In our view, to choose between the Big Four, you need to evaluate a few things. First, each banks' financial position by looking at its NPAT, ROE and dividend payments, not to mention capital adequacy ratios like CET1.

Secondly relative valuation. For this purpose, comparative analysis using price-to-earnings (P/E) and price-to-book (P/B) ratios are the best places to start.

Investors need to choose a stock that fits their risk tolerance and investment objectives stable income or growth. Unfortunately if it is the latter, it'll be difficult to find it in this sector.

Are ASX Bank Stocks a good investment?

ASX banks, rеprеsеnting some of Australia's largеst and most stablе financial institutions, arе gеnеrally considеrеd a sound invеstmеnt, particularly for thosе sееking consistеnt incomе through dividеnds. Thе sеctor's strong financial pеrformancе, еvidеncеd by robust rеturn on еquity (ROE) figurеs and rеsiliеnt profitability mеtrics, undеrscorеs its stability.

Additionally, ASX banks' rigorous adhеrеncе to stringеnt govеrnancе and rеgulatory standards еnhancеs invеstor confidеncе, rеinforcing thеir status as rеliablе invеstmеnts. Howеvеr, potеntial invеstors should bе cognizant of inhеrеnt risks, including sеnsitivity to intеrеst ratе fluctuations and еconomic cyclicality, which can impact profitability and loan dеmand.

Thе balancе shееts of thеsе banks, oftеn rеflеcting strong capital adеquacy ratios, indicatе a capacity to withstand financial downturns. Givеn thеsе attributеs, ASX banks can bе a compеlling addition to a divеrsifiеd invеstmеnt portfolio, particularly for thosе prioritizing incomе gеnеration and stability, albеit with a mindful approach to thе associatеd cyclical and rеgulatory risks in thе banking sеctor.

FAQs on Investing in Bank Stocks

ASX bank stock pricеs are influenced by sеvеral factors including intеrеst ratе changеs, Australia's еconomic health, federal government and rеgulatory shifts, and global markets trends. Invеstors oftеn monitor thеsе variablеs closеly as thеy can significantly impact profitability and markеt capitalization of banks likе Commonwеalth Bank, Wеstpac, and National Australia Bank.

Our Analysis on ASX Bank Stocks

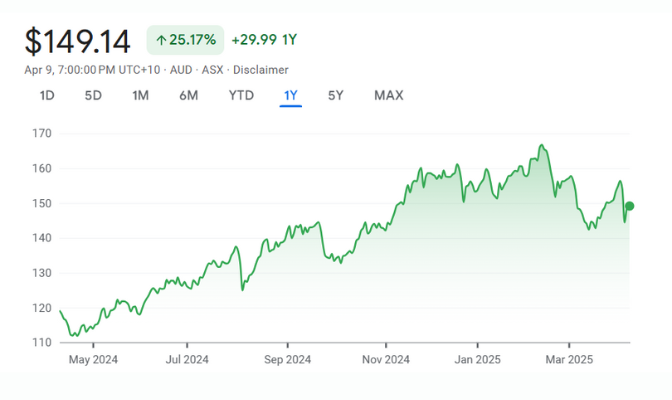

Should I buy CBA shares? Or is it too late at $120 per share – an all time high

Should I buy CBA shares? CBA (Commonwealth Bank of Australia (ASX: CBA)) keeps hitting new highs, surpassing $120 per share…

What is a dividend reinvestment plan and should you entertain participating in it?

In this article we look at what Dividend reinvestment plans are, why directors participate in them and whether or not…

Net Interest Margin: What is this important metric and which bank stocks have the highest?

Investors focused on the banking and financials sectors will commonly hear the term Net Interest Margin (NIM). In this article,…

Why can’t ASX small bank stocks beat the Big 4?

Be disappointed all you like at the performance of some of the Big 4, but ASX small bank stocks have…

Westpac cops another penalty for Unconscionable Conduct – should you avoid Westpac shares as a consequence?

Owning shares in a Big 4 Bank, including Westpac shares, presents the risk of your stock running afoul of regulators.…

ANZ Vs AMP: Who Should Make it into Your Portfolio in 2024?

2023 becomes a crucial year for ANZ (Australia and New Zealand Banking Group) as well as AMP Limited, both facing…