Alumina’s Dramatic Turnaround: What’s Behind the Surprising Stock Surge?

![]() Ujjwal Maheshwari, January 16, 2024

Ujjwal Maheshwari, January 16, 2024

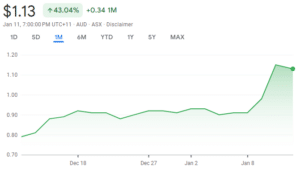

On January 9, 2024, Alumina (ASX:AWC) witnessed an extraordinary increase in its stock value, closing at AU$0.98. This was the highest since October 18, 2023, indicating a substantial shift in the company’s market trajectory.

This significant surge, the largest intraday percentage leap since mid-December, caught the market and investors’ attention. It wasn’t an isolated market anomaly but a reaction to Alcoa Corp’s announcement of halting production at the Kwinana Alumina Refinery in Western Australia from the second quarter of 2024.

What Led to the Kwinana Production Shutdown?

First of all, it is important to clarify some information about the Kwinana Alumina Refinery, to avoid confusion from our readers. A month ago, we wrote about Adbri (ASX: ABC) being impacted by the project. Alcoa Corp is the ultimate owner of Kwinana but its Australian subsidiary is 40% owned by Alumina. Adbri (which was formerly known as Adelaide Brighton) is a quicklime cement supplier to Kwinana. So both these companies will be impacted by any decisions from Alcoa about the project.

Alcoa Corp’s decision last week to curtail production at the Kwinana Alumina Refinery was the culmination of an extensive evaluation process, taking into account a myriad of factors that had been impacting the refinery’s operations. This move, which received backing from Alumina, was primarily driven by the considerable operational losses that the refinery had been incurring.

In FY23 alone, the Kwinana Alumina Refinery recorded a substantial net loss of around AU$ 130 million.

This financial outcome underlined the mounting challenges faced by the refinery. Key among these were the ageing infrastructure of the refinery, the escalating operational expenses, and a noticeable decline in the quality of bauxite grades being processed.

These factors combined to create an untenable situation, thereby necessitating a reevaluation of the refinery’s role in Alcoa Corp’s broader operational strategy and Alumina’s investment portfolio. The decision to curtail production was not made lightly, but it emerged as a necessary step in light of the prevailing circumstances.

Alumina Adjusting the Workforce

A crucial aspect of this decision was the phased reduction of the refinery’s workforce. From approximately 800 employees at the start of 2024, the numbers were expected to dwindle to an estimated 50 by the third quarter of 2025.

This workforce reduction was aimed at aligning the operational scale with the reduced production requirements and was a strategic, albeit challenging, response to the prevailing market conditions.

Decline and Recovery?

Throughout 2023, Alumina stock value had plummeted by nearly 40%, reflecting the volatile market conditions and internal challenges the company faced. Despite this decline, the recent positive trend suggested a possible market recalibration and recovery prospects for Alumina.

Macquarie, one investment bank covering Alumina, had predicted a nuanced financial trajectory for Alumina. In the short term, there’s an anticipated decrease in earnings per share for the fiscal years 2024-2025. This forecast accounts for an estimated 1-5% dip, attributable mainly to the cost implications arising from the curtailment of production at the Kwinana refinery.

Macquarie has considered various factors, including operational shutdown costs, severance pay for the reduced workforce, and other associated financial impacts of this strategic decision.

Will they Adjust to the Market Change?

The initial years following the refinery’s shutdown are expected to be a period of transition for Alumina. The company would need to navigate through the immediate financial impacts while adjusting its operations to align with the new production capacities. This period is crucial for the company to stabilize and set the stage for future growth.

What are the Best ASX Stocks to invest in right now?

Check our buy/sell tips

Mid- to Long-Term Growth Projections

Looking beyond the immediate challenges, Macquarie forecasts a positive growth trajectory for Alumina Ltd in the mid-long term. The period post-2025 is expected to see a rebound in earnings, with projections of a 3-5% increase in fiscal years 2026-2027. This positive turnaround is anticipated due to several key factors:

- With the downsizing of operations at Kianna and a focus on more efficient production lines, Alumina Ltd is expected to achieve better operational efficiency. This efficiency is anticipated to reduce overall operational costs, thereby improving profitability.

- The alumina market is expected to gradually recover from the current downturn. As prices stabilize and demand for alumina increases, Alumina will capitalize on these market conditions.

- The company’s strategic investments and focus on other lucrative projects are likely to start yielding returns in this period, contributing to the overall growth in earnings.

Since the start of 2024, Alumina’s stock has shown an increase of 24%, reflecting the market’s response to both the immediate changes and the long-term growth potential identified by Macquarie. This uptick is indicative of investor confidence in the company’s strategic decisions and its ability to adapt and grow in a fluctuating market environment.

Blog Categories

Get Our Top 5 ASX Stocks for FY25

Recent Posts

Your invitation to the Freelancer Investor Day

Your invitation to the Freelancer Investor Day Freelancer (ASX: FLN) is a Sydney-based company that has been the subject of…

Kamala Harris stocks: If Joe Biden’s VP wins the White House in 2024, which stocks will win?

With the US Presidential election now certain to be a Kamala Harris v Donald Trump showdown, we’ve looked at so-called…

South32 (ASX:S32): Is it the dark horse amongst ASX 200 miners or have cyclones and commodity prices hit it too hard?

South32 (ASX:S32) began life as a spinoff from BHP back in 2015, capitalised at $9bn. In mid-2024, it is capped…