Collins Food (ASX:CKF): Why Colonel Sanders should stick to frying chickens in 2023

![]() Marc Kennis, November 29, 2022

Marc Kennis, November 29, 2022

Mixed picture at Collins Food

Collins Food (ASX:CKF) reported its 1HY23 results this morning and they showed a mixed picture. KFC same-store-sales (SSS) in Australia and Europe were up 5.1% and 10.4% respectively. But Taco Bell SSS declined 7.8%!

Overall revenues were up 15%, to $534m, but that includes sales from new store openings (open for less than a year). Underlying EBITDA was up marginally, to $95.4m. That difference in growth illustrates to issues that many Quick Service Restaurants (QSR), including Domino’s Pizza (ASX:DMP), are struggling with … high cost inflation!

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Inflation is raging

Collins Food reported strong cost inflation in Europe for basically everything … ingredients, wages, utilities etc. In such an environment you can sell more buckets of chicken, but margins will suffer. And then there’s Taco Bell, the place to go to when you’re in the mood for Mexican food.

Stick to fried chickens

Well, Taco Bell disappointed on the sales front, that is, same-store-sales that were down. Overall sales were up 43% due to new store openings, bringing the total store count to 24 in Australia. But Taco Bell also closed stores due to underperformance and had to write off $11.9m in impairments. CKF said it has put the building of new Taco Bell restaurants on hold for a while.

So, instead of expanding into Mexican food, Colonel Sanders should probably stick to what he was good at … fried chicken!

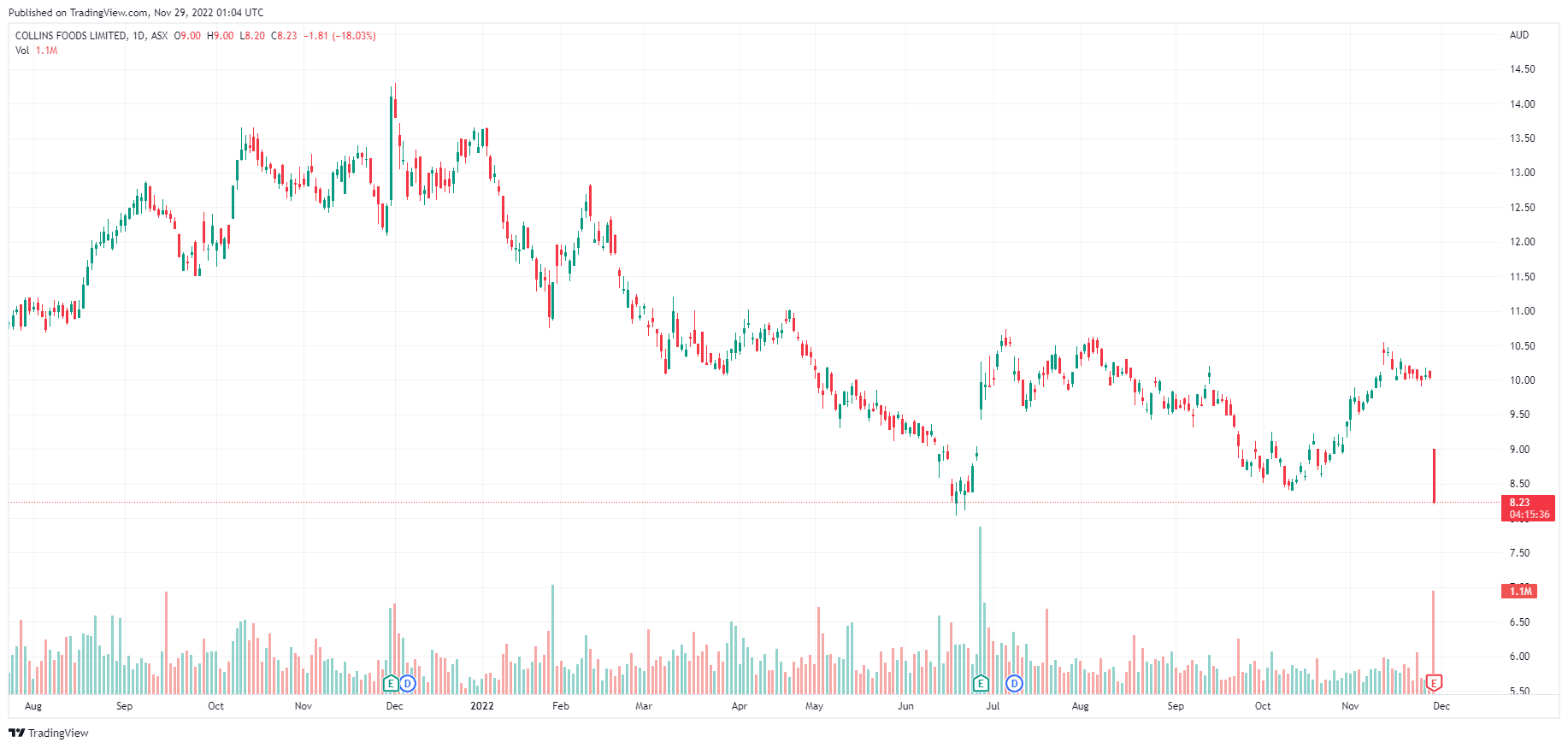

Collins Food (ASX:CKF) price chart, log scale (Source: Tradingview)

The shares took a hit after the earnings release came out and are now trading just above $8, a level last seen in June 2022. If this level doesn’t hold, things may become worse for Collins Food shareholders, because the next support level from a technical point of view is far far away.

On the flip side, long term investors looking through the current inflation cycle can pick up CKF about 40% below the level it traded at just 12 months ago.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Austal (ASX:ASB) Wins A$4bn Navy Deal: Is It Time to Buy the Dip?

Austal’s Defence Surge: What Investors Should Watch Austal (ASX: ASB) closed at A$6.30 on Friday, up 5.53% on the day,…

Oil Surges on Iran Crisis: Best ASX Energy Stocks to Buy Now

ASX Energy Stocks: What the Oil Spike Means Now Oil prices surged more than 5% in just two trading sessions…

ASX Reporting Season Halftime Report: 4 Stocks to Buy, Hold, or Avoid After This Week’s Results

ASX Reporting Season: What This Week’s Results Mean for Investors We are halfway through the ASX reporting season, and the…