Seek revenue guidance for FY23 downgraded by 1.2% and shares fall by 5%

Barely 6 weeks after it was issued, Seek’s revenue guidance for FY23 was cut. This led to a 5% sell-off in shares this morning, but it is still in positive territory in FY23.

No time to do stock research, but you still want to invest?

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

Seek revenue guidance cut from A$1.26bn to $1.245bn

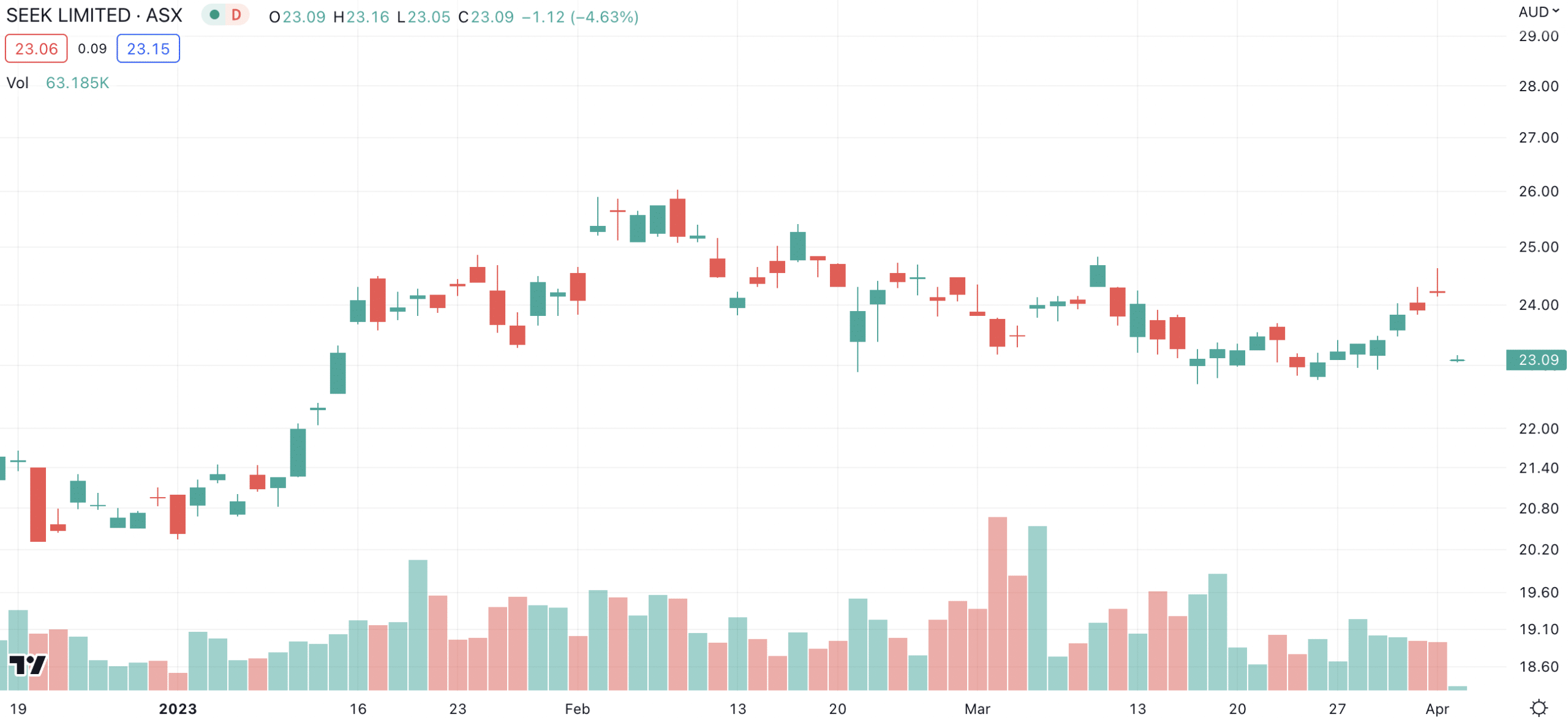

Seek’s revenue guidance was only cut by 1.2%, from $1.26bn to $1.245bn. Shares in the company fell by 5% this morning. Despite today’s losses, shares are still up on a YTD basis.

Seek (ASX:SEK) share price chart, log scale (Source: TradingView)

An over-reaction?

You could argue this was an over-reaction given that its EBITDA and NPAT guidance was unchanged and reiterated. However, three things may be of concern to investors.

First, it gave a warning that job ad volumes were moderating. The company wasn’t specific beyond that general warning – it did not state the extent to which they were moderating and how long it was expected. Granted, it is clearly not too vehement if Seek’s revenue guidance is only being downgraded by 1%.

Second, the company’s unchanged EBITDA and NPAT guidance was assumed to be offset by lower than assumed operating expenditure. And third, the fact that the company’s guidance was downgraded so soon after it was iterated.

Ultimately, only time will tell if its guidance holds. But investors may be forgiven for being sceptical amidst 4-decade high inflation.

Stocks Down Under Concierge gives you timely BUY and SELL alerts on ASX-listed stocks!

With price targets, buy ranges, stop loss levels and Sell alerts too.

GET A 3-MONTH FREE TRIAL TO CONCIERGE TODAY

There’s no credit card needed – the trial expires automatically.

Blog Categories

Get Our Top 5 ASX Stocks for FY26

Recent Posts

Australian Dollar Hits Multi-Year High Against JPY: What’s Driving the Rally and Who Benefits?

Australian dollar jumps against the yen as rate gaps widen The Australian dollar has been on a tear against the…

Copper Surges Past $14,000 to Record Highs: What It Means for ASX Copper Stocks

Copper prices have surged past US$14,000 per tonne this week, reaching a historic peak of US$14,527 on Thursday before profit-taking…

Star Entertainment (ASX:SGR) Drops 16% Despite First EBITDA Profit in Quarters: Buy, Sell, or Wait?

Star Entertainment turns EBITDA positive but survival risks remain Star Entertainment (ASX: SGR) plunged 16 per cent to A$0.14 on…