Here are 4 of the worst red flags for stocks that you need to watch out for

![]() Nick Sundich, May 16, 2024

Nick Sundich, May 16, 2024

Investors should always be on the look out for red flags for stocks. We’re talking about subtle signs that may appear to mean much in isolation, but could indicate that you have a bad company and you need to get out of it before you risk making a big loss on your investment.

Here 4 red flags for stocks

1. Directors selling shares

We’ve previously written about when directors buy shares and whether or not it should be viewed as a sign of confidence in the company. But when directors sell shares, it can be a bad sign. Because why would they be selling if they saw further upside?

Sometimes there might be good reasons like to pay a tax bill or a divorce settlement. Superloop (ASX:SLC) boss Bevan Slattery sold $500,000 worth of shares in early 2020 to help bushfire victims – that was probably the most selfless trade ever. But you always see a red flag when a reason isn’t given or if it is something vague like ‘diversifying [my] investment portfolio’.

Yes, even if a director is selling shares directly to an institution. Because it is a case of buyer beware. And if there isn’t really enough liquidity on the market for the trade to occur on-market, you have to ask yourself why.

2. Missing guidance

Companies will commonly issue shareholders guidance as to what revenues and earnings should be expected. If a company misses this guidance or revises it in the middle of the year, this is a red flag. This is because it can signal management does not have as firm a knowledge of their firm and its position as they will have been insinuating.

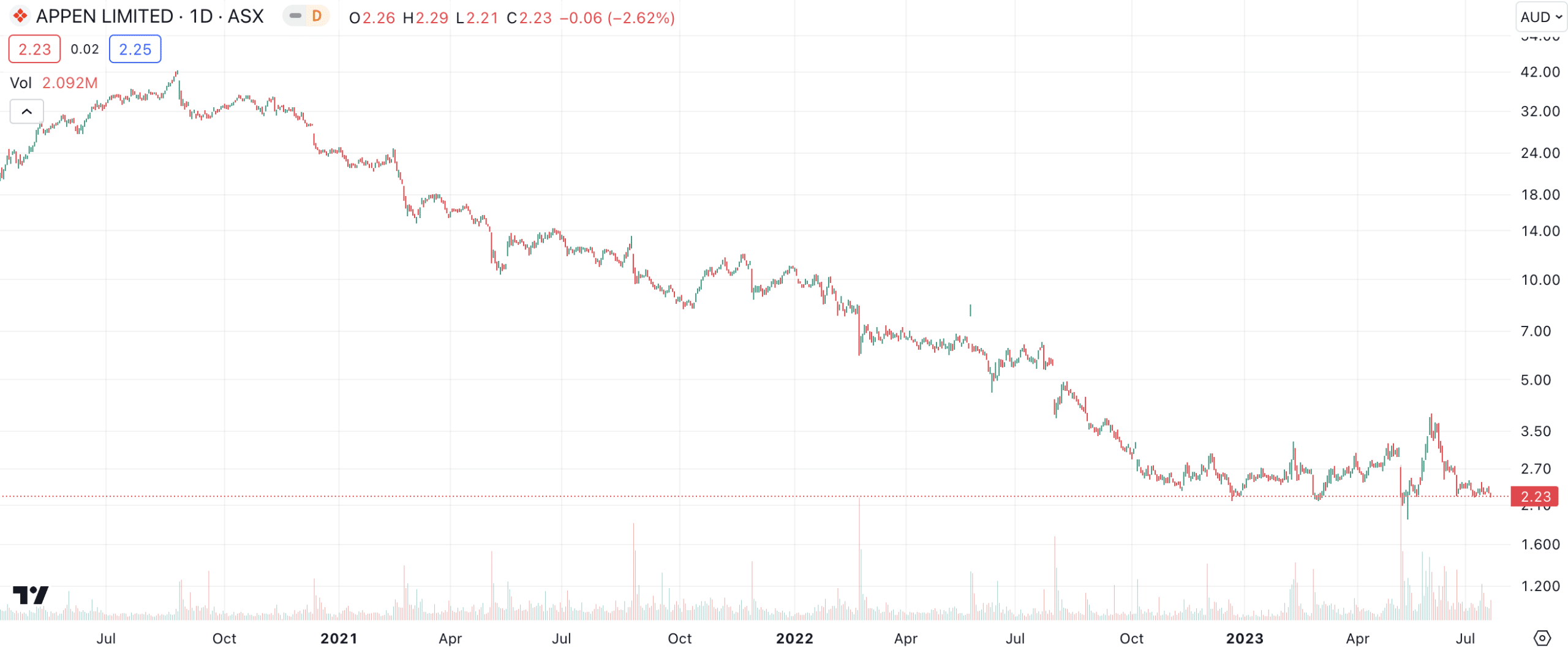

It could also be a warning sign that it might happen again and again, a circumstance that can lead to heavy losses for investors who don’t get out. Just look at Appen (ASX:APX), that has missed and/or downgraded its guidance literally every reporting season in 3 years, it lost over 90% of its value since mid-2020.

Appen (ASS:APX) share price chart, log scale (Source: Trading View)

3. Disconnect between what management is saying & reality

When management seems to be insolent regarding their company’s position, this is a red flag. If they are saying their firm has had a good year and a good future but they actually haven’t. If they are saying they’re in a good position but have intense competition and/or low to no profitability. This is a red flag for you to get out.

How can you tell if the company hasn’t had a good year in spite of management saying to the contrary? Just look at a company’s quarterly cash flow report, check its cash burn rate and how many quarters it has left. Only then should you read the rest of the report. That is just one obvious example, but even well intended management can take some time to steer a company onto the right path, as the recent example of Iress (ASX:IRE) depicts.

4. Constantly getting ASX queries

Now, some ASX companies legitimately see the ASX as having too much overreach. But if they are constantly getting queries from the ASX for any reason, then this is a red flag. A company might get a query for a variety of reasons whether a late reporting of a directors trade, persistently negative cash flow statement or other governance issues.

Companies will defend themselves every step of the way. But investors should be wary of companies that persistently get queries. If a company cannot govern itself, how can you expect it to grow?

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…