COVID stocks are losing their allure in FY23

![]() Nick Sundich, November 29, 2022

Nick Sundich, November 29, 2022

As the COVID pandemic wanes, so-called COVID stocks (companies that benefited financially from the pandemic) are coming back to earth. Not necessarily from a share price perspective, but their revenues are returning to normal after being inflated for two financial years.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Healius shows COVID stocks are losing their shine

Of all COVID stocks, Healius (ASX:HLS) is the ultimate example given it provided PCR testing services throughout the pandemic. As Australia began to tolerate higher case numbers, it began to tolerate self-administered Rapid Antigen Tests (RATs).

In the first four months of FY22, Healius made $370.6m in revenue attributed to COVID-19, out of a $903m total. In the first four months of FY23, Healius’ COVID revenues fell 85% to $54m and its total revenues fell 32% to $617.5m. This was despite its non-COVID revenues actually gaining 6%.

Sonic Healthcare feeling the pinch too

Healius’ peer Sonic Healthcare (ASX:SHL) also saw a plunge in COVID revenues from $795m in the first 4 months of FY22 to $280m in the first 4 months of FY23 – a drop of 65%.

Like Healius, Sonic recorded a gain in non-COVID revenues (by 7% to $2.4bn), but its total revenue and earnings fell – by 12% and 37% respectively.

Zoono leads the decline COVID stocks

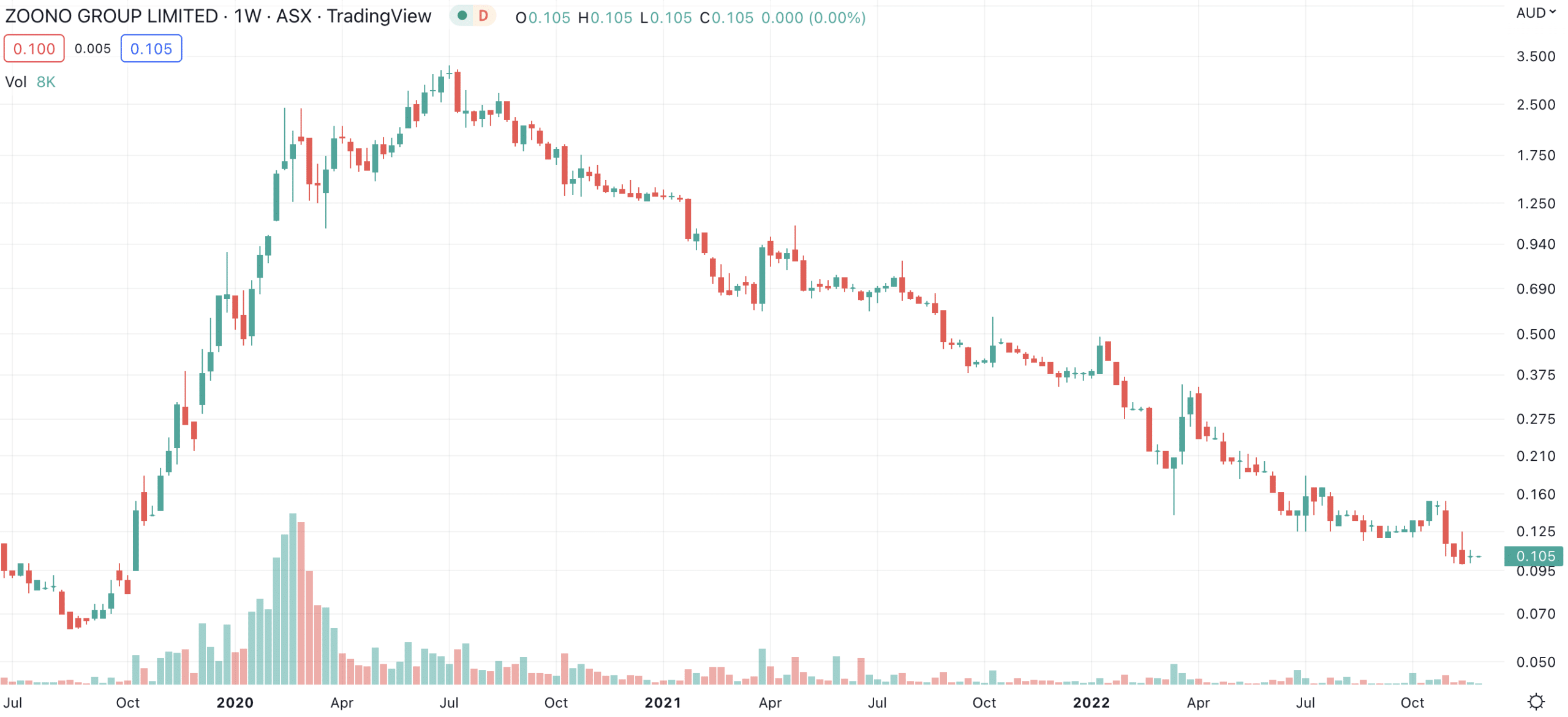

But the ultimate example of a COVID stock is Zoono (ASX:ZNO) which sells bacteria-killing sanitisers. In the early months of the pandemic it rose from ~10c to as high as $3.12 in July 2020, only to gradually fall back to earth.

Zoono (ASX:ZNO) share price chart (Graph: TradingView)

Zoono’s results have nearly mirrored its share price. From just NZ$1.8m in revenue and an NZ$0.8m gross profit in FY19, it rocketed to NZ$38.3m in revenue and a NZ$28.3m gross profit, up 2056% and 3369% respectively.

Its revenues fell 29% to NZ$27.1m in FY21 and another 67% NZ$9m in FY22. The decline has continued in FY23 with cash receipts coming in at just NZ$1m, down NZ$0.6m on the prior quarter. All COVID stocks have done it tough, but arguably none more so than Zoono.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

No credit card needed and the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…